The Federal Government of Nigeria through a technical committee that comprises of relevant regulatory bodies, have approved new modalities for SIM replacement in the country.

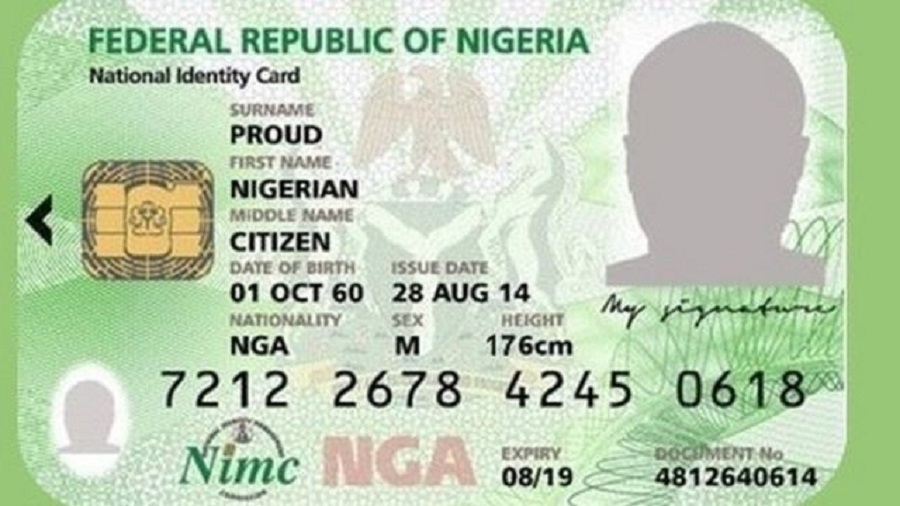

According to a verified tweet by the National Identity Management Commission, seen by Nairametrics, subscribers must present their National Identification Numbers (NIN) for their SIM cards to be replaced.

READ: FG extends deadline for Telcos to block SIMs without NIN to February 2021

Recall that Nairametrics had earlier reported the suspension of new sales and replacement of SIM cards by NCC to allow for an audit of the SIM database. Subsequently, the Federal Government of Nigeria partially lifted this order, halting its earlier pronouncement on replacement of SIM cards, although the ban on sales and activation of new SIM cards still remained.

READ: NCC initiates second phase of sim deactivation, disables 2.2 million lines

In lieu with the recent lifting of orders on replacement of lost, stolen or damaged SIM card, the Federal Government announced that subscribers who would love to replace their SIM will have to present the National Identification Numbers among other conditions as stipulated below;

- The subscriber will be required to present a National Identification Number.

- An effective verification of the National Identification Number will be subsequently carried out by NIMC

- Lastly, the relevant Guidelines and Regulations of NCC concerning SIM Replacement will be fully adhered to.

READ: FG orders removal of N20 NIN retrieval charge across all networks

This policy is part of the Federal Government’s efforts to ease the burden on subscribers and simplify the exercise. It is aimed at enabling telecommunications service users who need to replace their damaged, stolen or misplaced SIMs to re-establish access to telecom services.

READ: Business owners will now get CAC certificate with TIN

What you should know:

- The recent policy is based on the recommendations of a Technical committee under the chairmanship of the Honourable Minister of Communications and Digital Economy.

- The representatives of the Technical Committee are; Nigerian Communications Commission (NCC); National Identity Management Commission (NIMC); The Association of Licensed Telecommunications Operators of Nigeria (ALTON); and Mobile Network Operators (MNOs).

- The Technical Committee is charged with the operationalization of the process to ensure an expedited linkage of all SIM Registration Records with NIN.

- Nairametrics gathered that prior to this new policy, subscribers who want to replace their SIM were among other things expected to provide valid photo identification, SIM Pack or other evidence of direct ownership of SIM/Affidavit, etc. But following the recent directive by the FG, the NIN is now incorporated as part of the statutory requirements, among others.

My Sim is I’ve ten months now since it was stolen and NCC has not open the portal for it what do I do?