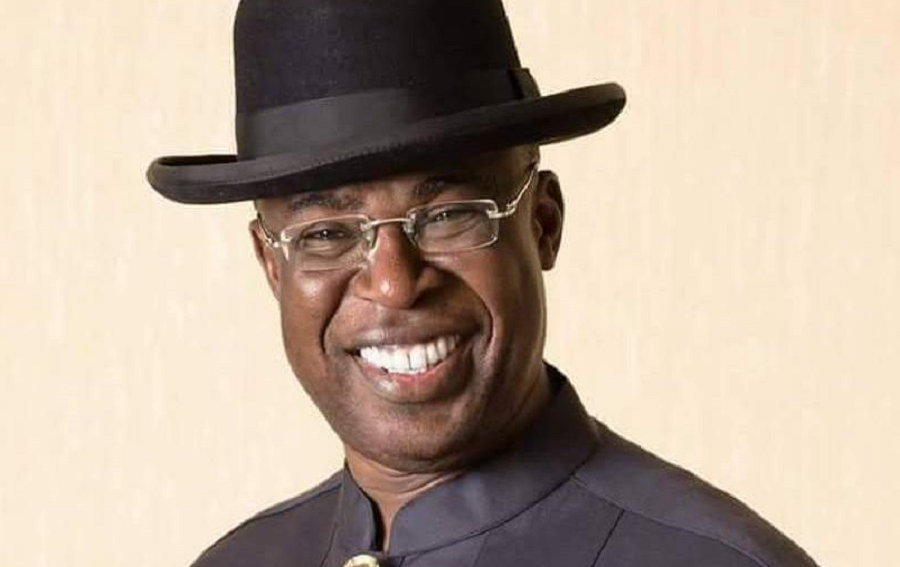

The Minister of State for Petroleum Resources, Timipre Sylva, has given the condition under which there will be an increase in the retail pump price of Premium Motor Spirit otherwise known as petrol.

Sylva, in his reaction to the reported increase in the pump price of petrol, said that there will be no increment in its pump price by the Federal Government until the conclusion of its consultation with the Organised Labour.

According to a report from the News Agency of Nigeria (NAN), this disclosure was made by Sylva during a chat with the press on Friday, March 12, 2021, in Lagos.

The minister pointed out that the clarification was necessitated by reports that the price of petrol, had been increased to N212.61 per litre.

READ: Oil marketers say petrol will sell for N230 per litre in March

What the Minister of State for Petroleum is saying

Sylva in his statement said, ”Irrespective of the source of that information, I want to assure you that it is completely untrue. Neither Mr President who is the Minister of Petroleum Resources nor myself who deputise for him as minister of state has approved that the petrol price should be increased by one naira. I therefore urge you to disregard this misleading information.”

The minister said that in the past few months, the government has been in consultation with organised labour to find the least painful way to respond to the increase in the global price of crude oil which has inevitably led to increase in petrol prices.

He said it was unthinkable that the government would unilaterally abandon these discussions and act in the manner suggested by the information under reference.

READ: FG says vehicle owners to pay N250,000 to convert from petrol to autogas

Sylva maintained that cynicism and deceit have never been the trademark of President Muhammadu Buhari’s administration.

The minister said, “I will like to equally assure you that the engagement with the organised labour and other stakeholders will continue even as the calculations to arrive at a reasonable price regime are being done; all in good faith and you will be availed of the final outcome at the appropriate time.

“Until then, all marketers are strongly advised to maintain the current pump price of PMS before the emergence of this unfortunate information.

“Those who may want to take advantage of this unfortunate information to extort Nigerians should not give in to such temptations as there are regulatory mechanisms that government can enforce to protect its citizens.

“In conclusion, I want to sincerely apologise to all Nigerians for any distress and inconvenience the unfortunate information might have caused,“ he said.

READ: Amid new minimum wage tussle, govt accused of illegal salary deductions

What you should know

- It can be recalled that Nigerians woke up on Friday, March 12, 2021, to a reported increase in the retail pump price of petrol to N212.61 per litre.

- According to some media reports, the Petroleum Products Pricing Regulatory Agency (PPPRA) in its memo said that petrol is expected to sell at a lower retail price of N209.61 and an upper retail price of N212.61.

- However, NNPC in its statement insisted that there will be no increase in the pump price of petrol in March.

- The PPPRA also bowed to pressure as it deleted the earlier published template announcing the increase

Liars!

I bought at #209.00 this evening at about 5:26pm

What Boohari cannot spoil does not exist!

This is unfortunate it all going this way. May God help more of the lower earners for sure it all land on them.

Pls can u send me ur contact via email, am de general manager of lead homes ,one of de Leading real Estate company in Nigeria