The Nigerian stock market was one of the best performing in the world in 2020 after it posted a return of 50%. However, in the first half of this year, it has struggled to maintain the 2020 4th quarter momentum that helped it achieve those returns.

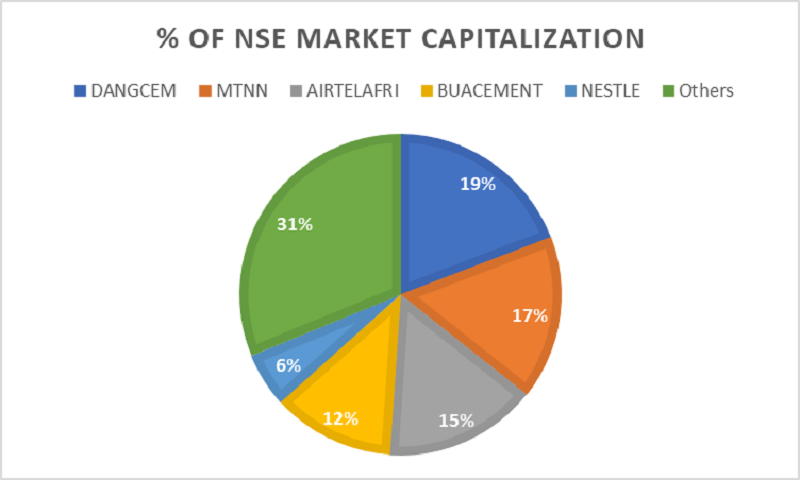

Its ability to replicate the same return in 2021, will depend on 5 key stocks that make up over 66% of the market capitalization of the stock market. The quintet of Stocks Worth Over One Trillion Naira in market cap otherwise called the SWOOT could very well determine how the market performs this year.

The Nigerian Stock Exchange SWOOT currently has a combined market capitalization of N14 trillion and collection earnings (based on trailing twelve months or last four quarters) of N900.7 billion. This generates a price to earnings ratio of about 15.5x for the quintet. This compares to the broader index with a PE ratio of 13.26.

Why the focus on the SWOOTs?

In a stock market that has 5 stocks dominating as much as 66% of its market capitalization, it is obvious that whatever happens to their performance will impact significantly on the broader index. Thus, a portfolio that some if not all of this stock is betting on, for the stronger 2021 performance for the Nigeria All Share Index.

Last year, except for Nestle, these stocks all posted double digit returns with BUA and Airtel leading the pack with 185% and 327% respectively. However, this year, the SWOOT are currently trading at negative returns mirroring the broader index performance. They also seem to have limited upsides going by their significantly higher price to earnings ratio.

We will delve right into each of the SWOOT to provide an insight into their numbers and what if any, could propel them to do better.

DANGOTE CEMENT

As of the close of Friday, DANGCEM share price traded at ₦230 per share which puts the price-earnings ratio at 12.90. The current share price also puts the total valuation of the company at ₦3.9 trillion. The company’s valuation represents 19.20% of the total Nigerian Stock Exchange market capitalization.

The company’s quarter 1, 2021 results revealed it posted an earnings per share of N5.26 compared to N3.56 same period last year representing a 47.7% increase year on year. Also, the company’s net asset was just shy of a trillion naira to settle at approximately ₦971 billion.

DANGCEM is struggling to outperform the market as its share price performance Year-to-Date (YtD) is currently down by 6.08%. Compared to the total market performance of the All-Share Index (ASI) which is down by 4.84%, DANGCEM has been underperforming.

However, it will be foolhardy to write off the stock especially when you consider how blistering its Q1 performance was. One challenge however is that its 12.9x price to earnings ratio appears to have considered its future earnings giving it limited upside.

MTN NIGERIA

MTNN shares are currently trading at ₦165. This puts the price-earnings ratio to about 14.75x. The company’s valuation based on its current price puts it at approximately ₦3.4 trillion. This valuation represents 16.46% of the total market capitalization of the Nigerian equity market.

From its quarter 1 financials for 2021, the company reported earnings per share of N3.62, 42% higher than what it reported a year earlier. Its total assets and total liability stand at ₦2.2 trillion and ₦1.9 trillion respectively. This puts the net asset of the company at approximately ₦252 billion.

MTNN performance this year has been better so far when compared to the performance of the ASI. Although MTNN share price is down 2.88% YTD, it is currently outperforming the general market which is down over 4%.

MTN’s price to earnings ratio of 14.75% also seem to have priced in future earnings. The limited upside could change if it promises higher dividend payouts.

AIRTEL AFRICA

AIRTELAFRI is trading at ₦837 at the close of the market on Friday with a price-earnings ratio of 12.12. The current price puts the company’s market valuation at ₦3.1 trillion which represents 15.41% of the total market capitalization of the Nigerian equity market.

Its latest financial statement revealed that excluding one-off items its earnings per share is up 44% compared to the year before. Also, its net asset is $3.3 billion on the back of total assets and total liabilities of approximately 10 billion and 6.6 billion respectively.

Of the SWOOTs, AIRTELAFRI is the best performer so far YTD. Its share price, although down 1.74%, has outperformed the market in which ASI is down over 4%.

BUA CEMENT

BUACEMENT is currently trading at ₦74 per share which puts the current price-earnings ratio at 35.58. The current share price also puts the company’s market capitalization at ₦2.5 trillion which represents 12.28% of the total equity market capitalization of the Nigerian stock exchange.

In its latest financials, the company reported earnings per share of 66 kobo compared to 58 kobo reported a year earlier. Its net assets is ₦398 billion after recording a total asset and total liability of ₦714 billion and ₦315 billion respectively. The shares are somewhat illiquid because of the heavy concentration of its shares to the founder, making it difficult to buy.

BUACEMENT is the worst performer of the SWOOTs. The share price so far is down over 12% YTD, underperforming the general market ASI which is down just 4%. It appears there is limited upside with this stock.

NESTLE NIGERIA

NESTLE is trading at 1400 per share which puts the price-earnings ratio at 28.30. The current price also puts the market capitalization of NESTLE at ₦1.1 trillion which represents 5.44% of the total equity market capitalization of the Nigerian stock exchange.

In its Quarter 1 2021 results, it reported earnings per share of N15.64 compared to N14.12 reported same period in 2020. It also revealed the position of the company’s total assets and total liability at approximately ₦240 billion and ₦200 billion respectively. This puts the total net asset of Nestle Nigeria at approximately ₦41 billion.

NESTLE is also struggling to outperform the general market as the share price performance YTD is currently down 6.98% which underperforms the market that is currently down 4.88% so far. Nestle also has limited upsides going by its price to earnings ratios.

Bottom line

Finally, the analysis above suggests the SWOOT are currently overvalued relative to their most recent performance. At a price earnings ratio of 15x, the market seems to have priced in the double-digit profits they are currently recording.

Things could change if they recorded double digit profitability growth at the end of the second quarter but even that would not lead to the exponential share price appreciation that was recorded last year.

Excellent work. We’re proud of you. Keep it going.

Beautiful. Keep it up