Hitting the gym and having a great body, meditation, relationship goals and financial goals are regular appearances in most people’s New Year resolution lists. However, I think most people desire to make more money in the New Year than anything else.

Didn’t they say money answers all things? Unfortunately, it’s not as straightforward as it seems. As expected, there are a few nuances to it. For instance, if you work a job, it would be a miracle to get a double-digit pay rise in one year. To make matters worse, the cost of living would probably go higher since the prices of consumer items are almost guaranteed to go up.

If you look at it, what item has exchanged hands at the same price or lower in the last two years? Perhaps none.

Understanding investments: For most people, the only way out is investment vehicles. In 2022 for example, an investment in Orange Juice yielded a 45.98% ROI. Clearly, the most possible way people can reach their financial goals is by investing in profitable assets. By “simply” investing in profitable assets, you may get returns substantially higher than the meagre returns savings accounts to promise.

The conversation, however, has been a very one-sided exposé. A new investor or speculator may be tempted to assume that there is only one outcome of an investment decision – profits. Nothing else can be farther from the truth. Take, for example, those investors who invested in Tesla stocks at the beginning of the year and walked home with their tails between their legs as the stock plummeted more than 65. Most often, new investors realize this part of investing too late.

Now that the excess euphoria in investing has been expelled, it’s a great time to look into the various investment options and basic terms to get us all up to speed. Let’s unpack investment options together.

Different asset classes: Although in most cases there is little or no embargo on who can invest in an asset, there are some assets that require a minimum principal or are simply inaccessible to the “average Joe”.

In this article, we’ll look at some investment options that are accessible to many individuals and are generally easier to get started with. Examples of such are – Stocks, Indexes/ETFs, Mutual Funds, Currencies, Cryptocurrencies, Commodities, Startups, and Real Estate.

If there’s anything the previous year taught us, it is the fact that some assets and equities can be volatile. Tesla, for example, plummeted and caused its CEO Elon Musk to lose a lot of money. Hence, as an investor, you need to define your risk appetite before investing. You need to ask yourself if you can manage a huge drawdown on your portfolio.

20 years ago, you probably needed a broker, and a minimum of a few thousand dollars (or its equivalent) to invest in stocks but today some platforms offer investment options of as low as $1 and investing is a “simple” click of a button. To invest profitably in stocks you need to do your analysis properly. You can rely on Fundamental analysis like economic conditions, internal company crises or news to make a buy decision or you can choose technical analysis which looks purely at the charts.

In some situations, stocks in a particular sector may show varying returns for example IBM was up by 6% in 2022 while some of its rivals and competitors like Tesla were down by 65%. Because of this, some investors prefer to invest in indexes/ETFs. ETFs (Exchange Traded Funds) are simply defined as investment vehicles that aggregate the weightings of different stocks that save you the stress of stock picking but track indexes instead. A popular ETF is NASDAQ-100(-33.10%) which tracks the performance of the top 100 non-financial companies listed on the NASDAQ exchange. While betting on Tesla stock in 2022 may have been a 65% loss, speculating on the NASDAQ would have resulted in a far lesser loss. Investing in indexes like these is safer and presents less risk of heavy losses.

For a more hands-off approach, a great option is investing in Mutual funds like the ARM Money fund(15.11%) managed by Citibank Nigeria Limited. The fund invests 40% of its asset under management in the money market and 60% in fixed-term investments. According to Cowrywise, the fund size is N92.0B. Other mutual funds of repute in Nigeria include Lotus Halal Fixed Income Fund(10.36%), and United Capital Wealth For Women Fund(-0.02%). Although nothing is guaranteed in investing, mutual funds have a high probability of producing a net positive return after a while since most of these funds are managed by experts.

The last year saw the Naira depreciate badly against the US Dollar in the parallel market and some investors made mouthwatering returns by converting assets to the Dollar at lower prices and selling at a premium later. This is the basic logic behind currency trading. Another instance is the rally of the USD again the Euro- USD/EUR(5.66%), and the Japanese Yen plummet against the Dollar- USD/JPY(13.91%).

The claim by Bitcoin enthusiasts that it is a store of value came under great scrutiny last year as it lost more than half of its value. Not something we expect of a store of value. Ethereum(67.7%), Doge(-64.14%), SAND(-92.91%) and others followed suit. It however doesn’t mean investing in cryptocurrencies is entirely a bad way to go since many investors profited in previous years from the appreciation of the digital currency industry. It is also important to know that the crypto industry is just a budding one and these market cycles are pretty normal.

Commodities are also great asset classes to invest in. Traditionally, commodities are less volatile than other investment classes like stocks. However, there are some outliers that over or underperform other assets in their category. For instance, in 2022 citrus juice yielded a 45.98% ROI. Unfortunately, picking the right commodity to invest in can be tricky, hence why you need to properly do your research before starting.

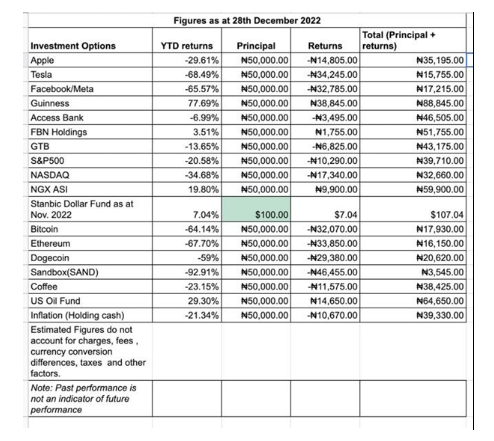

In the diagram below, you’ll see what an N50,000 investment would have returned from the beginning of the year to December 28, 2022.

Another great way to invest in 2023 is to invest in new startups. Finding the next Flutterwave, Andela, and Patricia from Africa and investing in them early on can bring in massive returns but at a more significant risk. Only a small percentage of startups succeed to justify initial capital and human investments. Most successful angel investors and startup funds have sometimes admitted to the fact that luck plays a huge role too in making these investment decisions. Also, investing in startups is most likely a longer-term investment since most startups take a long while to generate ROI for investors. Although it is relatively easier to invest in startups it is still not straightforward as it is investing in other asset classes.

Some investors prefer physical and tangible assets. Some investors are unimpressed by the digital count of dollars on some computer screens. They prefer tangible investments and investing in Real Estate is a great option to look at if you have such a personality. Except in a Real Estate market bubble, it’s unheard of to see very high YTD returns on properties but in the long run, the returns are worthwhile. In Nigeria though, the Real Estate industry is still very unstructured and investors should always do the necessary due diligence before purchasing any property.

Dollar-cost Averaging DCA: 2022 saw most assets plunge to historical lows amidst panic in the market. This is a great opportunity for investors to buy back assets at a much lower price. However, it is very difficult to pick out the exact bottom or low of an asset hence why Dollar-cost Averaging is advised.

Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. Instead of trying to pick the bottom, the prudent investor puts in a certain amount at certain price points.

In conclusion, it is wise to think of diversifying cash flow by looking out for profitable investments instead of relying solely on income from your job. These asset classes in this article are the most popular ones out there. Also, the rule of thumb in investing is “if it’s too good to be true, then it probably is”. Be wary of any investment opportunity that promises unbelievable returns in a short period.

Great article, thanks.