Though we are still grappling with the effects of COVID-19, it may not be too early to begin to take stock and find out what we did well during the pandemic and what we should have done better.

Almost everyone’s radar has been on the ill-preparedness or lack of appropriate response by the government, with little or no time for an inward look at ourselves.

The type of government we have in Nigeria should not have left anyone surprised at their response to the pandemic, especially when it came to the welfare of the populace. What do you expect from a government that is dysfunctional, at best?

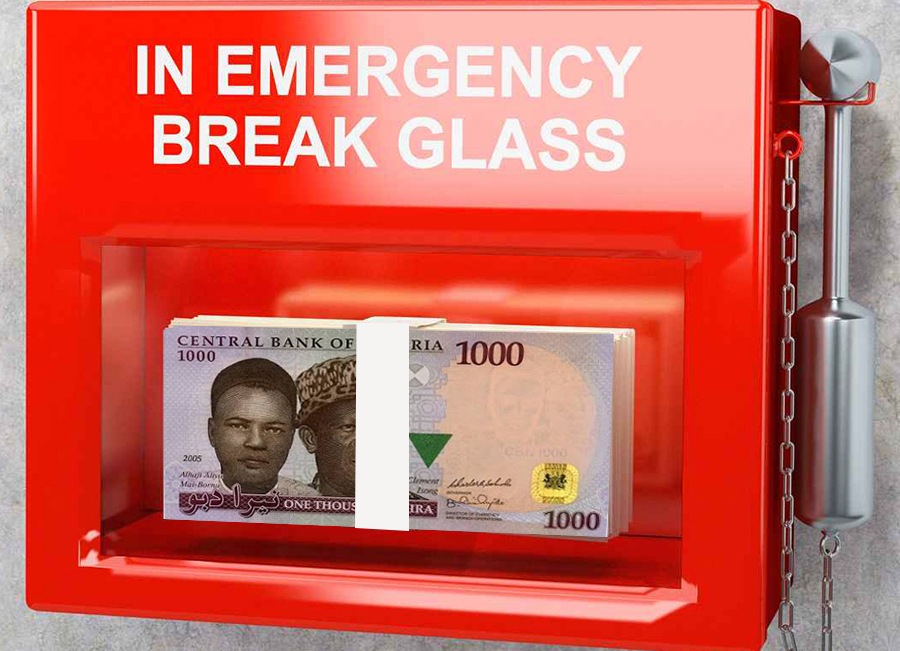

With such government, it is time for Nigerians to begin to watch out for themselves and prepare for the unforeseen, like the times we are in currently. The playout of events following the lockdowns caused by the ongoing COVID-19 pandemic shows that Nigerians do not have emergency savings.

According to a recent publication from one of the national dailies, “Barely one month of a lockdown of Abuja, Lagos and Ogun state, millions of Nigerians had become stricken with hunger. Many could not bear an extension of the movement restrictions.” The ensuing protests were indicative of the fact that many Nigerians were living off their daily incomes with no savings to fall back on.

High Poverty Level

Many may have asked how they could save without having funds, to begin with. Agreed, the level of poverty is high in Nigeria; however, people should know that having savings is not a luxury, but a necessity. It does not have to be large, but putting aside something, no matter how small on a regular basis goes a long way in times of emergency.

I have seen images of Nigerians who surprised themselves and others with how much they saved over time in their piggy banks. There is no hard and fast rule of how much one should have in emergency funds, but there seems to be an agreement among financial analysts and planners that having the equivalent of 6 months’ expenses in your emergency savings account is the ideal.

The author of the book “Richest Man in Babylon” stated it clearly that if you do not save, it means that you have paid everyone else but yourself.

How to Start Saving

Pay yourself first: In line with the instructions in “The Richest Man in Babylon,” when you receive your monthly salary or collect that sales proceed from your business, “pay yourself first” by saving at least 10% of your collections or salary. For the salary earner, set up a direct deposit account where the money would be taken out of your pay directly into a bank savings account. By so doing, you are forced to save.

(READ MORE: If you experience these signs then know your salary is not enough)

Cultivate the savings habit: Just as spontaneous buying is a habit, form the habit of saving. Do not see saving as putting aside the remnants (if any) after all your expenses. If that is your attitude to savings, then you fall into the group that pays everyone else but themselves.

One thing is certain; as long as you have the money, there will always be something that is going to demand that money from you.

Remind yourself to save: If you are a salary earner who does not want to set up a direct deposit from your paycheck or you are a businessman or woman of any means, you can set up a savings reminder around the time you receive your salary or around your peak business time.

One website that can help you with this is here. With this, you can send an email to yourself to be delivered around the time you expect to receive your pay or business income, reminding yourself to save. Just like you set an alarm on your mobile phone, you can do so with a reminder to save.

Start Small ASAP: The Bible says that if you are not faithful with small things, how can you be faithful with larger things. You do not need millions to start saving, all you need is the will, the determination, and consistency. So, start small and start now, but be consistent.

Reduce your Expenses: As already noted, one of the reasons that people do not save is because their expenses keep increasing, even when income sources are shrinking. If you find yourself in that situation (and you surely will, at one point or the other), cut down on your expenses and make them fall in line with trends in your income. Avoid spontaneous, emotional and flamboyant buying. Buy out of need, not out of want.

(READ MORE: Between saving, investing, speculating, trading & gambling)

Why It Seems Difficult to Save: To a whole lot of people, it is difficult to save because they live in the now. This is what financial psychologists call scarcity of attention. This scarcity of attention stops people from seeing what is really important and makes them see the urgent current expenses they need to cover.

One reason why it is difficult to save is that while the expenses keep rising (out of increased need and inflation), sources of income keep shrinking or stagnating. The good thing however, is that we have the option to shrink our expenses in line with shrinkages in our income, but often times, we do not choose to do that. That is where the inability to save starts from.

Conclusion: If there is any lesson, we learned from the sudden outbreak of COVID-19, it is and should be that emergencies happen, and efforts should be made to cushion the financial impact of such emergencies by preparing for them in advance through emergency savings.

Written by Uchenna Ndimele uchenna@mutualfundsnigeria.com

Thanks very much for the timely and workable advice.

Nigeria gorvernment doesn’t have emergency saving , don’t expect citizens to have

You have highlighted some good points and tips. Not always easy to do but will make life easier in a crisis.

well you forget to realise that in Nigeria there is no savings account, every savings account is syphoned by banks through incessant sms alert, card maint fees etc at the end of the day your account has depleted. or should we be arguing about deposit that you can not withdraw in this kind of time.ideally banks should be charging for transfers only so that you would be happy to see that your funds are untouched as far as you haven’t made any transfer that way banks would be a reliable and encouraging support for making savings a reality.