Article Summary

- Inflation played a significant role in the increase of audit fees from N10.8 billion in 2021 to N11.5 billion in 2022.

- Rising inflation impacted audit firms by increasing costs associated with wages, man-hours, technology operating expenses, and other resources required for conducting audits effectively.

- Nigerian banks constituted a major revenue source, contributing about N8.1 billion or 70.4% of the total audit fees collected.

- Access Bank, UBA, FBN Holdings, GT Bank, and Zenith Bank were the top contributors, paying substantial audit fees to auditors.

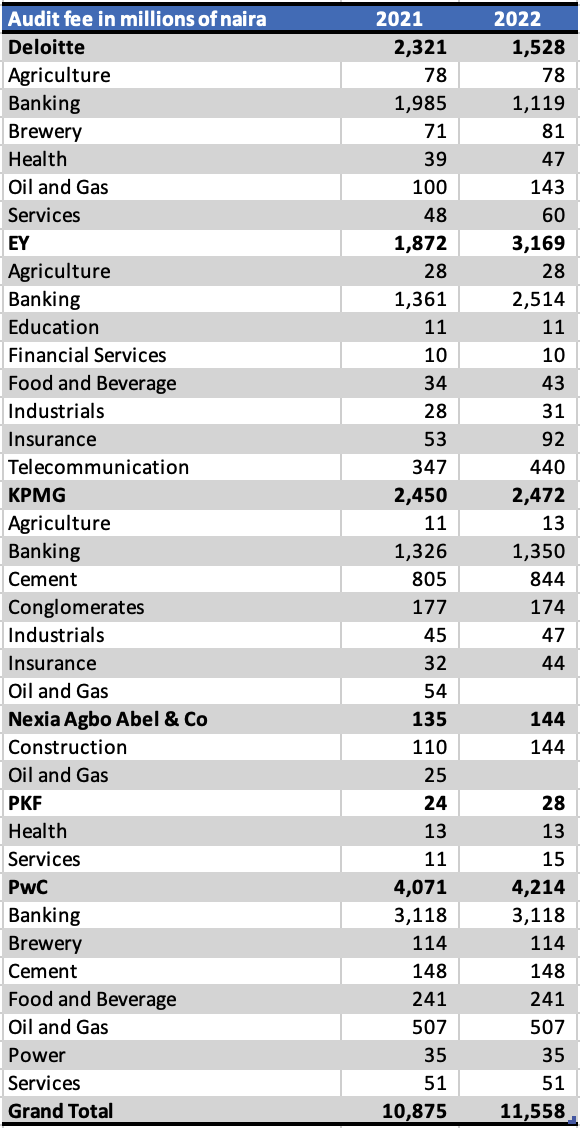

A recent analysis by Nairametrics of audit fees earned by top auditors in Nigeria shows that top audit firms earned N11.5 billion in audit fees in 2022 from auditing quoted companies listed in Nigeria

This is based on research that provided insights into the substantial earnings of these auditing firms during the years 2021 and 2022.

The study focused on the audit fees paid to auditors by prominent Nigerian companies quoted on the Nigeria Exchange. A total of 51 companies were surveyed between 2021 and 2022 respectively cutting across several sectors of the economy.

Top earners

Among the auditors, PricewaterhouseCoopers (PwC) emerged as a dominant force, earning substantial audit fees across 13 companies.

- In 2022, PwC secured audit fees totalling N4.2 billion, with Access Holdings, Stanbic IBTC, Zenith Bank, BUA Cement Plc, and Seplat Energy among their key clients.

- Similarly, in 2021, PwC earned N4.1 billion, underscoring its consistent performance and wide-ranging influence.

Ernst & Young (EY), known for its global reach, also experienced notable growth in audit fees.

- In 2021, EY earned N1.9 billion, which increased to N3.2 billion in 2022 from 10 companies.

- This growth can be attributed to their services provided to GT Bank, UBA, AIICO Insurance Plc, and MTN Nigeria, among others.

- The increase in audit fees underscores EY’s growing influence and expertise within the Nigerian business sector.

KPMG, another prominent Big 4 auditor, also garnered significant earnings during this period.

- FBN Holdings, Wema Bank, AXA Mansard Insurance Plc, Lafarge Africa Plc, and Dangote Cement were among the companies that paid KPMG audit fees, resulting in a total of N2.45 billion in 2021 and N2.47 billion in 2022.

- In total KPMG audited 22 companies on our list in 2022 down from 12 in 2021.

Deloitte, earned a total of N2.3 billion in 2021, which decreased to N1.5 billion in 2022.

- Key clients contributing to Deloitte’s audit fees during this period included Fidelity Bank, Sterling Bank, Fidson Healthcare Plc, and Presco Plc.

- Deloitte audited 12 companies down from 13.

The analysis also revealed the significant contributions of other auditors, such as Nexia Agbo Abel & Co, PKF, and others, in earning millions of naira in audit fees from companies like Arbico Plc, Julius Berger Nig Plc, and Livestock Feed Plc.

Nexia Agbo Abel earned N144 million in 2022 all from auditing Julius Berger.

Gainers and losers

Deloitte was one of the major losers as their earnings fell by 34% year on year. A major reason for this was the change of auditor by UBA who switched from Deloitte to EY. Deloitte still audited about 5 banks more than any other auditor on our list.

- EY was the top gainer in the period under review with a 68% rise in audit fees earned during the year. The addition of UBA to its fold of audited banks helped push its earnings from banks by N1.2 billion.EY has also toppled KPMG as the second-largest fee earner trailing just PwC.

- A central bank policy issued in 2010 mandates commercial banks to change auditors every 10 years. This move affects the earnings of most auditors as banks make up a significant chunk of their revenue sources.

- This rule appears to have favoured EY which now audits two of the FUGAZ banks, UBA and GT Bank helping it with a combined earnings contribution of N2.3 billion. EY also audits Union Bank.

Apart from EY, PwC is the only other audit firm that audits two of the FUGAZ banks which explains why it retained a revenue of N3.1 billion from banking audits alone.

Banks dominate earning sources

Nigerian banks continued to be a major revenue source for audit firms contributing about N8.1 billion or 70.4% of total audit fees collected.

- The FUGAZ or Tier 1 banks contributed about N6.1 billion or 75% of fees earned from the 14 banks in our coverage.

- Access Bank led the pack with the most audit fees, paying a total sum of N1.5 billion in audit fees to PwC the market leader.

- UBA and FBN Holdings came second and third respectively with about N1.2 billion and N1.1 billion in audit fees respectively. GT Bank and Zenith Bank made up the last two with N1.1 billion and N1 billion respectively.

Several factors contribute to the high audit fees charged by auditors for Nigerian banks. These factors are typically driven by the unique characteristics and complexities of the banking industry in Nigeria.

- For example, the banking sector is highly regulated, and banks are subject to extensive regulatory requirements imposed by regulatory bodies such as the Central Bank of Nigeria (CBN) and the Financial Reporting Council of Nigeria (FRCN).

- Auditors must ensure that banks adhere to these regulations, which requires additional effort, expertise, and time. The increased complexity and scrutiny associated with regulatory compliance contribute to higher audit fees.

- In addition, Banks with a significant number of branches typically have a larger customer base, higher transaction volumes, and more extensive financial reporting requirements.

- Auditors must review and assess a larger volume of financial transactions, account balances, and supporting documentation.

The increased workload and extended financial reporting scope contribute to higher audit fees. This explains why the likes of Access Bank, UBA, and FBNH pay the most in audit fees. They have about 2, 400 branches between them.

Other factors include risk and complexity, financial statement complexity, information technology and data security, auditors’ liability, industry reputation, and brand.

Companies outside Banks

Outside of banks, the likes of Dangote Cement, MTN, Seplat, and Nestle also have large-scale operations that incur high audit fees.

High audit fees for companies across industries are influenced by factors such as company size, the complexity of operations, industry-specific considerations, the effectiveness of internal controls, geographic reach, information technology systems, regulatory compliance, and reporting, as well as the reputation and expertise of the auditor.

Larger companies with complex operations, extensive financial transactions, and international subsidiaries require more time and resources to audit, leading to higher fees. Industry-specific factors such as regulatory requirements, unique accounting practices, and intricate supply chains can also increase audit complexity.

- KPMG earned the most fees from the non-banking sector earning about N1.1 billion in fees. Some of its major clients were the likes of Dangote Cement (N724 million), UACN (N128 million), and Lafarge with N120 million

- PwC earned about N1 billion from non-banking clients with the likes of Seplat N424 million, BUA Cement N148 million, and Intl. Breweries N114 million, leading the pact. PwC gained TotalEnergies from KMPG adding N58 million to its revenues during the year. PWC also gained Conoil from Nexia Agbo and Abel & C0 with N25 million added to its revenue.

- EY earned N655 million from the companies under our review with MTN contributing the most with about N440 million. Deloitte earned N409 million in revenues from about seven companies which include the likes of NB, Transcorp lc, and Presco.

Inflation and audit fees

The total audit fees for the 51 companies analyzed witnessed an increase from N10.8 billion in 2021 to N11.5 billion in 2022.

This rise can be attributed to various factors, with rising inflation being a significant contributor. Inflation impacts audit firms as they face increased costs in terms of wages, man-hours, technology operating expenses, and other resources required to conduct audits effectively.

The effects of inflation on audit fees can be observed through several instructive details. Firstly, higher wages are necessary to attract and retain skilled auditors who can handle the complexities and demands of the auditing profession. As inflation erodes the purchasing power of the currency, auditors’ wages need to be adjusted to maintain competitive compensation levels.

Additionally, inflation impacts the costs of resources required for audits. Auditing firms often invest in advanced technology systems and tools to enhance audit procedures, improve efficiency, and ensure accurate financial reporting.

As inflation increases the cost of technology operating expenses, such as software licenses, maintenance, and upgrades, audit firms may pass on some of these costs to clients through higher audit fees.

Inflation also affects the overall cost structure of audit firms, including general overhead expenses such as rent, utilities, and administrative costs.