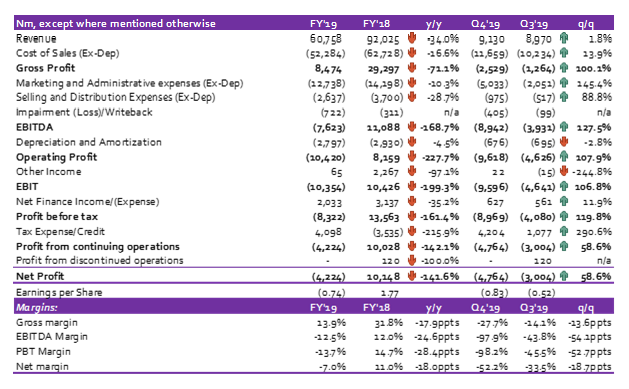

On Thursday, Unilever Nigeria Plc published its unaudited FY 2019 results, announcing a disappointing 34.0% y/y slump in revenue to N60.8 billion in 2019 from N92.0 billion in 2018. Q4 revenue was higher by 1.8% q/q but was down 57.9% y/y to N9.1 billion.

The steep decline in Q4 revenue follows a disappointing quarter and compounds an already disappointing 2019 where revenue plunged in 3 of 4 quarters. In line with our observation in Q3, the plunge in revenue comes alongside a steep decline in receivables.

Trade receivables fell 26.9% q/q to N24.5 billion in Q4 2019. This explains our findings on how the company has restructured its route to market while cutting down on credit extension to distributors. To buttress this, we note that over the past 5 quarters, quarters with over 20.0% decline in receivables (Q4 2018, Q3 2019, Q4 2019) have seen revenue plunge at least double digits within the quarter implying quarters, where growth in Revenue was recorded, were driven by elevated credit sales.

The company’s two product segments were pressured within the quarter with Home and Personal Care (HPC) business suffering the biggest weakness declining 39.5% y/y to N28.8 billion in FY 2019. In addition, the Food Products business segment fell 28.0% y/y to N31.9 billion in FY 2019.

Cost of Sales (adjusted for Depreciation) declined by 16.6% y/y to N52.3 billion in FY 2019 from N62.7 billion in FY 2018 largely on the back of lower volumes. On a q/q basis, Cost of Sales grew faster than the growth in Revenue, climbing 13.9% q/q to N11.7 billion in Q4 2019. The faster decline in revenue and per-unit cost pressures saw Gross Profit decline 71.1% y/y to N8.5 billion.

[READ MORE: Fintech: Increasing funding rounds affirms growth opportunities)

We note the company recorded a Gross loss of N2.5 billion in Q4 2019, higher than Q3 2019 Gross loss of N1.3 billion. Input cost continues to pressure operating performance as high cost of industrial heavy Linear Alkyl Benzene continues to pressure margins in the HPC business. Overall business Gross margin dipped 17.9ppts y/y to 13.9% for FY 2019.

In the face of pressured revenues and input costs, management placed a tight lid on Operating Costs. Thus, Marketing & Administrative Expenses, as well as Selling & Distribution Expenses adjusted for depreciation, dipped 10.3% y/y and 28.7% y/y to N12.7 billion and N2.6 billion respectively for FY 2019. However, the decline in Operating Expenses was inadequate to stop the company from recording negative EBITDA.

Loss before depreciation & amortisation printed at N7.6 billion in FY 2019 against EBITDA of N11.1 billion in FY 2018. Despite lower Depreciation & Amortisation (down 4.5% y/y to N2.8 billion), the company recorded Operating loss of N10.4 billion in FY 2019 compared to Operating Profit of N8.2 billion in FY 2018. The company also recorded a 97.1% y/y decline in Other Income to N0.7 billion in FY 2019 from N2.3 billion in FY 2018 which further dragged losses.

Net Finance Income was down 35.2% y/y to N2.0 billion in FY 2019 from N3.1 billion in FY 2018 due to lower Interest Income (down 20.4% y/y to N2.9 billion) and higher Interest Expense (up 82.1% y/y to N0.8 billion). The decline in Net Finance Income was driven by decline in Cash & Cash Equivalents (down 37.5% y/y to N35.7 billion) for the period.

READ ALSO: Nigerians purchasing power to drop in 2020 – CBN survey

The Net Finance Income booked tempered losses, but the company still posted Loss before Tax of N8.3 billion in FY 2019 as against Profit before Tax of N13.6 billion in FY 2018. Overall, the company booked a Net Loss of N4.2bn in FY 2019 as against a Net Income of N10.1 billion in FY 2018. We note the company saw Loss after Tax grow in Q4 2019 by 58.6% to N4.8 billion from N3.0 billion in Q3 2019.

In our earlier notes, we have communicated our concerns on the growth prospects for Unilever. The company’s disappointing Q4 performance confirms our fears. Our model is currently under review.

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.