Following the End SARS protest which currently ongoing in several parts of the country, many victims of the atrocious activities of the Police unit have been coming forward to narrate their unpleasant experiences.

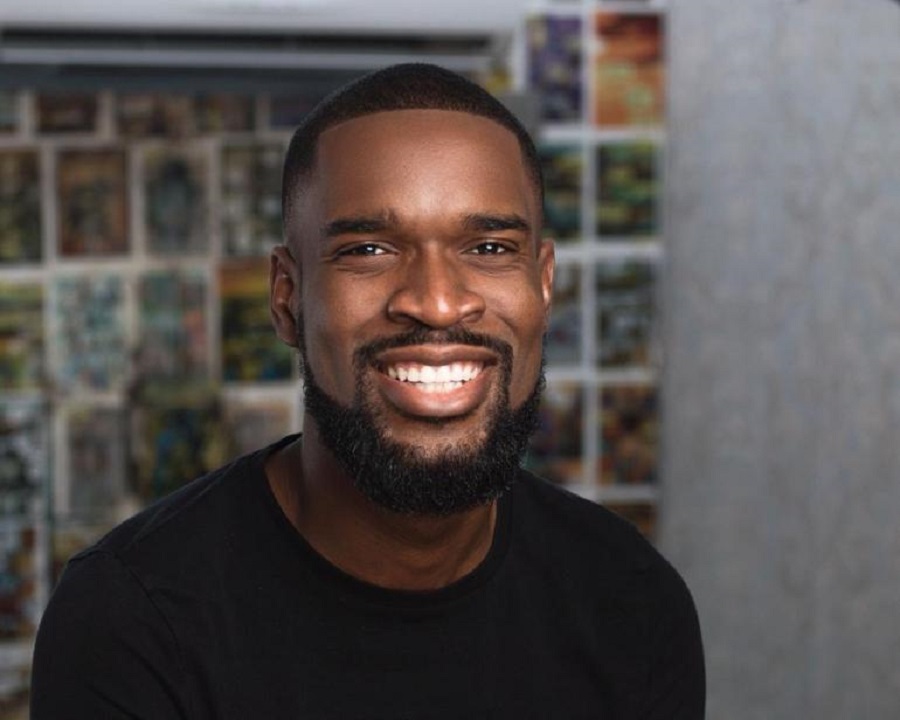

One such victim is Yele Bademosi, a tech entrepreneur and CEO of Bundle – a social payment app for cash or crypto. Bademosi took to his Twitter handle @YeleBademosi to narrate how he was abducted by the officers, harassed, threatened and extorted from last year, in the Lekki axis of Lagos while on his way home.

Explore Data on the Nairametrics Research Website

“On October 2019, I got kidnapped by SARS. I was less than 2 mins from my home, they refused to listen to anything I said and took me from Lekki to Ajah then all the way to Ikoyi, whilst stopping and harassing other young adults, I’m not sure how many cars they stopped and robbed,” he narrates.

Bademosi said that even after identifying himself to the officers and explaining to them his line of work, his phones and other devices were seized from him as the officers insisted he is a “yahoo-boy.” Fearing for his life, Bademosi allowed the officers access into his devices where they took the little he had in his account even though they initially insisted he must give them a million naira before he could be set free.

READ: Landlords offer incentives to counter “work from home” induced vacancy rates

“They took my phones, wallet, house key, my Apple Watch, they didn’t care about my ID cards and claimed I was a Yahoo Boy because I had messages on telegram with foreigners. They demanded N1m from me, made a “fake” phone call to their commander, and said I would sleep in prison. They stopped at the end of Eko Bridge and demanded more money before driving me to somewhere on the mainland near the international airport. I don’t keep a lot of Naira on me as I am long Bitcoin, and only had N51,000 in my account, which they asked me to withdraw at a UBA ATM. They forced me to open my US bank accounts and said I should transfer USD from my Bank of America account to my GTB account. I cried and prayed because I didn’t know what to do and couldn’t understand why and how this was happening. It was one of the scariest experiences of my life,” he said.

READ: N75 billion Nigerian Youth Investment Fund to be rolled out before end of October – Minister

The serial entrepreneur said he thought to himself that these errant officers could kill him and no one would even know. All he could do was pray to God to deliver him. He however didn’t disclose how he was eventually able to…., but insists, “SARS must be banned! They have no place in Nigeria and we must hold our government and leaders accountable. This could be any of us, we shouldn’t wait until we lose a loved one before we take action!”

In the last three days, the call for the disbandment of the notorious Police unit has continued on social media and on the streets of some Nigerian cities with protests and demonstrations led by celebrities and social media influencers.

READ: This is a copy of the Self-Certification form govt. wants targeted account holders to fill

A few days ago, the Inspector General of Police, Mohammed Adamu had banned the Federal Special Anti-Robbery Squad (FSARS) and other Tactical Squads of the Force including the Special Tactical Squad (STS), Intelligence Response Team (IRT), Anti-Cultism Squad operating at the Federal, Zonal and Command levels, from carrying out routine patrols, it is yet to be seen if the warning will be heeded.

SARS needs Reform not ending SARS, if it were armed robbers that caught you…you may not be alive to tell the story, Armed Robbers will finish Nigerians in one month if government end SARS.

Who then are the armed robbers if not SARS? Majority of the high and low profile cases that have taken place in this country were committed by SARS operatives. Despite my personal experience, I won’t support an outright ban of SARS, I would rather support reform. The problem with the entire Nigerian Police Force is that their recruitment process is flawed: many “serving and retired criminals” easily found their ways into the Police Force during recruitment exercises. At times they used money to buy their ways into the Force. If SARS should be outrightly banned, honestly, we would end up having more problems and challenges than we currently have. My position is, let us try and reform SARS by all means and at all means, even if it requires inviting other countries to come and assist us with Police recruitment.

They should be banned. Because they are Killers. Even the armed robbers we are talking about knows that nobody carries money around this days. And even if they steal your phones they can be tracked. SARS have longed been in Nigeria but I have never heard that SARS has at anytime intercept with kidnappers. Are kidnappers not still operating in Nigeria? They are only good at oppression.

If this actually happened to a citizen of the nation where Ruling government I think it’s unfair

Every Sars official should be probed by efcc, but it’s not possible because they are brothers in crime even our leaders their oga at the top will protect them. We will only comment and do nothing but I know that what ever a man sow he will reap one day