FirstBank, the West African premier financial institution and financial inclusion services provider, has emerged as Nigeria’s Best Bank for Environmental, Social, and Governance (ESG) at the prestigious Euromoney Awards for Excellence 2025, held recently in London.

This marks FirstBank’s second consecutive win in the ESG category, affirming its leadership in sustainable finance and responsible banking across Nigeria.

The Euromoney Awards for Excellence are regarded as one of the most coveted accolades in the global financial industry. The highly competitive selection process involves rigorous analysis and assessment, measuring performance against strategic and impact-oriented criteria.

The Bank earned the award through its deepened sustainability commitments embedded across its operations and community initiatives. In 2024, FirstBank screened 237 transactions worth over N3 trillion for sustainability risks, integrating ESG considerations into its credit framework.

Among its flagship sustainability initiatives, FirstBank commenced a tree planting campaign in partnership with Nigeria Conservation Foundation (NCF), planting over 30,000 trees in 16 locations across Nigeria. This was the first phase of its 50,000-tree initiative, projected to absorb approximately 720 tonnes of CO₂ by the end of 2025, contributing to climate resilience and supporting biodiversity preservation.

FirstBank has been proactive in gender inclusion through the Gender Market Strategy, disbursing over N43 billion FirstGem loans to women-led businesses in 2024. The Bank’s commitment to inclusive banking saw a significant increase in the worth of transactions facilitated by FirstMonie agents to over N9 trillion.

The Bank prioritises ESG/sustainability capacity building, evidenced by the training of over 9000 employees, and its webinars and workshops reaching over 2,000 SMEs and corporates. The bank’s investment in leadership for over 2,000 female employees through the FirstBank Women Network has demonstrated a dedicated structural commitment to cultivating a knowledgeable and diverse workforce catering to the dynamic ESG landscape.

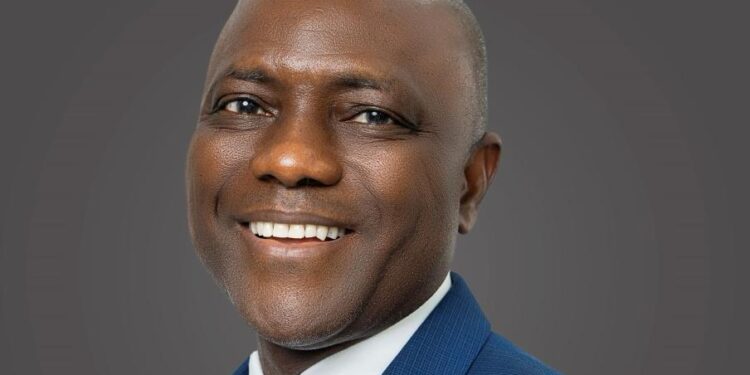

Commenting on the award, the Chief Risk Officer of the Bank, as well as the Chairman of the FirstBank Sustainability Committee, Patrick Akhidenor, said, “We are honoured to receive this prestigious award for the second time in a row, which is a validation of our efforts to create a sustainable and inclusive future for all our stakeholders. Our approach to sustainability is hinged on three pillars: education, health and welfare; diversity and financial inclusion; responsible lending, procurement, and climate initiatives”

He added: “We remain focused on driving impact through purposeful initiatives and inclusive growth, ensuring that our ESG efforts continue to create meaningful change in communities across Nigeria and beyond.”

The continued success in ESG and sustainability is driven by FirstBank’s vision to be Africa’s bank of first choice, leading with purpose, responsibility, and innovation.

About FirstBank

First Bank of Nigeria Limited “FirstBank”, established in 1894, is the premier bank in West Africa, a leading financial inclusion services provider in Africa, and a digital banking giant.

FirstBank’s international footprints cut across three continents ─ Africa, Europe, and Asia, with FirstBank UK Limited in London and Paris; FirstBank in the Democratic Republic of Congo, Ghana, The Gambia, Guinea, and Sierra Leone; FBNBank in Senegal; and a FirstBank Representative Office in Beijing, China. All the subsidiary banks are fully registered by their respective Central Banks to provide full banking services.

Besides providing domestic banking services, the subsidiaries also engage in international cross-border transactions with FirstBank’s non-Nigerian subsidiaries, and the representative offices in Paris and China facilitate trade flows from Asia and Europe into Nigeria and other African countries.

For over 13 decades, FirstBank has built an outstanding reputation for solid relationships, good corporate governance, and a strong liquidity position, and has been at the forefront of promoting digital payment in the country with over 13 million cards issued to customers (the first bank to achieve such a milestone in Nigeria). FirstBank has continued to make significant investments in technology, innovation, and transformation, and its cashless transaction drive has been steadily accentuated with virtually over 25 million active FirstBank customers signed up on digital channels, including the USSD Quick Banking service through the nationally renowned *894# Banking code.

With over 43 million customer accounts (including digital wallets) spread across Nigeria, the UK, and sub-Saharan Africa, the Bank provides a comprehensive range of retail and wholesale financial services through more than 820 business offices and over 280,000 agent locations spread across 772 out of the 774 Local Government Areas in Nigeria.

In addition to banking solutions and services, FirstBank provides pension fund custody services in Nigeria through First Pension Custodian Nigeria Limited and nominee and associated services through First Nominees Nigeria Limited.

FirstBank’s commitment to Diversity is shown in its policies, partnerships and initiatives such as its employees’ ratio of female to male (about 41%:59%; and 37% women in management roles) as well as the FirstBank Women Network, an initiative that seeks to address the gender gap and increase the participation of women at all levels within the organisation. In addition, the Bank’s membership of the UN Women is an affirmation of a deliberate policy that is consistent with UN Women’s Empowerment Principles (WEPs) ─ Equal Opportunity, Inclusion, and Nondiscrimination.

For six consecutive years (2011 – 2016), FirstBank was named “Most Valuable Bank Brand in Nigeria” by the globally renowned The Banker Magazine of the Financial Times Group and “Best Retail Bank in Nigeria” eight times in a row, 2011 – 2018, by the Asian Banker International Excellence in Retail Financial Services Awards.

Significantly, FirstBank’s Global Credit Rating was A+ with a positive outlook while ratings by Fitch and Standard & Poor’s were A (nga) and ngBBB+ respectively, both with Stable outlooks as at September 2023. FirstBank maintained the same level of international credit ratings as the sovereign, a milestone that was achieved in 2022 for the first time since 2015.

In 2024, FirstBank received notable international awards and accolades. Some of these include Nigeria’s Best Bank for ESG 2024 and Nigeria’s Best Bank for Corporates 2024 both awarded by Euromoney Awards for Excellence; Best SME Bank in Africa and in Nigeria by The Asian Banker Global Awards; Best Private Bank in Nigeria and Best Private Bank for Sustainable Investing in Africa by Global Finance Awards; Best Corporate Bank in Nigeria 2024, Best CSR Bank in Nigeria 2024, Best Retail Bank in Nigeria 2024, Best SME Bank in Nigeria 2024 and Best Private Bank in Nigeria 2024 all awarded by the Global Banking and Finance Awards.

FirstBank has continued to gain wide acclaim on the global stage with several international awards and recognitions received so far in 2025 which includes Best SME Bank in Nigeria 2025 and Best SME Bank in Africa 2025 by The Asian Banker; Best Private Bank in Nigeria 2025 and Best Private Bank for Sustainable Investing in Africa 2025 by Global Finance Awards; SME Financier of the Year in Nigeria 2025 by The Digital Banker Global SME Banking Innovation Awards; Best Retail Bank in Nigeria 2025 and Best Bank for Empowering Women Entrepreneurs in Nigeria 2025 all by The Annual Global Economics Awards.

Our vision is “To be Africa’s Bank of first choice” and our mission is “To remain true to our name by providing the best financial services possible”. This commitment is anchored on our core values of EPIC – Entrepreneurship, Professionalism, Innovation, and Customer-Centricity. Our strategic ambition is “To deliver accelerated growth in profitability through customer-led innovation and disciplined execution.”