From green bonds to foreign listings and a determination to plant its seeds across various nations on the African continent, Access Bank over the past few years has shown its desire to grow across its triple-bottom-line.

On the people front, the bank has a reputation for offering arguably the best incentives to its employees in the banking sector even though last year’s plan to cut down salaries threatened to dent this reputation.

It has also introduced some of the sector’s most innovating products aimed at driving financial inclusion and protecting the bank’s market share from FinTechs. The bank has also supported small businesses through loans and financial advisory in line with the CBN’s quest to improve private sector credit.

READ: Access Bank completes acquisition of Zambian Cavmont Bank Ltd

On the environmental front, it’s spending big bucks on CSR, making a name for itself as a leader in Sustainability, and in terms of dominance, its merger with Diamond Bank and other expansionary measures have turned it into Nigeria’s largest bank and one of Africa’s top banks.

While these moves have shed a positive light on the bank, investors are left to play catchup as the benefits of the mergers and acquisitions are yet to result in improved return on investment for anyone who bought the shares over a year ago.

READ: CBN, NDIC to set up bridge bank for struggling financial institutions

Its low Return on Investment (ROI)

While Access Bank has many strides to its name, a lot more needs to be done to make it a winner with investors. Its share price has struggled to gain the same momentum achieved by its rivals in the banking sector, particularly the FUGAZ.

Year to date 2020 Access Bank stock has performed poorly when compared to its peers. While the likes of Zenith Bank (33%), UBA (21%), Fidelity (23%), and FCMB (80%) posted double-digit returns, Access Bank fell by 16% in 2020.

In terms of value, the market prices the stock lower when compared to its earnings, making it one of the cheapest stocks in the sector. This is buttressed by its 2.9x (as of January 22nd) price to earnings ratio, one of the lowest in the sector.

READ: The Nigerian insurance sector; repositioning for efficiency

In the same vein, the Tier 1 bank also has a lower dividend yield compared to its contemporaries and has not been able to breach its 52-week high of N10.90. One reason for this is that investors are wary of the bank’s loan book mostly inherited from its merger with Diamond Bank. Investors will rather go with some Tier 2 banks that have better upward trends in price appreciation than getting stuck with low valuation multiples.

READ: CBN to increase loans to agricultural sector to 10% of total bank credit

Access Bank merger blues

As mentioned, one Achilles heel to its valuation problems could be its aggressive expansion strategy, driven by acquisitions. Since its acquisition of Diamond Bank, its valuation has plummeted piling on paper losses for investors who have held the stock since then.

Access Bank is currently valued at N325.2 billion in market capitalization less than half of its N679 billion suggesting a price to book ratio of 0.47x.

While being large provides the benefits of economies of scale, it needs to be nimble and focussed to milk the opportunities provided by the synergies

READ; Africa to spend $9 billion on Covid-19 vaccine, access to supply is big problem

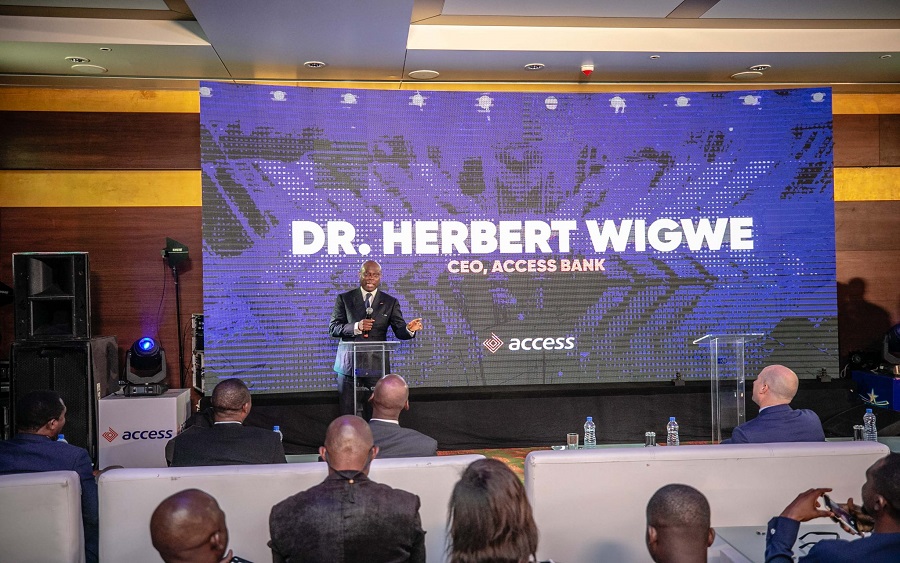

The bank recognizes this challenge, recently holding an investor call where it explained its move towards a HoldCo structure.

Access Bank will maintain four core subsidiaries under the holding company. They are Access Bank Group – focussed on commercial banking services, Payment Business – its mobile money and payment services business, Lending & Agency Banking – microfinance and microlending services, and Insurance.

Its efforts in restructuring into a HoldCo structure as well as expansions to other African regions – from Kenya to South Africa, is expected to further enhance its overall returns, and perhaps drive up valuations.

READ: Access Bank will no longer accept cheques with logo of defunct Diamond Bank

Fundamental analysis of recent financials

Access Bank has recorded positive strides in terms of its fundamentals. In its latest 9 months results, net interest income decreased by 6.6% year-on-year, but profits increased by 15% to N102.3 billion.

Access Bank also implements one of the most aggressive recoveries of bad loans in the banking sector pulling in N38.9 billion in recovery in 2019 and N24.7 billion in the first 9 months of this year. These recoveries filter into the bottom line and bolster confidence about its ability to confront its challenges and win.

The stock is not a value stock yet but a GARP stick. Fill stop.