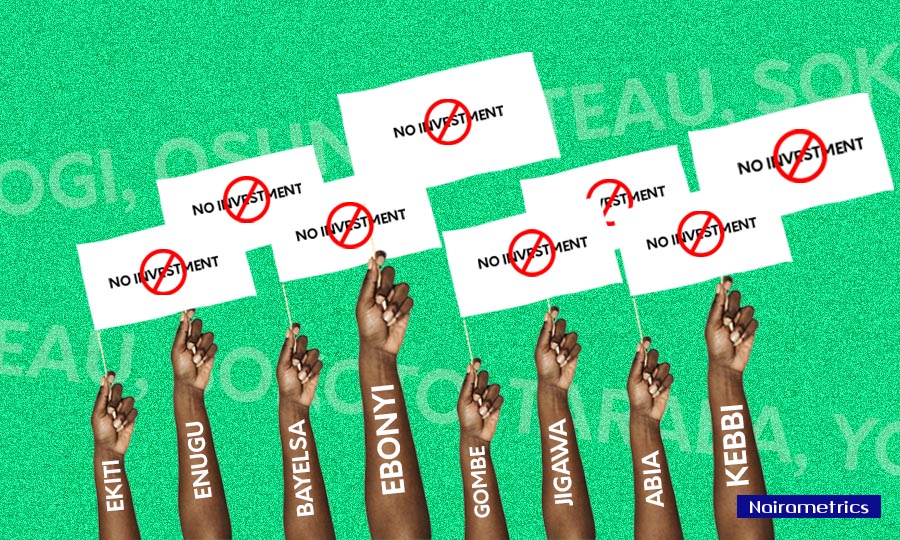

Only Abuja and 7 states in Nigeria were able to attract foreign investments in the first quarter of 2021 leaving 29 other states with zero foreign investments. This is according to recent data from the Nigerian central bank on capital importation into the country in the first quarter of 2021.

The data showed that Lagos, Abuja, Anambra, and Kano got capital importation of $1.58 billion, $318.4 million, $4.1 million, and $2.4 million respectively. Delta, Ogun, Akwa-Ibom, and Kwara also respectively got capital imports of $1 million, $757,187, $737,505, and $229,015.

Foreign investments in Nigeria in 2020 took a huge hit as a result of the coronavirus pandemic and the worldwide economic slump. The overall value of capital inflows for the year decreased to $9.7 billion, down from $24 billion in 2019, a 59.7% decrease and the lowest it has been in at least four years. Moreover, in 2020, only 11 states got foreign investment, while in H1 2021, 8 states received foreign investment.

READ: Foreign portfolio investments in Nigeria drops by 77.4% in Q1 2021

States in Nigeria are unlikely to see any major improvement in their capital importation capabilities if insecurity remains a challenge.

Nigeria’s President, Muhammadu Buhari mentioned in an interview on Arise TV last month that insecurity and violent protests were a disincentive to investing in Nigeria. However, insecurity under the watch of the current government has only gotten worse in recent months with cries of self-determination taking hold in different sections of the country.

READ: Why SEC banned investment technology platforms from offering foreign stocks to Nigerians

Banditry, herdsmen and farmer clashes have also led to an increasing spate of kidnappings, looting and killing of innocent citizens, further deterring foreign investors from investing in the country. Another major issue has been Nigeria’s forex challenges which have resulted in a wide disparity between the parallel market exchange rate and the official I&E window exchange rate.

The difference which is as high as N90/$1 is a major factor hindering foreign investors from flocking back into the country even as oil prices hit new highs. Foreign portfolio investors, for example, are not expected to return if the current situation remains a sticking point.

READ: Foreign investors jostling to exploit Nigeria’s $82 billion healthcare gap

What’s the way out?

Dr Jeremiah Ogaga Ejemeyovwi, a lecturer and consultant at Covenant University, believes that resolving Nigeria’s core macroeconomic vulnerabilities will result in more international investment.

He said, “Foreign investment reflects the foreign sector’s assessment of a country’s economic health. Nobody wants to make foreign investments in a country that lacks currency stability, is unpredictable, and has a high risk of losing money owing to inflationary consequences. Therefore, currency stability, inflation, and security (rule of law) are what would make Nigeria an enticing investment destination for foreign investors.”

Udegbunam Dumebi, a fixed income trader at UBA, agreed that fixing basic macroeconomic failures was important. Nonetheless, he believes that Nigeria should attempt to entice more foreign direct investment when seeking foreign inflows because hot money may not be sustainable.

READ: Foreign investors demand for Nigerian stocks increases to N38.98 billion

He said, “To entice foreign investment, we must enable a free flow of currency, improve security, and increase the ease of doing business in Nigeria. We have many restrictive rules and inadequate infrastructure that dissuade investors, such as high power or transportation costs. Raising interest rates in the NTB, bond market, and even the MPR will not make a difference in addressing sustainable growth.

This is due to the fact that foreign portfolio investments (Hot Money) rarely invest in the core Nigerian economy, preferring to invest in stocks and fixed income instead. As a result, it would be more advantageous for Nigeria to seek more foreign direct investment in order to increase foreign inflows.”