Following Stan Kroenke’s role in failed breakaway Super League, there has been outrage and protests with fans calling for his exit from the club’s ownership.

At Arsenal’s last Premier League match against Everton on Friday, thousands of fans protested outside the Emirates Stadium brandishing placards that read #KreonkeOut. Social media was also awash with protesting fans.

Daniel Ek, CEO of Spotify, the Swedish audio streaming and media services provider, has expressed his interest in buying the London giants on his Twitter account saying he would be happy to throw his hat in the ring if the club owner would like to sell.

READ: Abigail Johnson is the world’s richest in finance, manages a $5 trillion investment company

“As a kid growing up, I’ve cheered for @Arsenal as long as I can remember. If KSE would like to sell Arsenal I’d be happy to throw my hat in the ring,” his account read.

Daniel Ek is a Swedish billionaire entrepreneur and technologist. He doubles as the Co-Founder and CEO of audio streaming service, Spotify. The company has more than 180 million users and boasts of more than 87 million paying subscribers. According to Forbes, his real-time net worth is $4.3billion.

However, on Tuesday, Stan Kroenke through his Kroenke Sports and Entertainment (KSE), said in a statement that he doesn’t have any intention of selling.

READ: There are only 15 black billionaires in the world, here are the top 10

“In recent days we have noted media speculation regarding a potential takeover bid for Arsenal Football Club. We remain 100 percent committed to Arsenal and are not selling any stake in the club. We have not received any offer and we will not entertain any offer,” read the KSE statement.

In 2007, Stan Kroenke bought a 9.9% stake in Arsenal. Slowly, he built up his shares until it shot to 62.89% in 2011. Then, in 2018, he assumed full control of the club after Russian Alisher Usmanov, who has a net worth of $18.4 billion accepted his bid of £550million to buy him out.

READ: Football fans cashing out with Crypto as Juventus’ fan token rises by 596.98%

Ek’s ambition to buy Arsenal FC

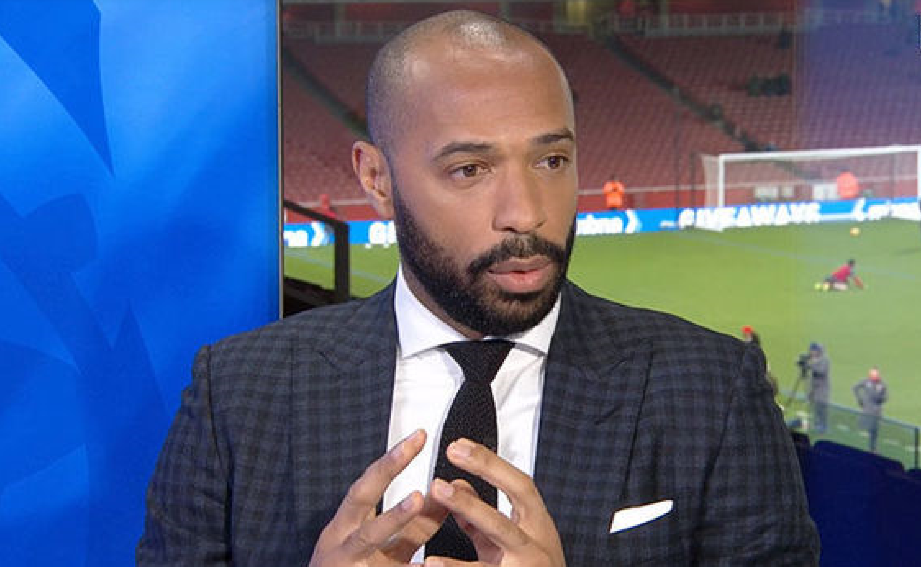

According to reports, Daniel Ek is expected to submit his first bid which is in the region of £1.8billion in the next few days. He has also enlisted the support of club legends Thierry Henry, Dennis Bergkamp and Patrick Vieira.

In an interview with CNBC, he said he has secured the funds to complete the takeover.

“I’ve been an Arsenal fan since I was eight years old. Arsenal is my team. I love the history. I love the players. And of course, I love the fans,” he said.

“So as I look at that, I just see a tremendous opportunity to set a real vision for the club to bring it back to its glory. And I want to establish trust with fans and I want to engage the fans again.

So, to answer your question, I’m very serious. You know, I have secured the funds for it and I want to bring what I think is a very compelling offer to the owners and I hope they hear me out.

READ: Jeff Bezos now worth over $200 billion

I’ve been a fan for 30 years of this club and I certainly didn’t expect that this would happen overnight and I’m prepared that this could be a long journey. But all I can do is prepare what I think is a very thoughtful offer and bring it to them and hope they hear me out.

I’m just focused on the club, I focus on the fans and I focus on trying to bring the club back to glory and as you said, I’m first and foremost a fan. That’s the most important thing for me and I want the club to do better – that’s my primary interest,” he added.

What Arsenal’s legendary coach, Arsene Wenger thinks about Ek’s ambition

In an interview, Arsene Wenger faulted the Swedish billionaire, Daniel Ek, for expressing his interest to buy the club saying he now has ‘a mountain to climb.’

He said, “For the project, the best deals are made when nobody knew about it and you come out and it is done.”

“Once you announce things, you have a mountain to climb after. Nobody wants to give in and I think it is better always if you do your deal, then when it is done you come out and tell people what you want,” he added.

Can Ek fund the move?

“His wealth actually has been misreported in recent days. I mean the exact detail is that he owns 8 per cent of Spotify and currently Spotify shares have actually fallen by 10 per cent on the New York Stock Exchange (NYSE) this afternoon.

The company is currently valued at around $50bn, so he owns 8 per cent of $50bn – around $4bn to be precise. Now we don’t know whether he has got liquid funds in addition to that,” Sky News Business Presenter, Ian King said.