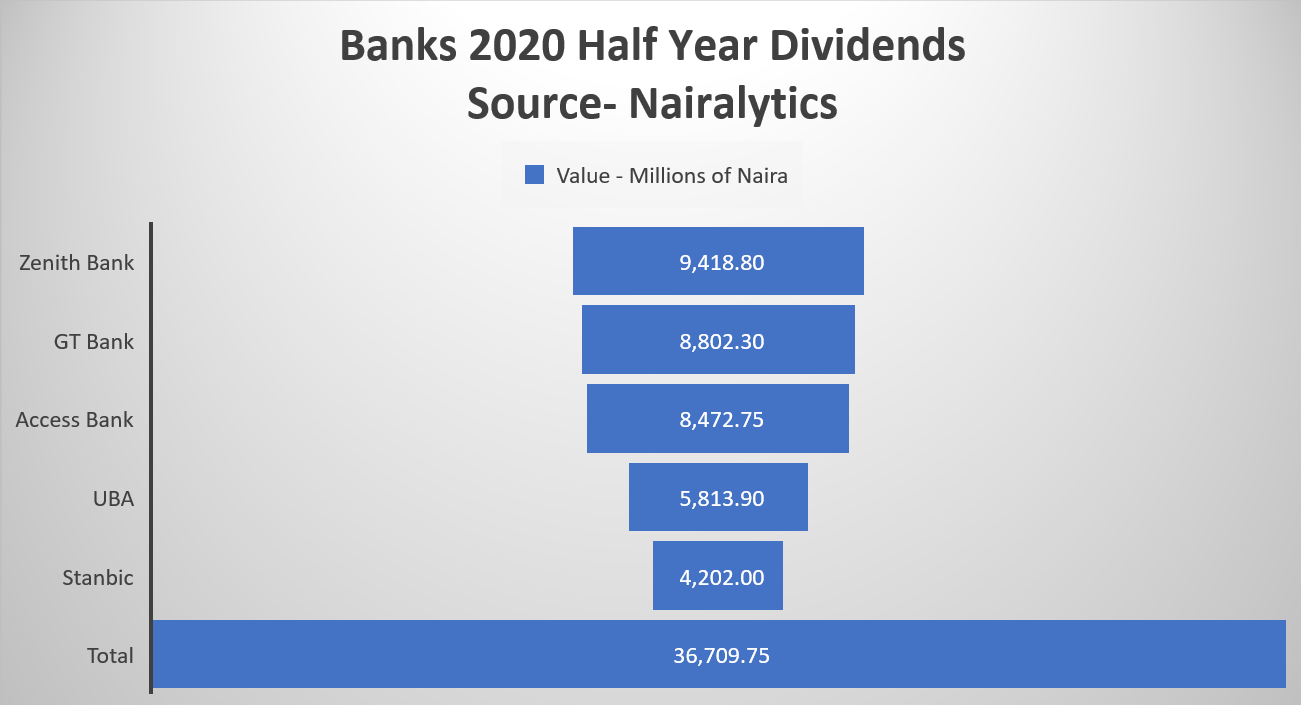

Some of the biggest commercial banks in Nigeria declared dividends of N36.7 billion in interim dividends in the first half of the year as the nation grapples with the economic consequences of Covid-19.

According to information gathered by Nairametrics Research, five of the six top banks in the country, all declared half-year dividends out of profits earned in the first half of the year. The banks reported a profit after tax of N348.7 billion in the first half of 2020 up from N344 billion the same period a year earlier.

Zenith Bank one of Nigeria’s largest banks proposed dividends of N9.4 billion out of profits of N103 billion the largest of the pack. GTB the second most profitable bank declared N8.8 billion out of its N94 billion profits. In total, dividend payouts of the 5 big banks totaled 10.5%. FBN Holding did not declare dividends.

READ: Nigeria’s tier-1 banks pay N29.8 billion worth of taxes in Q1 2020

Disconnect with the economy?

Contrary to expectations Nigerian banks have declared huge profits as the wider economy battle with arguably the worst economic crunch since independence. Globally bank profits have declined, mostly due to higher loan loss provisioning and expectation of high credit losses due to the impact of economic lockdowns on loan repayments.

In the US, six of its giant banks cut about $35 billion from their profits as they anticipate an increase in loan defaults. In South Africa banks have also cut profits as they expect a significant increase in loan losses. As banks around the world cut profits, so did dividend payouts halt. But Nigeria is a stark exception.

READ: Zenith Bank, Unilever, Okomu Oil record losses as investors lose N39.2 billion

Help from the Apex Bank

In Nigeria, banks reportedly cut a deal with the Central Bank to defer taking impairment on some loans effectively allowing them rake in significantly higher profits for the year. Despite the deals cut with the CBN, the top 6 banks (including FBN Holdings, owners of First Bank) saw their loan losses more than double in the first half of the year compared to 2019.

Loan losses rose to N92 billion in the period ending June 2020 compared to N45.4 billion in the same period in 2019. FBN Holdings and Zenith Bank reported the most loans with N30.6 billion and N23.9 billion. Despite the losses, banks still reported higher profits on the back of a significant reduction in interest expenses, another benefit from CBN policies.

READ: Covid-19: Unilever Nigeria suffers 40% revenue loss

Since the central bank forced down interest rates on savings deposits banks have taken advantage, cushioning the drop in interest revenues emanating from a reduction in new loans. While gross interest income dropped, interest expenses dipped even further filtering into higher profits.

Banks have also recorded an uptick in deposit this year despite the increase in CRR debits.

- In a nutshell, cheaper deposits led to a boost in profits

- Banks also saw a boost in profits driven by a revaluation of the foreign currency positions another factor helped by the devaluation of the naira, another CBN monetary policy.

- The banks have had a breather this year and as they did in 2016 are fairing better than the economy. Data from the National Bureau of Statistics also buttresses this. As the economy suffered a 6.1% contraction, financial institutions grew by 28.41% in the second quarter of the year.

- The banking index on the Nigerian Stock Exchange is also up 3.5% month to date.

READ: Zenith Bank’s Profit After Tax in H1,2020 rises by 16.8% to N103.8 billion

Optics: The spate of loan losses recorded so far this year, despite the deferment in provisioning of some loans portents a deeper problem that could come back to bite banks sooner rather than later.

- Critics of the banking sector operations will once again point to the disconnect between the real sector and the financial sector as yet another major example of banks profiting at the expense of the larger economy.

- By paying dividends banks are sending a message to the economy that all is well with their finances and do not require any policy assistance from the CBN.

- It also begs to wonder why banks cry foul whenever their accounts are debited with CRR sequesters.

Some of the banks took advantage of the lockdown to pass double debit to customers account for pos services, which they refused to reverse even after the lockdown. GTB did this to me, each time I called their customer care, they apologised but did not reverse the transaction. I believe it was deliberate.

This writer is downright biased poorly written and full of inaccuracies. In USA all major banks posted better than expected profits despite increasing NPL provisioning. No bank in USA cut nor suspended dividend payments. The only outlier is Wells Fargo due to some other legacy issues that bank has been grappling with.

Looking at the Nigerian banks ..the deposit rate increased across the board in part due to the cashless policy of CBN started in April and drop in operational costs as most branches did not operate. If one looks at the VAT receipts for the quarter for the Financial sector ..it was generally unchanged showing that banks should have performed well by being at least resilient in this environment.