The Federal Government of Nigeria has called on the West African stock exchanges, operators and regulators must think hard to find liquidity, growth, and sustainability in their markets.

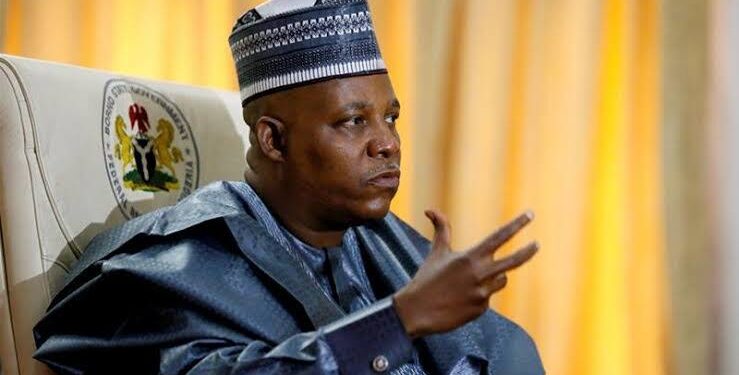

The country’s Vice President Kashim Shettima made the call at the 3rd West Africa Capital Market Conference (WACMAC) in Lagos, Nigeria.

Shettima represented by Dr Tope Fasua, Special Adviser to the President on the Economy, in the office of the Vice President said:

- “If New York Stock Exchange still thrives since it was started up in 1792, and London Stock Exchange still attracts African listings even though it’s been around since 1571, the Amsterdam Stock Exchange started in 1611 and even closer home, Bombay Stock Exchange since 1875 and Egyptian Stock Exchange since 1883, there must be reasons why these entities are still thriving and those reasons are the fundamental underpinnings that we must explore, to gain purpose, to find strength, to discover resilience, and to establish sustainability for our markets”.

Disincentive around further investments

Shettima noted that his thinking is whether there is a disincentive around further investments in the capital market.

- “Perhaps the long-term nature of investments there, traditionally speaking, is the problem as we live in a microwave world where young people want their returns immediately or within a short period.

- Decades back, parents proudly purchased shares of companies for their children at birth and did not even care much about losses in unclaimed dividends and scrip issues.

- Children matured to discover that their parents had invested in their behalf. And on several occasions, such investments have become substantial.

- These days, in a dematerialized world where confirmations do not require paper evidence and liquidity, it is even better assured that these investments are not happening with the frequency with which they happened in times past,” he said.

Young generations

He called on the exchanges to find ways to reach out to the young generations where they reside presently.

- “Meet young West Africans online. Create Apps that they can relate to. Use blockchains where necessary, to show transparency and to give them some of the control that they seek.

- Show them value, solidity, history, structure, resilience, and sustainability, so that rather than invest in legless risky ventures where they see their monies disappear daily, they will learn the beauty of capital market investment, and will through your efforts, invest in the companies and instruments that will guarantee the sustainable future of West Africa, the very last bastion of development and opportunities in the world.

- I want to say that we’ve only just begun. We have seen the surge of cryptocurrencies and other arcane instruments and trades in West Africa and not all the stories had happy endings.

- We must understand that though savings may be shrinking, and economic crises have caused a shrinkage in investible funds, still they are there and only the truly innovative will access them. The times call for innovation, ingenuity, thinking ahead and at the speed of light, inventiveness, diversification of product offerings, continuous education, and interactions with the public on every platform, on and offline.

- We have to do all that it takes, legitimately, to establish a solid base for our capital market, to weed out unscrupulous elements who get into the market or find ways of confusing folks about their registration or affiliations with capital market regulators, just to run scams on people,” he said,

Nigeria’s $3 trillion infrastructure gap

Shettima noted that just two days ago, on Monday, 23rd of October 2023 at the opening of the 29th Annual Conference of the Nigerian Economic Summit, President Bola Ahmed Tinubu sought the cooperation and intervention of Nigeria’s private sector – and specifically the capital market – toward the funding of Nigeria’s $3 trillion infrastructure gap.

According to him, Tinubu said closing the gap should not require 300 years to cover – as propounded in some texts – but 10 years.

- “If this is so for Nigeria, it presupposes that the entire region has similar – or perhaps larger – infrastructural deficits waiting to be filled. They are better filled from inside, not through foreign borrowing alone,” he said.

West Africa Capital Market Conference

Lamido Yuguda Director-General, SEC Nigeria and Chairman, of the West Africa Securities Regulators Association said the West Africa Capital Market Conference (WACMaC) was conceived as a platform to address crucial issues related to the orderly growth and development of regional and continental capital markets.

Hosted by WASRA and co-hosted by ECOWAS, WACMIC, and WAMI, this conference is held biennially in rotation across the member states of WASRA.

- “Our inaugural conference held in Abidjan, Cote D’Ivoire, in 2019 drew over 300 stakeholders from around the world, and the subsequent conference in Ghana in May 2022, gathered over 200 participants both in person and virtual.

- These gatherings have been instrumental in shaping the integration project, expanding the membership of WASRA and WACMIC to include Cape Verde, and advancing our collective mission,” he said.

Yuguda noted that Nigeria, with its vibrant capital market and a market capitalization of USD 98. 28 billion, is proud to host the 3rd WACMAC.

- “This conference takes place at a time when Nigeria’s President, His Excellency, Asiwaju Bola Ahmed Tinubu, GCFR, serves as the Chairman of ECOWAS, underscoring Nigeria’s pivotal role in the region.

We are confident that this,

- “Infrastructure Deficit and Sustainable Financing in an Integrated West Africa Capital Market” event will foster integration, encourage capital formation, promote tourism, and attract investors,” he said.

Collaborative spirit

In an address, the executive Governor of Lagos State Mr. Babajide Sanwo-Olu said the cooperation between the various bodies fortifies the bedrock of the W/African region fostering a collaborative spirit among member states.

Sanwo-Olu said governments are actively aware of the imperatives of addressing infrastructure deficit and sustainable financing in the region.

He said the conference’s theme is especially apt for the moment as modern infrastructure such as roads, rails, ports, fibre optics connectivity power, etc. are largely inadequate across the sub-region.

- “These perennial inadequacies have hindered the economic growth of our various nations and the economic development of our people. It behooves therefore us to deliberate on ideas and financial strategies that can bridge these infrastructural gaps, enhancing the quality of life of our people and propelling our economy to greater heights.

- “While governments like ours continue to make efforts at plugging the huge infrastructural deficits, we cannot do it alone and that is why we are collaborating with you and saying we are waiting to see the types of innovative instruments and ideas that you can bring forward for us to be able to do the quick and very difficult work that you have asked us to do,” he said.