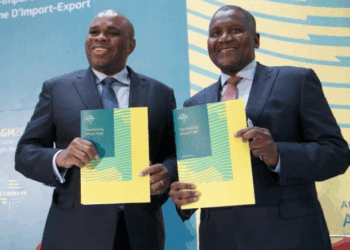

MUFG and African Export-Import Bank (Afreximbank) have signed a $520 million facility, following Nippon Export and Investment Insurance (NEXI) agreement to support and cover the arrangement.

Afreximbank will use the $500 million proceeds from the signed agreement with MUFG Bank for its Pandemic Trade Impact Mitigation Facility (PATIMFA).

READ: Africa’s economy to dip by 3.4% this year – AfDB President, Akinwumi Adesina

NEXI’s proactive support for this facility was agreed on the basis of Afreximbank being a strategic partner, participation from Japanese investors, and the deal contributing to the UN’s Sustainable Development Goals (SDGs).

MUFG was the sole Mandated Lead Arranger, Bookrunner, Agent and NEXI Coordinator on the transaction, with the documentation closing in December 2020.

READ: House of Reps directs NAICOM to suspend recapitalisation of insurance firms

The facility fully aligns with Afreximbank’s strategic priorities in the area of intra and extra African trade and investment, export manufacturing, as well as industrialization. These objectives find common ground with NEXI’s objectives of supporting sustainable African growth and development in line with TICAD objectives.

READ: Afreximbank announces $3 million COVID-19 response grant for African countries

Working together with NEXI and Afreximbank, MUFG was able to access under-utilized Japanese liquidity, resulting in an extremely successful outcome of distribution to Japanese investors, many of which were new investors for Afreximbank. This follows in the footsteps of two Samurai loans for Afreximbank in 2017 and 2019, including the largest ever Samurai Loan for an African issuer.

READ: Debt forgiveness will help boost development in Africa – Gbajabiamila

What they are saying

Speaking on the transaction, Christopher Marks, Head of Emerging Markets EMEA, commented:

- “This facility marks a watershed moment for African institutions looking to tap the Japanese investor pool, and we couldn’t be prouder to have played a leading role. It goes without saying that we are delighted to have once again partnered with Afreximbank, which is not only leading the way in terms of bringing in new investment and growth opportunities to Africa, but also providing vital support to the region in the face of the COVID-19 pandemic.”

READ: Arsenal star, Aubameyang fined $10,000 by CAF for social media posts

What you should know

- The signed arrangement between the banks is the first to be covered by NEXI.

- Afreximbank will use the proceeds towards its Pandemic Trade Impact Mitigation Facility (PATIMFA), which was launched in March 2020 to help African sovereigns, commercial banks and corporates to weather the impact of the crisis due to the COVID-19 pandemic.

- The facility will support the Bank’s interventions in response to the COVID-19 pandemic and will be used to finance trade and trade-related investments which contribute to the sustainable development of the socioeconomic, health, manufacturing, environmental, agri and agri-related sectors across the 51 African Member States of Afreximbank.

- The African Export-Import Bank (Afreximbank) is a Pan-African multilateral financial institution with the mandate of financing and promoting intra-and extra-African trade. Afreximbank was established in October 1993 and owned by African governments, the African Development Bank and other African multilateral financial institutions as well as African and non-African public and private investors.

- MUFG Bank is Japan’s largest bank and one of the world’s largest, with offices throughout Japan and in 40 other countries.

READ: Resources mobilisation critical to Africa’s recovery from Covid-19 – Adesina

cant this facilities be shared within the masses as a relief fund that could help in boosting there little busness and a relief on the masses is a relief on the entire nation thanks my suggestion, like me am a small scale business man and i am ready to employ more if i am been given the relief as a grant thanks