A digital financial services firm, Carbon has partnered AXA Mansard to launch a range of healthcare benefits to reward the former’s, regular customers.

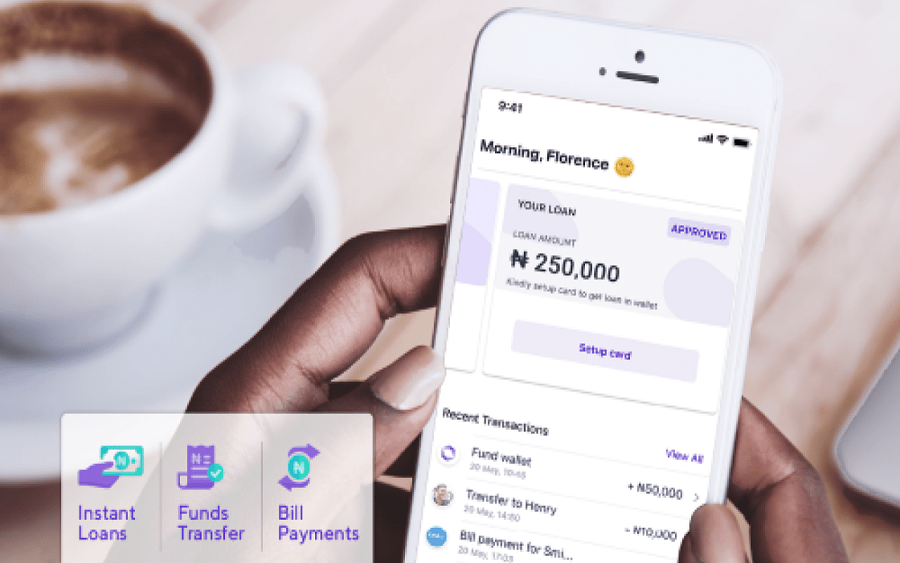

The initiative, which was disclosed in a statement issued by the company and seen by Nairametrics, was designed to reward customers that save a minimum of N3,000 monthly with Carbon, as they will qualify for an N20,000 cash benefit in the event that they are hospitalised for 2 or more nights.

It stated, “Customers that also have an existing loan that is not in arrears or do over N5,000 in transactions with Carbon monthly (transfers, bills, airtime) will also qualify for this health benefit. This cover is for a period of one month for every qualifying month on a recurring basis as long as customers continue to qualify and is currently only available to Carbon’s customers in Nigeria.

“In addition to this new program, we have also announced some new measures designed to ease the financial burden caused by the ongoing COVID-19 pandemic. As well as providing customers who pay their loans on time with access to the new healthcare benefits, Carbon is rescheduling loans for eligible customers who experience difficulty paying back their loans. Users will also be able to make up to 30 fee-free transfers on the platform.”

READ ALSO: COVID-19: Why banks would rather donate billions to FG than credit their customers’ accounts

Co-founder, Carbon, Ngozi Dozie, explained that across Africa, as well as the rest of the world, many lenders have stopped issuing loans to customers, potentially depriving people of funds when they need it the most.

To fix this, she added that the firm put some additional safeguards in place but will continue to disburse loans and that it would also keep loan amounts constant on renewals and in some cases reduce loan amounts.

She said, “Our main aim as a business is to empower our customers to live a life of dignity and prosperity. Whether that is by rewarding their discipline and loyalty or by adjusting the terms of their loans, we are committed to seeing them thrive and flourish. That is why we have rolled out these benefits and announced the new measures. We want to ensure that they have the best support and access to life-changing services, even at this difficult time.”

Group Head, Emerging Customers and Financial Inclusion, AXA Mansard, Alfred Egbai said, “We are really excited to partner with Carbon to roll out these benefits across Nigeria. In Carbon, we have a partner that understands the needs of the Nigerian consumer and is committed to putting the customer first, just as we are. We are confident that, by working together, we can deliver services that add value to the lives of our customers.”