Like several industry watchers and Nigerians, some Senators in the National Assembly have expressed their concerns over the decision of the Central Bank of Nigeria (CBN) to ban financial institutions from transacting in crypto currencies.

Below are their views and proffered solutions, which they shared via Twitter, to address the fears of CBN instead of an outright ban:

Senator Solomon Adeola, a Chartered Accountant and Tax Consultant

I am strongly against the outright ban of this medium of exchange by the Central Bank of Nigeria. What the CBN should be telling Nigerians are the regulations put in place to regulate the activities of the operators.

All over the world, these cryptocurrencies are regulated. The operators of this so called currency are everywhere.

I would indulge this Senate to allow the regulators also to be invited so that they can also tell the Committees their own position concerning the operation of cryptocurrency in Nigeria.

READ: Crypto ban: CBN rule does not criminalize cryptocurrencies – Moghalu

Senator Biodun Olujimi, former board member, Nigerian Communication Commission

We didn’t create cryptocurrency and so we cannot kill it and cannot also refuse to ensure it works for us. These children are doing great business with it and they are getting results and Nigeria cannot immune itself from this sort of business.

What we can do is ensure bad people must not use it. This motion is most important to us. The time has come for us to harmonize all the issues concerning cryptocurrency.

READ: Why the CBN wielded the big stick on cryptocurrency transactions

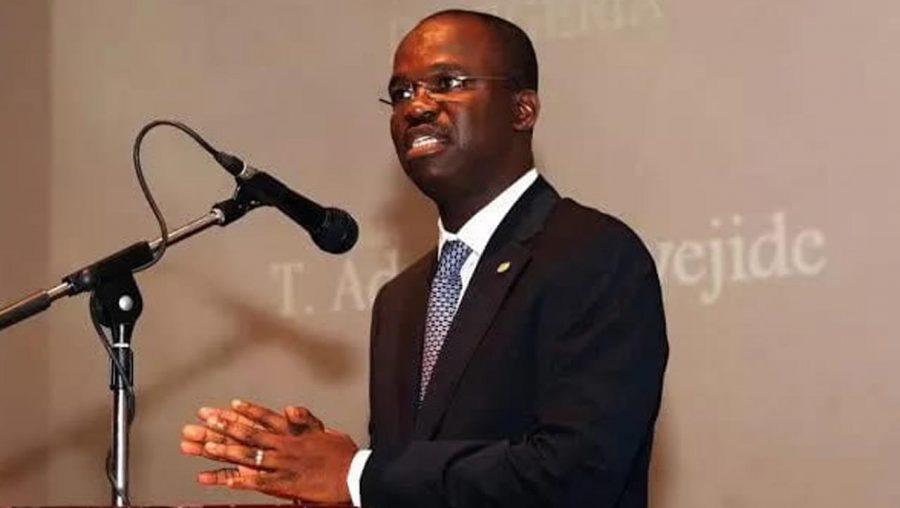

Senator Tokunbo Abiru, immediate past Group Managing Director, Polaris Bank

In the last five years, we have had people changing cryptocurrencies to over $500 million. It is good to ban because of the challenges it has presented; in reality, banning it doesn’t take it away.

Even our Securities Exchange Commission (SEC) also recognized cryptocurrency as a financial asset they need to regulate. What we should do is to invite the major stakeholders to a public hearing.

READ: FG to convert N10 trillion “ways and means” loan into 30 year bond – DMO

Senator Sani Musa

Cryptocurrency has become a worldwide transaction of which you cannot even identify who owns what. The technology is so strong that I don’t see the kind of regulation that we can do. Bitcoin has made our currency almost useless or valueless.

If we have an economy that is very weak and we cannot regulate cryptocurrency in Nigeria, then I don’t know how our economy would be in the next seven years.

READ: Nigeria’s capital inflows hit a new record low of US$9.7bn since 2016

2. CBN’s decision to stop Financial Institutions from transacting in Crypto currencies and matters arising therefrom by Senator ID Gyang and Senator Tokunbo Abiru {@TokunboAbiru}

— The Nigerian Senate (@NGRSenate) February 11, 2021

What you should know

- On February 5, 2021, the Central Bank of Nigeria warned Deposit Money Banks, Non-Financial Institutions, and other financial institutions against doing business in crypto and other digital assets, according to Nairametrics.

- In a circular dated 5th February 2021 and distributed to regulated financial firms, the apex bank of Africa’s largest economy warned and reminded local financial institutions against having any transaction in crypto or facilitating payments for crypto exchanges.

- In addition, the apex bank instructed the financial institutions to immediately close the accounts of such persons or entities transacting in or operating cryptocurrency exchanges.

- The Apex bank further warned the Nigerian Financial Stakeholders that any breach of this directive would attract serious regulatory sanctions.

- The CBN released a press statement further justifying its position to the general public and clearly stating that cryptos are issued by unregulated and unlicensed entities which begs the question of legality. It also claimed that cryptocurrencies have been used to finance several illegal activities including terrorism and money laundering.

- The Senate has, however, mandated its Committees on Banking, Insurance and other Financial Institution, ICT and Cybercrimes and Capital Market to invite the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele for briefing on the ban of Crypto transactions placed by the apex bank.