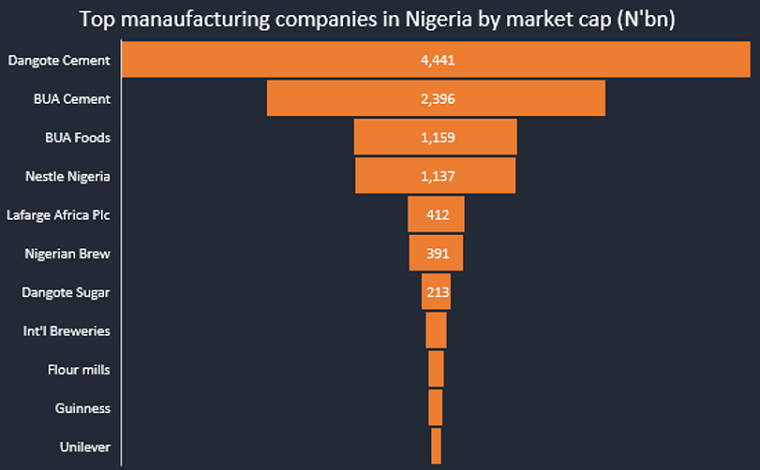

Dangote Cement, BUA Cement, BUA Foods, and Nestle Nigeria led the list of most valuable manufacturing companies in Nigeria, following impressive market performance in the month of January 2022.

The likes of Dangote and BUA Cement maintained their spot as the most capitalized manufacturing firms while newcomer, BUA Foods displaced Nestle to seat in third position after just one month of listing on the Nigerian Stock market, hereby joining the elite list of Stocks Worth Over One Trillion (SWOOT).

The Stock market closed on a positive note in the review month as the All-Share index rallied 9.15% in January, closing at 46,624.67 points while the market capitalization closed at N25.1 trillion. The NGX Industrial goods index rose by 3.39% in January to close at 2,076.32. However, the consumer goods index recorded a 2.48% decline in the review month.

The aggregate market capitalization of the 30 companies under consideration, comprising of consumer and industrial goods companies increased by N592.6 billion to close at N10.8 trillion

In line with Nairametrics’ timely rankings of listed companies on the Nigerian stock market, we present the ranking of the most valuable manufacturing companies on the NGX as of the end of January 2022. You can read the first series on the banking sector here.

Top companies by market valuation

Dangote Cement, maintained the top spot with a market value of N4.44 trillion, having gained N61.3 billion in the month under review compared to N4.38 trillion recorded as of the previous month. Fellow industry giant, BUA Cement followed with a valuation of N2.4 trillion. BUA Cement gained 5.5% in the review month from N2.27 trillion recorded as of December.

Similarly, newly listed consumer goods company, BUA Foods displaced Nestle Nigeria in third position with a market capitalization of N1.16 trillion. The company, which listed on the NGX on the 5th of January 2022, rallied 61% in just less than a month after listing, gaining N439.2 billion in its first month.

The surge in the market value of BUA Foods has been attributed by analysts to the tight liquidity in the company’s shareholding structure, with Abdulsamad Rabiu and his son owning about 99.8% of the listed shares of the company. This implies very little floating shares available to the public, hence any change in demand will significantly affect the price of the stock.

Nestle Nigeria dropped by one spot to stand in fourth position with valuation at N1.14 trillion as of the end of January 2022. Its downturn is attributed to the 7.8% decline in the share price of the company as it lost N96.3 billion in valuation.

Others on the list include, Lafarge Africa (N412.36 billion), Nigerian Breweries (N391.27 billion), Dangote Sugar (N212.57 billion), International Breweries (N153.1 billion), Flour Mills (N117.07 billion), and Guiness Nigeria (N106.34 billion).

Biggest gainers

The two listed BUA companies were the biggest gainers in terms of value in the month of January, with BUA Foods gaining N439.2 billion in the month, followed by BUA Cement, which gained N125.3 billion. Dangote Cement also gained N61.3 billion after the share price of the company appreciated by 1.4% in January.

Lafarge Africa, another cement giant in the country recorded an appreciation of N26.6 billion in its market valuation, Guinness Nigeria gained N20.9 billion, while International Breweries appreciated by N20.1 billion in January.

Similarly, in terms of percentage increase, BUA Foods’ 61% gain, ensured it maintained top spot on the list, followed by Guinness Nigeria with a gain of 24.5%. Also, paint company, Meyer Plc gained 19.6%, with International Breweries appreciating by 15.2% in the review month.

On the flip side, Cutix Plc dipped the most with an 8.7% decline to close its market cap at N8.49 billion. Consumer goods giant, Nestle Nigeria dipped 7.8% to close at N1.14 trillion, causing it to lose its initial third position to Bua Foods.

Why the rally in the equities market

In the first series of this January ranking, we explained that the Nigerian stock market has received positive reception from investors so far in the new year, as investors rush to buy stocks of companies with history of dividend payments.

It is worth noting that, listed companies are preparing to release their full-year 2021 financial statements, with a number of these companies expected to declare final dividends for the year.

For example, MTN Nigeria had declared a dividend per share of N8.57 in January, which is expected to be paid by 28th April 2022. The company also noted that it will only be paying dividends to shareholders whose names appear on the Register of Members as of 6th April 2022. A major incentive for investors to establish their positions in these companies before the qualification date.

Similarly, the bearish position in foreign stocks, crypto assets, and less than desirable yields in government securities has left local investors with limited option to put their monies, hence move into the equities market.