Nigerian based Popular stock broking application, Bamboo, informed its users on Wednesday that it will no longer allow USD wire transfer options for deposits.

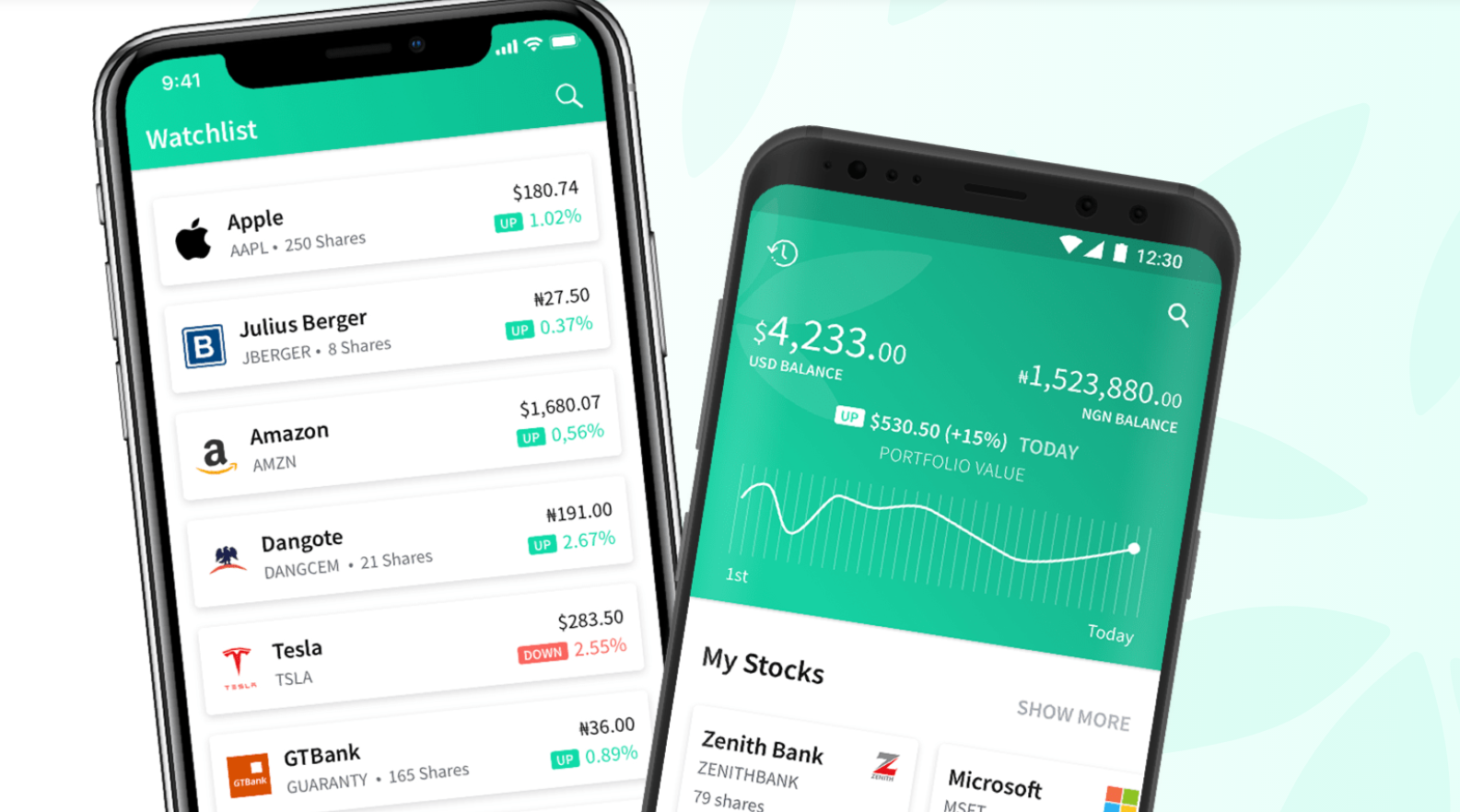

Bamboo offers investors a platform to invest in stocks listed on the New York Stock Exchange and NASDAQ. Users can access these markets by depositing dollars in their wallets, or Naira which will then be converting at the prevailing exchange rate (which is usually closer to the parallel market exchange rate).

The company notified its customers via the application’s notification feature leaving the option to fund wallets with United States dollars to USD domiciliary deposits or cash deposits.

“The USD Wire Transfer option is no longer available for deposits. However, you can still make deposits through USD domiciliary transfers or other channels. We apologize for any inconvenience caused.”

(READ MORE: How to own your home in 5 years without a mortgage)

The company also sent an email stating in part as follows;

“We will like to inform you that our USD Wire transfer option is no longer available for use due to regulatory reasons. Effective immediately, no transfers made to our Silvergate or BBVA accounts will be received. We encourage you to use our USD Domiciliary Transfer option on the Bamboo app, or any other payment method you prefer. We sincerely apologize for any inconvenience this may cause you.”

The company did not provide further information detailing which regulator may issue the instruction to stop the service.

What this means

USD Wire transfers allow investors who have domiciliary accounts in the US to transfer dollars to Bamboo’s corresponding account in the US. It also allowed its users to transfer directly from Nigeria to their US Dollar accounts. This helps investors avoid some of the local USD transfer restrictions from one domiciliary account in a bank to a third party account in another bank.

The is often convenient for investors who have dollars abroad and want to avoid the hassles of sourcing forex locally. Whilst no reason was provided for the regulatory requirement, Nairametrics believes it may not be unconnected with several unscrupulous. activities associated with wired transfers or a Nigerian regulators trying to block a loophole which would allow investors transfer fx out of the country from their domiciilary accounts.