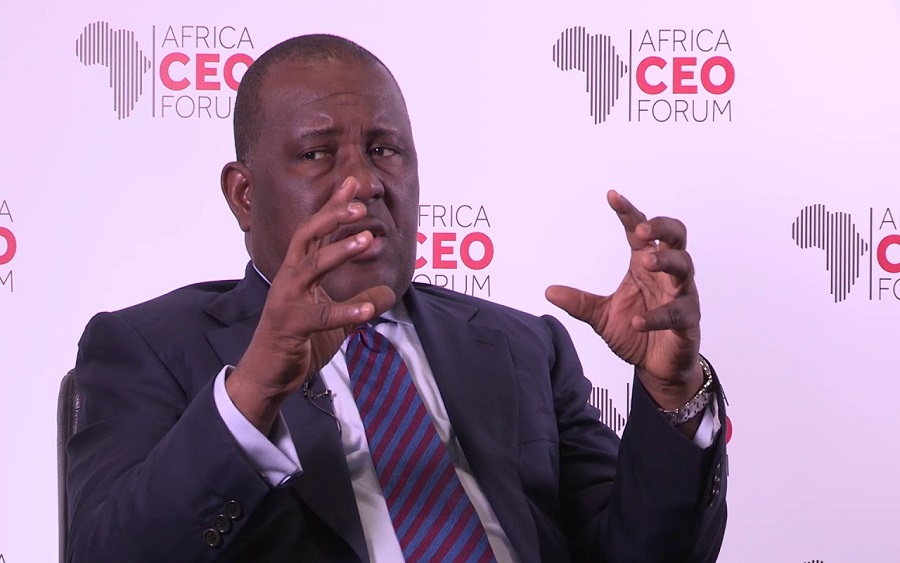

Abdulsamad Rabiu, the founder of BUA Group, one of Nigeria’s leading manufacturing conglomerates, is set to earn a mega dividend of N39.4 billion from his cement business – BUA Cement Plc – via his direct stake.

According to Forbes, Abdulsamad is currently the 6th richest man on the African continent with an estimated net worth of $4.7 billion.

The billionaire is set to earn a dividend of N2.067 per share on his direct holdings in BUA Cement Plc.

READ: The Zero to Hero Story of Abdulsamad Rabiu

Abdulsamad is the single majority shareholder of his cement business, with a direct stake of 19,044,995,225 ordinary issued shares of the company. This represents 56.24% ownership of the company.

Information contained in BUA Cement’s audited statement revealed that he has an indirect stake of about 12.2 billion shares through Damnaz Cement Company Limited, BUA International Limited, and BUA Cement Company Limited.

READ: Dangote Cement joins MTN in the trillion-naira club, as 2020 revenue surpassed N1 trillion

In case you missed it

Recall that the Board of Directors of BUA Cement Plc proposed a final dividend of N2.067 per share to its shareholders, the total payment as dividend to shareholders is put at about N70 billion.

With Abdulsamad’s direct stakes, the billionaire is expected to pocket a mouth-watering N39.4 billion dividend for the financial period ended 31st December 2020. While his total stake both direct and indirect will earn him about N65 billion in dividend.

READ: Dangote Sugar, sweet in more ways than one

What you should know

- BUA Cement Plc declared in its audited financial statement for 2020, that its profits grew by 19.4% year-on-year to N72.34 billion for the financial year of 2020, compared to last year’s figure of N60.34 billion.

- The double-digit profit growth was driven by the cement maker’s focus on efficiency, excellent cost optimization strategies, investment in newer technologically advanced plants, and lastly the strong growth in revenue which was spurred by the rising demand for cement.