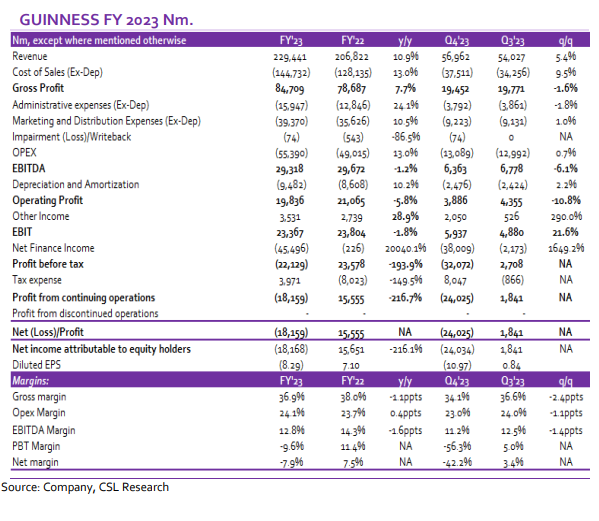

Guinness Nigeria Plc’s (GUINNESS) FY numbers showed mixed performance across key metrics.

The renowned foreign extra stout brewer recorded a double-digit Revenue growth of 10.9% y/y to N229.44bn, amidst high inflationary pressure which has weakened consumer purchasing power.

Despite a moderate rise in Cost of Sales (13% y/y to N144.7bn) and Operating expenses (13% y/y to N55.4bn), a net FX loss of N49.1bn resulted in a Pretax loss of N22.1bn compared with a Pre-tax profit of N23.6bn in FY 2022.

To mitigate environmental risk, the business is shutting down its sachet mainstream spirit (MSS) products.

This, in addition to the lingering effects of the fuel subsidy removal and the FX unification policy on demand, may result in a minimal decline in Revenue in the short term especially as there is little room for price increases without a dent in volumes.

We however maintain a positive long-term outlook on GUINNESS Nigeria Plc, given its widely accepted products, improved production efficiency, market position, and plans by the company’s management to pay up dollar-denominated loans.

We retain a Buy recommendation on Guinness and increase our price target slightly to N95.60/s from N93.13/s previously.

We derive our price target using a 40/60 blend of sector-relative valuation estimates and a DCF valuation.

Resilient Top-line

Improved Revenue growth of 10.9% shows the business’s resilience amidst various economic headwinds like inflation, insecurity, Q3 cash crunch & fuel scarcity, elections, and FX scarcity.

Although Volume was down by 3.7% y/y, management attributed this to insecurity in the eastern part of Nigeria (major market), which was confronted by incessant “sit at home” orders by FG.

Therefore, Revenue was impacted by the average price increase of 20%-30% across the different product categories last year.

Revenue by product contribution: Brand Guinness +14% vs FY22, Mainstream Spirit +36% vs FY 22, Ready to Drink (RTDs) +12% vs FY22, Premium spirits +1% vs FY22.

Management strategy to reduce cost.

Cost of Sales adjusted for depreciation grew by 13% y/y to N144.7bn while Gross Margin marginally declined to 36.9% from 38% in FY 2022.

As part of the management plans to reduce overdependence on imported raw materials for production, in order to save the business sizable FX cost and improve its Gross Margin, there are plans to further increase domestic sourcing of raw materials from 60% to 85%, leaving only types of machinery to be imported.

Operating Expenses grew in tandem with Cost of sales, up 13% y/y. Previous year growth (2022 vs. 2021) was 42.6%.

In our view, this shows consistent effort by the company’s management to maintain a considerably cost-effective operation as shown in their productivity savings: +114% vs. FY 2022 and logistics efficiencies despite the hike in diesel price.

Business Liquidity

The business has a stable cash conversion cycle of 23 days, which has optimally improved its cash and cash equivalent balance, up 33.13% to N92bn from N69bn y/y. With this, management believes dollar-denominated debts can be paid from the cash flow.

Outlook

To mitigate environmental risk, the business is shutting down its sachet mainstream spirit (MSS) products, implying Revenue may take a minimal hit.

Factoring fuel subsidy removal and FX unification policy and with no clear direction of possible price increase from the management, we readjust our revenue growth for 2024e from 20.2% to 17.5% (N269.5bn).

Valuation

We have a Buy recommendation on Guinness with a price target of N95.60/s derived from a 40/60 blend of sector-relative valuation estimates (EV/EBITDA) and a DCF valuation.

On EV/EBITDA, we utilised Bloomberg’s 2023e Middle East & African peer average (11.1x) and derived a fair value (FV) estimate of N164/s. Our DCF FV is N45.69/s assuming a 17.2% WACC and 3% terminal growth rate.