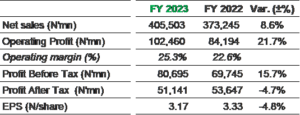

FY 2023 NET SALES UP 8.6% YOY; PAT DOWN 4.7% YOY, IMPACTED BY FX DEVALUATION LOSSES

- FY 2023 Net Sales up 8.6% YoY

- Strong Balance Sheet position: FY 2023 Free Cash Flow N109.7bn, strong Net Cash N142bn

- FY 2023 PBT up 15.7% YoY in spite of N21bn Foreign exchange losses in 2023

- Higher effective tax rate in 2023 (after expiry of Pioneer Status Incentive in 2022) coupled with pressures from FX losses led to a PAT decline of 4.7% YoY.

- Continued focus on Product Solutions, Innovation, Operational Excellence, Health and Safety and Decarbonization

PERFORMANCE OVERVIEW

FY 2023 Financial Highlights

Lolu Alade-Akinyemi, CEO of Lafarge Africa, commented,

- “The fundamentals of our business remain strong. In spite of extremely challenging macroeconomic head winds, we grew the top line by 8.6% and improved Operating Margin from 22.6% to 25.3% in FY 2023.

- In the face of very material FX devaluation losses and higher effective tax rate, Profit After Tax declined YoY by 4.7%.

- Our performance was largely impacted by spiralling inflation and unprecedented Naira devaluation, with the attendant pressure on energy and supply chain costs.

Despite these challenges, we continue to maintain a strong free cash flow position and a strong balance sheet, positioning us for sustainable growth over the medium to long term.

We are committed to delivering sustainable value to all stakeholders in the coming years, as we have done historically.

I would like to thank all employees and stakeholders of Lafarge Africa for their commitment over the years.”

Recommended reading: Lafarge reports 17.4% pre-tax profit in Q3, 2023

BUSINESS UPDATE

GREEN LOGITICS INITIATIVE: Lafarge Africa unveiled its first green depot in Abeokuta, designed to accelerate green mobility. As part of our commitment to promoting sustainable growth, the Green Depot runs entirely on a solar power system, which guarantees 100% energy conservation in lighting, air-conditioning, and electric forklift charging.

This complements our electric and CNG trucks; the additional injection of CNG trucks further facilitates eco-friendly transportation of cement from our Ewekoro plant to the depot, further underscoring our dedication to green mobility.

ECO-LABEL CEMENT BRAND: Earlier in the year, Lafarge had announced the launch of Eco Label cement brand; Lafarge UniCem; which contributes about 23% of the company’s entire volume and is eco-friendly with a 30% lower carbon footprint compared to the local industry standard (Global Concrete & Cement Association). It represents a broad range of green cement produced for high performance, sustainability and circular construction.

BAG MANUFACTURING PLANT: Lafarge Africa commissioned its cement bag manufacturing plant in Ewekoro Plant in May 2023 with a monthly production capacity of 8.8 million bags and an annual capacity of 105 million bags. The new bag plant allows Lafarge to reinforce availability and handle large scale production of bags while also improving livelihood through direct employment of 254 individuals, with 60% being residents of Ewekoro Community.

OUTLOOK

The Nigerian Infrastructure and Construction Sector is expected to continue growing despite inflationary pressure and currency depreciation affecting the economy.

As a result, we maintain our positive outlook, expecting increased demand in 2024 as the economy picks up. We will continue to maximize volume opportunities across our markets and actively manage our costs.

The Company remains committed to its sustainability ambitions and strategy of ‘Accelerating Green Growth’ through innovative building solutions and delivering stakeholder value.

Lafarge Africa Plc, a leading Sub-Saharan Africa building solutions company is a member of Holcim Limited, a world leader in building solutions accelerating our world’s green transformation.

Listed on the Nigerian Exchange Group, Lafarge Africa is actively participating in the urbanization and economic growth of Nigeria, the largest economy in Africa.

Lafarge Africa has the widest footprint in Nigeria with cement operations in the South West (Ewekoro and Sagamu in Ogun State), North East (Ashaka, in Gombe State), South East (Mfamosing, Cross Rivers State) with Ready-Mix operations in Lagos, Abuja and Port Harcourt. Lafarge Africa has a current installed cement production capacity of 10.5Mtpa.

Lafarge Africa leverages on its innovative expertise to provide value-added products and services solutions in the building and construction industry in Nigeria. Additional information is available on the web site at www.lafarge.com.ng

Recommended reading: Lafarge appoints Grant Earnshaw as a Non-Executive Director

About Holcim

Holcim is a global leader in innovative and sustainable building solutions. Driven by its purpose to build progress for people and the planet, its 63,448 employees are on a mission to decarbonize building, while improving living standards for all.

The company empowers its customers across all regions to build better with less, with its broad range of low-carbon and circular solutions, from ECOPact to ECOPlanet.

With its innovative systems, from Elevate’s roofing to PRB’s insulation, Holcim makes buildings more sustainable in use, driving energy efficiency and green retrofitting.

With sustainability at the core of its strategy, Holcim is becoming a net-zero company with 1.5°C targets validated by the Science Based Targets initiative (SBTi).

Learn more about Holcim on www.holcim.com

Contact: Adewunmi Alode

General Counsel & Company Secretary