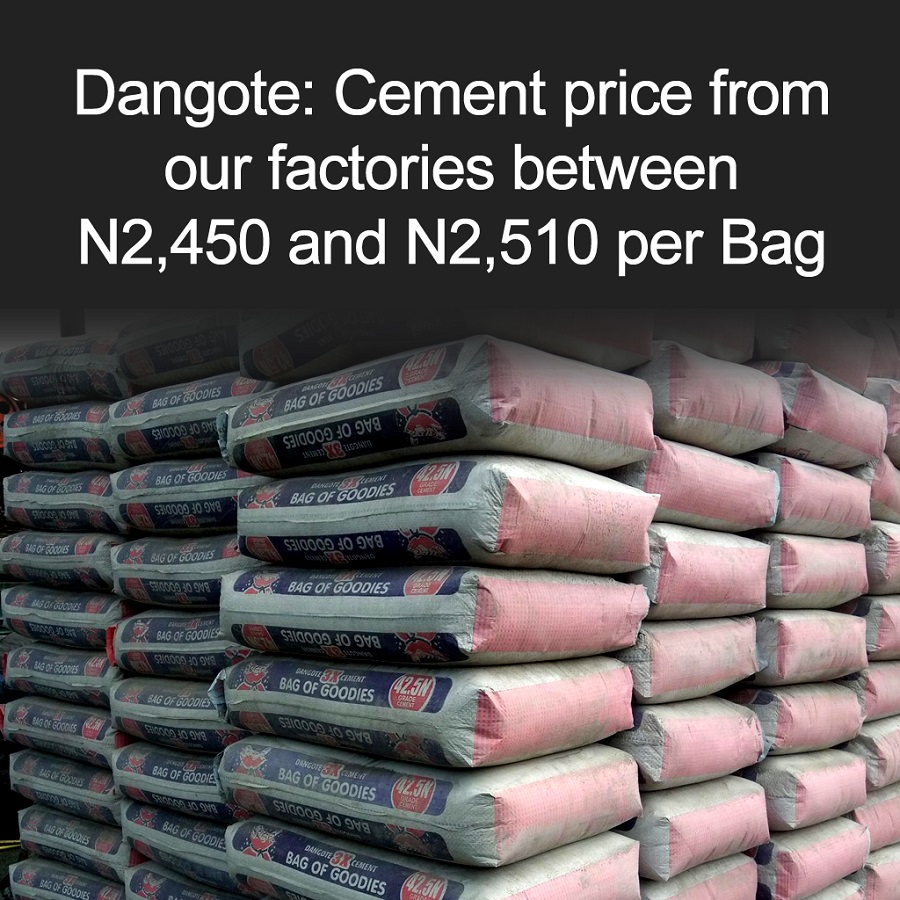

Management of Dangote Cement Plc has clarified that the price of a bag of cement from its factories and plants across Nigeria (as at 12th April, 2021) is N2,450 in Obajana and Gboko, and N2,510 in Ibese inclusive of VAT. The clarification was made in view of recent insinuations that the company sells cement in Nigeria at significantly higher prices relative to other countries, particularly Ghana and Zambia.

Dangote’s Group Executive Director, Strategy, Portfolio Development & Capital Projects, Devakumar Edwin revealed that, while a bag of Cement sells for an equivalent of $5.1, including VAT in Nigeria, it sells for $7.2 in Ghana and $5.95 in Zambia ex-factory, inclusive of all taxes. He said that though the company has direct control over its ex-factory prices, it cannot control the ultimate price of cement when it gets to the market. He advised that it is important to distinguish Dangote’s ex-factory prices from prices at which retailers sell cement in the market.

READ: Dangote Cement pays N1.1 trillion in dividends in 5 years.

He, therefore, frowned at intentional misinformation or demarketing, allegedly sponsored by some individuals, that Dangote sells its cement at higher prices in Nigeria relative to other African countries at the expense of Nigerians. He described the allegation as false, misleading, and unfounded, while giving the media persons present at the press conference copies of invoices from Nigeria and some other African countries (Cameroun, Ghana, Sierra Leone, Zambia), and urging them to conduct independent investigations on the price of cement across the West African coast.

Edwin further explained that while Dangote cement has 60% share of the market, other companies have the remaining 40%. DCP has no control over neither the prices charged by other cement manufacturers nor the prices charged by retailers in the markets.

READ: Dangote Cement joins MTN in the trillion-naira club, as 2020 revenue surpassed N1 trillion

He further explained that “Demand for cement has risen globally as a fallout of the COVID crisis. Nigeria is no exception as a combination of monetary policy changes and low returns from the capital market has resulted in a significant increase in construction activity. To ensure that we meet local demand, we had to suspend exports from our recently commissioned export terminals, thereby foregoing dollar earnings. We also had to reactivate our 4.5m ton capacity Gboko Plant which was closed 4 years ago and run it at a higher cost all in a bid to guarantee that we meet demand and keep the price of Cement within control in the country.”

READ: Dangote Cement considers debt funding options under 300 billion bond issuance programme

He said: “Over the past 15 months, our production costs have gone up significantly. About 50% of our costs are linked to USD so the cost of critical components like: gas, gypsum, bags, and spare parts; has increased significantly due to devaluation of the Naira and VAT increase. Despite this, DCP has not increased ex-factory prices since December 2019 till date while prices of most other building materials have gone up significantly. We have only adjusted our transport rates to account for higher costs of diesel, spare parts, tyres, and truck replacement. Still, we charge our customers only N300 – 350 per bag for deliveries within a 1,200km radius. We have been responsible enough not to even attempt to cash in on the recent rise in demand to increase prices so far.”

If u sale 2450 or 2510,why are ur retailers sale 3900. Why treating us the end users like this? If the cement is sold as u said,no one can sale 4000 or 3900. Investigate the real issue

This is a blatant lie.Do you mean they are making whopping profit of 400 naira per bag?That is insane

If dangote even 2600 let’s be realistic how much is transportion then why should it get to consumers at 3900 or 4000

If is sell like he said is all nonsense how much for transportation hw much for shop hw he will gin

IN BENIN CITY THE CURRENT PRICE OF CEMENT IS 3800 \ 3900 PER BAG