I want to review the performance of the largest quoted companies in Nigeria.

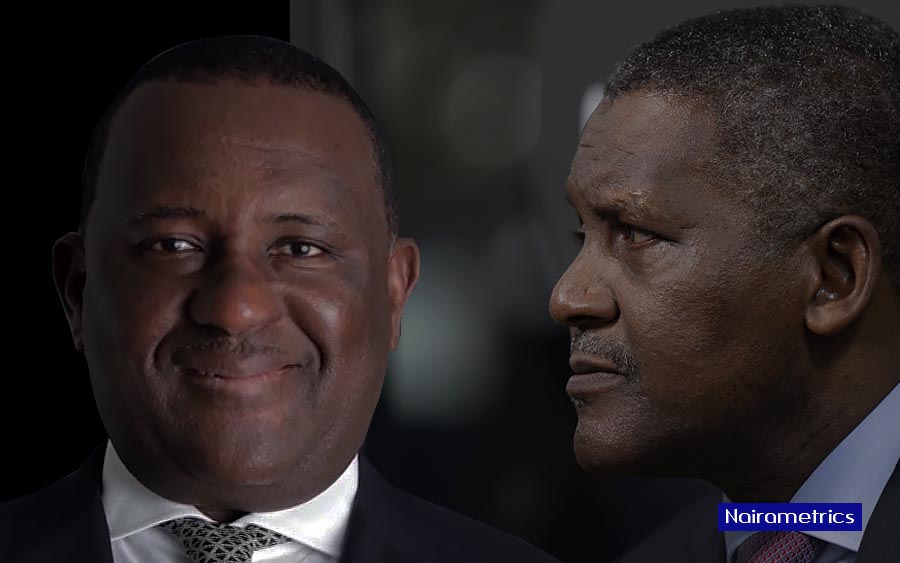

On the Nigerian Stock Exchange, they don’t come any bigger than Dangote Cement (Dangote) and BUA Cement (BUA). Only MTNN stands with both cement companies in terms of market capitalization. Dangote and BUA are both blue-chip companies, in the same sector and both enjoy federal import protection, they also both serve a local market with huge demand for cement.

Which is a better investment? Let us assume I have N100,000.00 (One Hundred Thousand Naira,) which should I buy? Let us review both stocks with FY 2020 results they posted. For consistency, I am going to use my trading view terminal numbers.

READ: Dangote Cement joins MTN in the trillion-naira club, as 2020 revenue surpassed N1 trillion

Market Capitalization

First, we talk about capitalization, (Market cap is the number of shares issued x market value of shares ). Dangote Cement has a market capitalization of N3.65 trillion, while BUA posts a N2.49 trillion capitalization. Does size win? Dangote is bigger? Not yet!

Market Price

With N100,000 I can buy about 465 shares of Dangote at N215 a share and 1,360 shares of BUA at N73.50 per share. Is BUA cheaper? do we have a winner? Not quite. Let us dig deeper.

Dangote Cement posted a Net Income figure of N276 billion, if we divide this earning by the number of issued shares which is 17 billion, we get an Earnings Per Share (EPS) of N16.14, so every share of Dangote Cement earns (not pays) the investors N16. Similarly, the Earning Per Share of BUA is N2.0

READ: BUA Cement loses N162 billion in market value in a week

Thus when I buy Dangote Cement N215 per share, I am buying 16 times the earnings of Dangote. We can simplify this by simply comparing the price I pay per share of Dangote to the EPS of Dangote (Price to Earnings Ratio), thus I invest my cash of N215 to buy 16 times the earnings of Dangote, thus the Price to Earnings Ratio of Dangote is 13.31 (P/E). Using the same calculation, the price for each earnings of BUA (the P.E.) is 35.38. This means even though I am paying more cash for each share of Dangote, I am paying less to buy the earnings of Dangote, thus Dangote is cheaper than BUA.

So our first milestone is reached, we have used the Net Income, Market Price, and Number of Issued shared to get the Earnings Per Share, we have then determined what amount of earnings we are buying to determine which stock is at a bargain.

READ: Oba Otudeko’s stakes in Firstbank and Honeywell are worth over N10 billion

What else?

Let us look at the earnings that will be paid in cash. Remember, Earnings, is just the Net Income of Dangote, we as equity holders have the opportunity to share in any portion of the Net Income.

Dangote in 2020 paid out from earnings N272.69 billion as dividends, this translates to about N16 per share or in terms of returns 7.44%. We get this Dividend Yield return by comparing the dividend paid to the market price per share (D/P). BUA also in 2020 paid out N59.26 billion as dividends from earnings, this translates to a dividend yield of 2.81%.

So, if I invested N100,000 in shares of Dangote Cement, I would earn a cash return of 7.44%, if I did the same with BUA I would earn a cash return of 2.81%.

READ: Jumia: In search of the elusive break-even sales

Let us go a bit deeper…

When you buy a stock, you are buying into the earnings and cash flow. Dangote Cement in 2020 earned N276 billion and paid N272 billion as dividends meaning they retained about N3 billion for that FY while generating over N248b in Free Cash Flow. Similarly, BUA earned a net N71.52 billion, paid out N59 billion in dividends, retained N19 billion but posted a negative Free Cash Flow of (N95.49 billion). Should BUA cement have simply used that cash to finance working capital rather than paying it as dividends? Perhaps. Let us speak more of Cash flow.

Cash retained is cash not paid to you the investor. You have to ask how well your company is utilizing that cash retained. Should it all be paid out as dividends? Or retained in the company to fund expansion and growth?

READ: Three things Nigerians can learn from Warren Buffet’s latest letter

Look at it this way, if Federal Government Bonds were offering a Yield of 15% and we see that Dangote is offering a yield of 7.44%, then as shareholders you should demand that Dangote pays more cash to you to allow you to invest in FGN bonds because you get a higher return (at lower risk). The point is any company retaining cash or paying cash at a lower yield than the market is hurting the investors, who are missing the opportunity of investing higher elsewhere.

Let us score both company managers by how well they have managed the revenues and capital of the companies

| Return on Assets % | Return on Equity % | Return on Invested Capital % | EBITA Margin % | Net Margin % | Debt to Assets | Long Term Debt to Assets | |

| Dangote Cement | 14.62 | 31.21 | 26.92 | 44.04 | 24.31 | 0.24 | 0.08 |

| BUA Cement | 11.15 | 19.12 | 15.35 | 41.87 | 32.03 | 0.36 | 0.23 |

FY 2020

Across the board, the management of Dangote Cement has done a better job when compared to BUA Cement in managing the assets of the company. Dangote Return on invested capital is higher with a much lower recourse to debt and of course a higher FCF number.

Overall, on Earning, Returns and Efficiency, it appears Dangote Cement posts better fundamentals…

Disclaimer

There is a wealth of information that should help decide whether you should buy a stock or not and how long you can hold on to it. Our recommendation is based on the information we currently have and is wholly the opinion of the writer

This article is an investment guide and as such you should conduct extra analysis before deciding whether to buy, sell or hold a stock. The decision to buy, sell or hold a stock is solely yours.