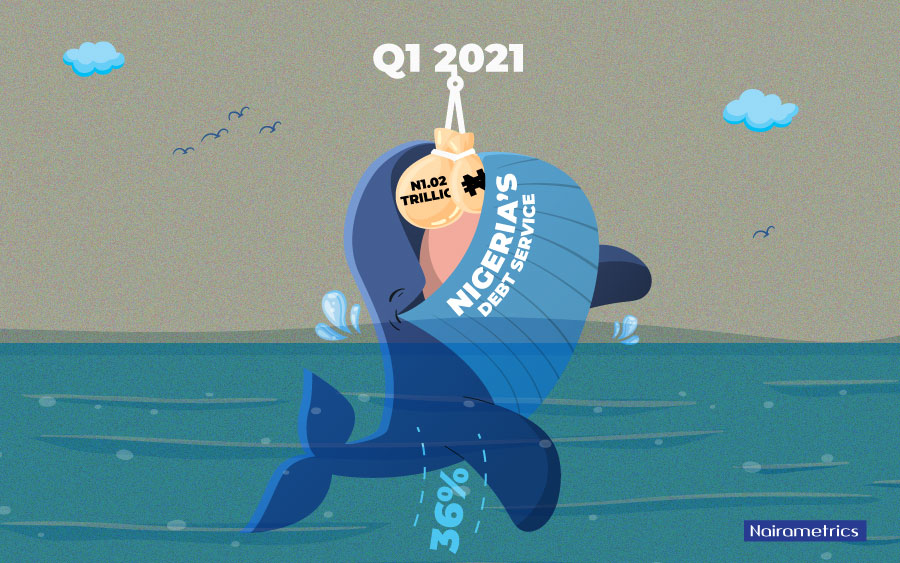

The Nigerian government spent a sum of N1.02 trillion on domestic and foreign debt service in the first quarter of 2021, representing a 35.7% year-on-year increase compared to N753.7 billion spent in the corresponding period of 2020.

This is according to the debt service payment report for Q1 2021, released by the Debt Management Office (DMO).

A cursory look at the data reveals that N612.71 billion was spent on domestic debt service, while N410.1 billion was expended on servicing of external debt.

Breakdown

- A sum of N537.78 billion was used to service FGN Bonds in the review period. This represents a 124.6% increase compared to N239.46 billion recorded in Q1 2020.

- Nigeria repaid a sum of N31.44 billion as principal repayment, while N35 billion was used to service Nigerian Treasury Bills.

- In terms of external debt, $134.04 million was used to service multilateral loans, which includes $104.4 million to International Development Association, $16.21 million to AFDB, and $9.5 million to African Development Fund.

- Also, $106.3 million was used to service bilateral loan agreements, while $763 million was spent on Euro bonds.

READ: Nigeria is falling into China’s debt trap

Recall that Nigeria’s total debt portfolio rose to N33.1 trillion as of March 2021 from N32.9 trillion recorded as of the end of 2020, representing an increase of 0.58%.

It is noteworthy that the debt expense for the period already represents 30.7% of the total N3.32 trillion budgeted for debt service for the entire year.

READ: Nigeria’s debt sentence: The burden of the Port Harcourt refinery

Debt service dwarfs government revenue

Nigeria’s dwindling revenue is still a major factor militating against the expected development of the economy. The situation has continually led the federal government to borrow to funds its fiscal budget.

- Nairametrics reported that Nigeria spent the equivalent of 83% of its revenue in 2020. The total revenue earned by the government during the year stood at N3.93 trillion, while the amount spent on debt service stood at N3.26 trillion.

- In the same vein, Nigeria also recorded a 99% debt service to revenue ratio in the first quarter of 2020, having recorded a retained revenue of N950.56 billion and incurred a sum of N943.12 billion in debt service.

- However, the federal government projects a debt service ratio of 46.9% for the year 2021, with its revenue projected to stand at N6.6 trillion, depending on the crude oil benchmark of $40 per barrel.

- According to the 2021 signed budget, N7.99 trillion was projected as the amount available for the year, indicating a budget deficit of N5.6 trillion, which is expected to be funded by borrowing.

- The Minister of Finance, Budget, and National Planning, Zainab Ahmed, explained that the deficit will be financed by borrowings from domestic and foreign sources. She also stated that that N205.15 billion will come from privatization proceeds.

READ ALSO: Nigerian assets that may be taken over by China

What this means

The Nigerian government’s increase in the debt service fee, despite a decline in government revenue, indicates that the country is spending most of its revenue on servicing debts, which opens us up to more loans in the future, especially in the area of funding capital projects.

The recent positive rally in the global oil market, might not result in a growth in government revenue due to Nigeria’s reduced production quota of 1.52 million bpd. According to the NNPC, exports of crude in March 2021 was 66.67 million barrels despite lifting about 7.62 billion barrels in the month.

Notably, according to the foreign trade report by the NBS, the value of crude oil export reduced to N1.93 trillion in Q1 2021 from N2.52 trillion recorded in the previous quarter.