Two weeks into the new year and the Nigerian Stock Market is already up 2.5% year to date. Stocks got to a fly last week following a slew of corporate deals that got the market excited.

During the week, Ardova, Transcorp, Champions Breweries, etc. were all in the news for reported acquisitions that are already paving the way for what could be a very busy 2020 for the stock market.

As corporate deals dominated the headlines, penny stocks topped the gainers’ charts with stocks like Japaul, Mutual Benefit, Royal Exchange, etc. posting double-digit gains. In fact, the top ten gainers last week all returned over 30%.

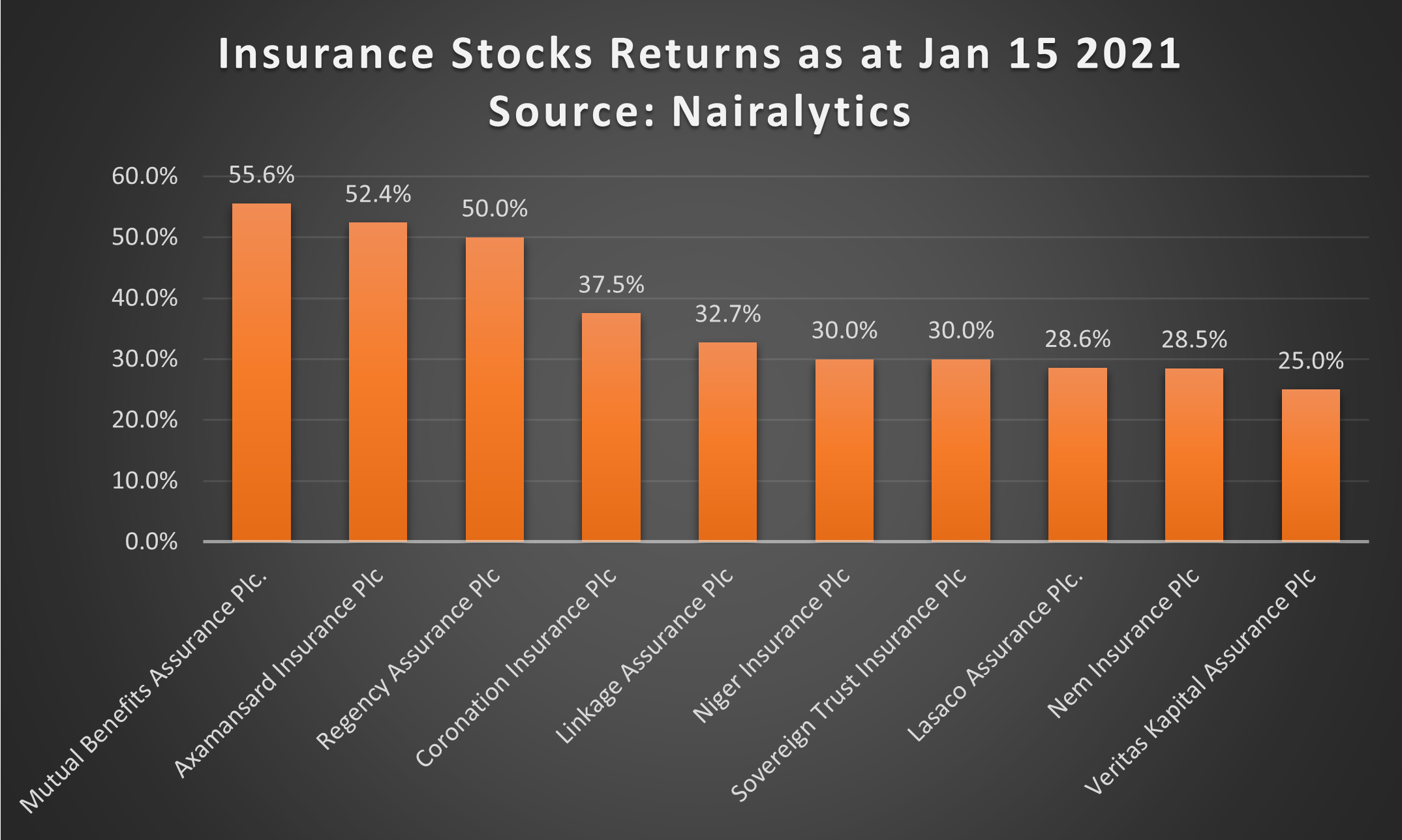

Among the top ten stocks, last week include about 7 Insurance stocks which all gained 30% and above. None of these companies have published any corporate actions lately and neither have they published any results. Yet their share prices have gained significantly in just 10 days of trading.

READ: Worry over stagnation in insurance stocks prices: investors call for action

Insurance Stocks on the fly

The insurance sector is currently the best performing in the country with the NSE Insurance Index already posting a YTD return of 28.63% in just two weeks.

- Out of the 23 stocks listed in the index, 14 have posted at least 9% gains and above while the top ten are up by over 25%.

- Apart from being the best performing index on the exchange, it is arguably the best asset class to invest in Nigeria now.

- At 28,63%, the index is already beating the inflation rate which topped 15% in December.

- Last year, Sunu Assurance, another insurance stock was the best performing stock in the country posting a return of 400% YTD. AIICO ended with a 57% pop and Lasaco 40%.

READ: Insurance: Recapitalisation exercise sets consolidation in motion

Fundamentals not the driver

- While most insurance stocks appeared undervalued for much of the last two years, the harsh business environment faced by most insurance last year firms could not have pushed valuations this high.

- For example, insurance claims for the nation’s top insurers, Custodian, NEM, Axa Mansard, AIICO, WAPIC, and Consolidated Insurance rose from N56.3 billion in the first 9 months of 2019 compared to over N78 billion in the first 9 months of 2020.

- Insurance claims as a percentage of Net Premium in the same period hit 72% in 2020 compared to 61% in the same period in 2019.

- Insurance companies make money from a combination of underwriting profits (net premiums net of claims) and investment income.

READ: Cornerstone Insurance in consolidation talk with two underwriting firms

Recapitalization is seen driving insurance stocks

Nairametrics understands the driver is likely the recent recapitalization efforts that have dominated the sector since 2019. Insurance regulator NAICOM had given Insurance firms until December 2020 to recapitalize or risk their licenses being revoked.

- The recapitalization rules require life insurance firms to meet a minimum paid-up capital of N8 billion, up from N2 billion previously.

- In the same vein, general insurance companies are required to raise their minimum paid-up capital to N10.0 billion from N3 billion previously.

- The regulatory capital for composite insurance was raised to N18 billion from N5 billion previously while reinsurance businesses are now required to have a minimum capital of N20 billion from a previous N10 billion.

However, the ravaging covid-19 pandemic forced the regulator to move the deadline to September 20202 but insurance firms were required to meet half the recapitalization requirement by the end of December 2020.

READ: House of Reps directs NAICOM to suspend recapitalisation of insurance firms

Court order Suspends Recapitalization

As insurance firms battled to raise capital, some took the regulator to court and obtained a court order suspending the recapitalization requirement.

- According to reports, Justice C. J. Aneke of the Federal High Court issued an order suspending the recapitalization on the back of an ex parte application applied for by the Incorporated Trustees of the Pragmatic Shareholders’ Association of Nigeria.

- In late 2020 the House of Representatives also passed a resolution demanding a suspension of the recapitalization efforts.

- Nairametrics understands despite all these suspensions and postponements, Insurance firms have till June to at least meet 50% of the recapitalization goals.

Upshots: As we continue to watch this space, Nairametrics expects a flurry of public offers, acquisitions, divestments to dominate the insurance sector in 2021. As charter around potential deals dominates the rumour mills of the market, insurance stocks will increase in demand. As usual, investors are advised to pick choose wisely.