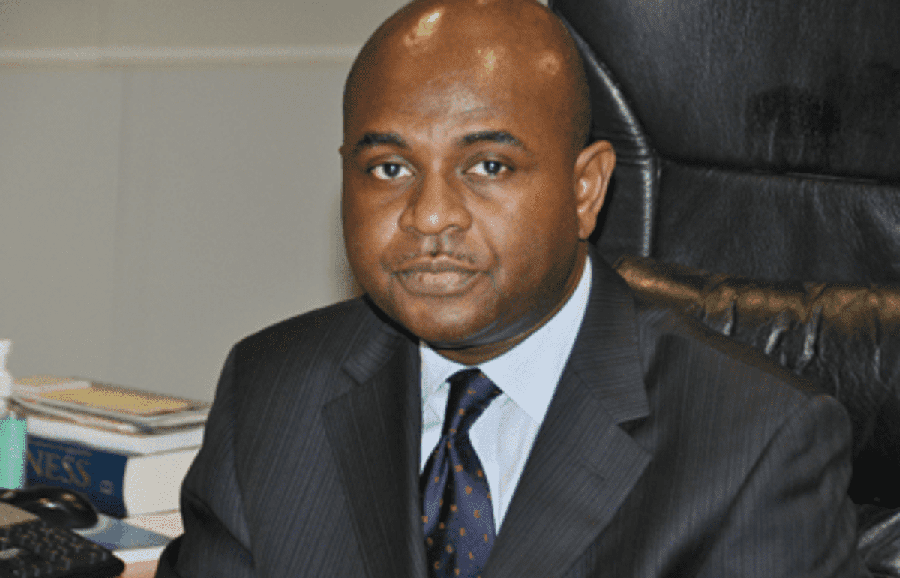

Former Deputy Governor of the Central Bank of Nigeria, Kingsley Moghalu, has said that the CBN ruling on the prohibition of crypto operations does not criminalize the use and trade of cryptocurrencies in Nigeria. He also added that banning cryptos might have not been the wisest decision by the CBN.

Moghalu disclosed this in an interview with Channels TV on Sunday evening.

On criminalizing of crypto

“I do not interpret it as criminalising crypto; I interpret it as a directive to financial institutions under the control of the CBN not to deal with these cryptocurrencies,” he said.

He added that the directive was targeted at exchanges of cryptocurrencies. According to Moghalu, it did not “criminalize individuals transacting in exchanging based on crypto, although it becomes more difficult, if the exchanges are made suspect by the CBN.”

“It’s a bit of a grey area, but the CBN said it’s not legal tender; but they don’t have to tell me what we can exchange for value. Therefore, it does not criminalise cryptocurrency,” he added.

On whether the ban was a wise decision

Moghalu said that although the CBN had previously put out a circular as far back as 2017, warning that cryptos weren’t legal tender, “the SEC recognizes crypto as a financial asset and in September they said they were going to put out a regulatory framework for that.”

He stated that Bitcoin and other cryptos, are known as ‘freedom money’, as crypto value is not determined by the value of legal tender currencies.

“We need to understand that crypto doesn’t have an underlying value, because unlike a normal currency, which is backed by foreign reserves, productive nature of the country that owns the currencies and other factors… that’s not what happens with cryptocurrencies. But we live in a world of innovation and cryptocurrencies bypass central banks.

“Nigeria is the second biggest user of bitcoin and during the endSARS protests, these cryptocurrencies were used to support the protest when the CBN blocked accounts.”

He added that the use of crypto transcended aspects from political to business opportunities for young Nigerians and banning its legal use in banking institutions might not have been the wisest decision.

“There is the financial aspect, there is the political aspect, there is the private economic aspect of it and the aspect of business opportunity for young Nigerians who trade these instruments.

“The CBN directive is legal, but was it the wisest way to approach the risk of cryptocurrencies? I am not sure about that. That is why I was worried about this response from the central bank,” he added.

In case you missed it

- The CBN, a few days ago issued a circular prohibiting banks and other financial institutions from carrying out transactions in cryptocurrencies or facilitating payments for crypto exchanges.

- The CBN’s directive has since gotten very harsh reactions on social media with many condemning the policy as a deliberate attempt by the government to impoverish young Nigerians who have been able to create wealth for themselves through crypto trading.

- The CBN released a press statement further justifying its position to the general public and clearly stating that cryptos are issued by unregulated and unlicensed entities which begs the question of legality. It also claimed that cryptocurrencies have been used to finance several illegal activities including terrorism and money laundering.