United Capital has revealed that slower than required recovery in key markets, notably South Africa, Nigeria and Angola, may drag the expected Sub-Saharan Africa (SSA) growth in 2021.

This is according to its latest report, Nigeria Outlook 2021 — A Shot at Recovery, published this month.

The company said even though the IMF asserts that regional growth will rebound to 3.1% in 2021, many SSA countries will not return to 2019 output levels until 2022-24.

READ: Fiscal actions of $11.7 trillion expended for COVID-19 pandemic and associated lockdowns – IMF

According to the report…

- The region recorded its first recession in three decades last year, mainly due to the negative effects of the Covid-19 pandemic on economies. Among other things, the negative effects of the Covid-19 pandemic affected commodity prices across the region so that organisations recorded and are still recording declined revenues and huge costs.

- Countries whose economies are dependent on tourism (Mauritius: -32.9%, Seychelles: -17.0%) were the hardest hit, with sharp GDP contractions in Q2-2020. Results of listed companies in the hotel and tourism space in selected SSA countries also picture declining fortunes.

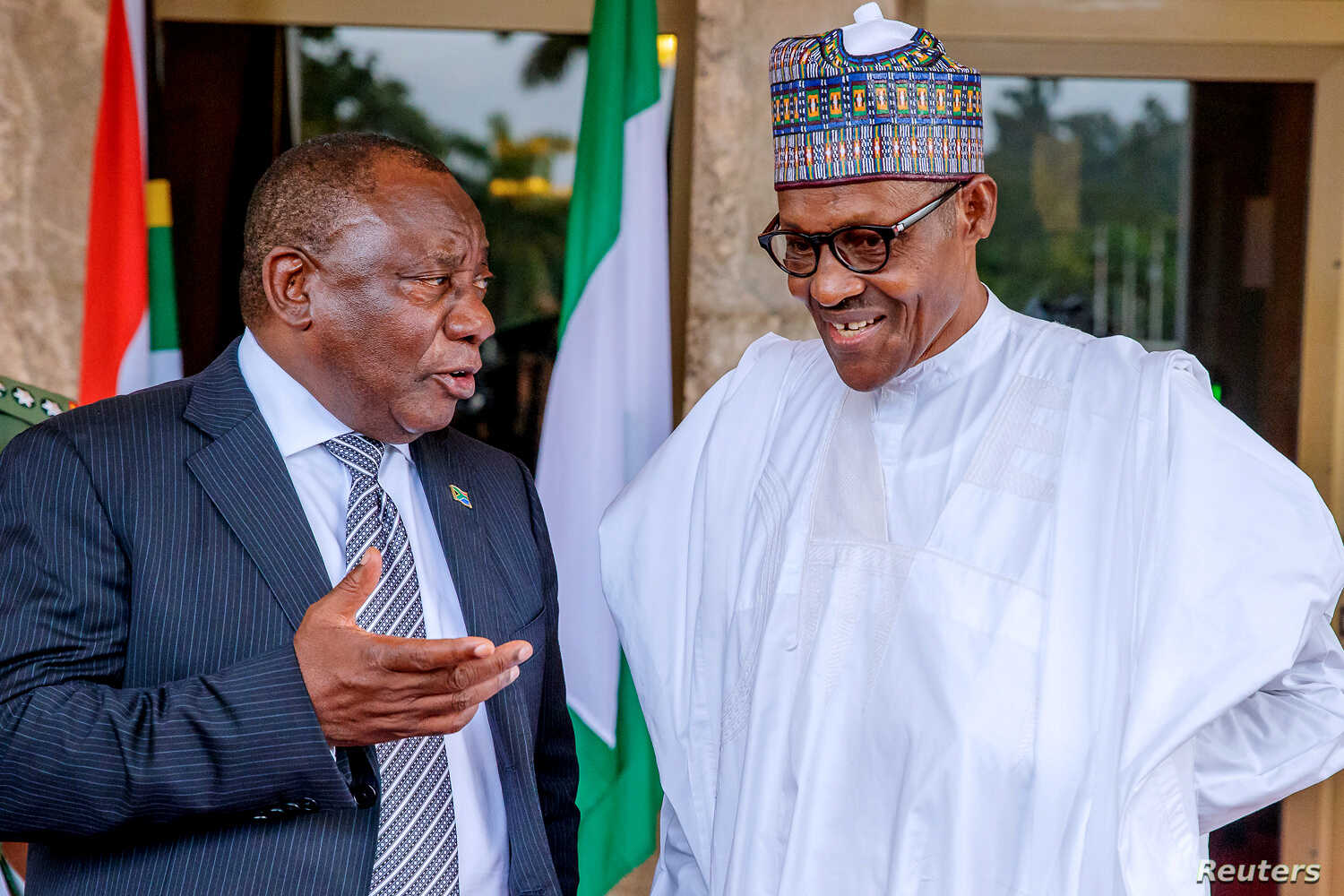

- Oil exporting countries including Nigeria and Angola followed suit. South Africa, which is more of a diversified economy also recorded a -17.1% contraction in Q2-2020.

- Although SSA countries are so far the least affected by the Covid-19 pandemic, recovery is projected to be slower compared with developed regions and some other developing regions.

- In addition to the fragile state of the economy of most SSA countries prior to the pandemic, weak policies are also a contributory factor to the projected drag in recovery.

READ: China to overtake United States as the world’s biggest economy in 2028

READ: United States loses $11 billion to shutdown

The report notes that in 2021 growth in the region will be driven by a few factors:

- The ability of SSA economies to keep the spread of the coronavirus pandemic at bay amid potential vaccination bottlenecks and financial distress will be a significant factor, as the region must avoid another round of unaffordable lockdowns.

- The implementation of the AfCFTA trade agreement, now scheduled to begin from January 2021 rather than July 2020, and the commitment of major economies such as Nigeria and South Africa to the success of the pact will also play a significant role.

- Fiscal policy operations, supported by access to more concessional financing, relief, and private financing amid bold policy reforms, will help bolster recovery.

READ: Nigeria’s economy to grow by 1.1% in 2021 – World Bank

What you should know

- The report, Nigeria Outlook 2021 — A Shot at Recovery — considered global economy, Sub-Saharan Africa, Domestic Macro and Policies, Financial markets key sectors as well as companies.

- Part of the global economy was suspended in Q1 2020 with majority joining in Q2 and most in Q3 2020 to safeguard human health.

- In Q3 2020, the global economy began to reopen as countries looked to recover from the negative effects of the pandemic.

- The second wave of infections, which began in many advanced markets, particularly in the United States and Europe, is however, halting the reopening of economies.

- That countries are beginning to reintroduce lockdowns as a result of the second wave appears to mean that forecasts, especially the favourable ones, may be altered.

- Aside from lockdown measures, productive policies are also needed to scale through as lockdowns only curtail the spread of the virus; but lockdowns spread economic pressures, especially in low-income and fragile economies.

READ: Nigeria’s economy will grow by 2.4% on average in 2021-25 – CEBR