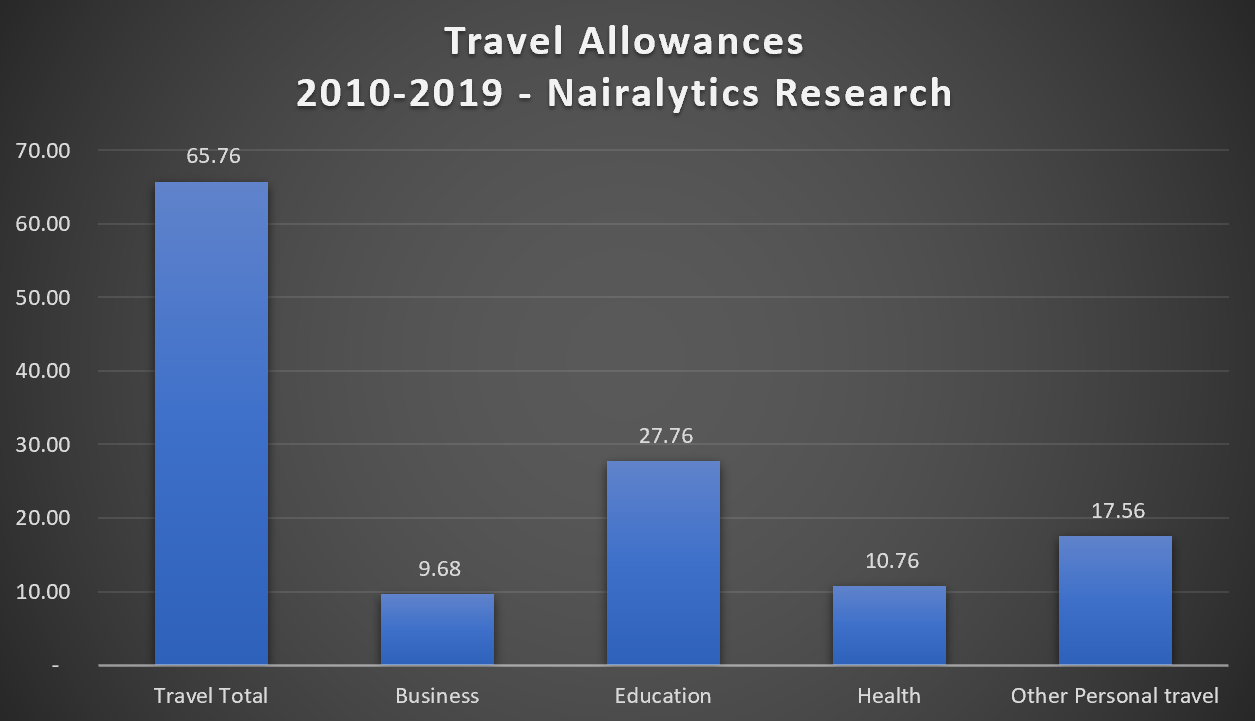

Nigerians have spent roughly $65 billion in the last 10 years on travel-related allowances, data from the Central Bank of Nigeria reveals.

In the last 5 years, travel allowances – which can also be broken down into business and personal travel, topped $35.5 billion between 2015 and 2019.

READ: UPDATED: Nigeria received $1.29 billion capital inflows in Q2 2020, down by 78.6%

- Travel allowances include Personal and Business Travel.

- Personal Travel is further broken down into allowances for education-related travel (school fees), health-related travel, and other personal related allowances.

- Nigerians spend more on education-related travel compared to business-related travel.

Travel allowances are a major component of Nigeria’s dollar utilization and can be found in the breakdown of Nigeria’s balance of payment report.

READ: Bill to assist banks recover bad loans scales through 2nd reading in Senate

READ: CBN issues subtle warning explaining how domiciliary accounts should be used

Dollar demand forces devaluation

Nigeria is currently facing an exchange rate crisis brought on by the Covid-19 pandemic, followed by a drop in oil prices that have both dominated the whole of 2020.

- With oil export earnings down, Nigeria has seen a major source of forex inflow for the country decimated, forcing currency shortages in the country.

- The pressure to secure dollars from Africa’s largest economy has forced the central bank to devalue the currency on three major occasions across its multiple exchange rate windows.

- While the central bank still reports the dollar at N378/$1, it trades for N395/$1 at the NAFEX window and N475/$1 at the parallel market.

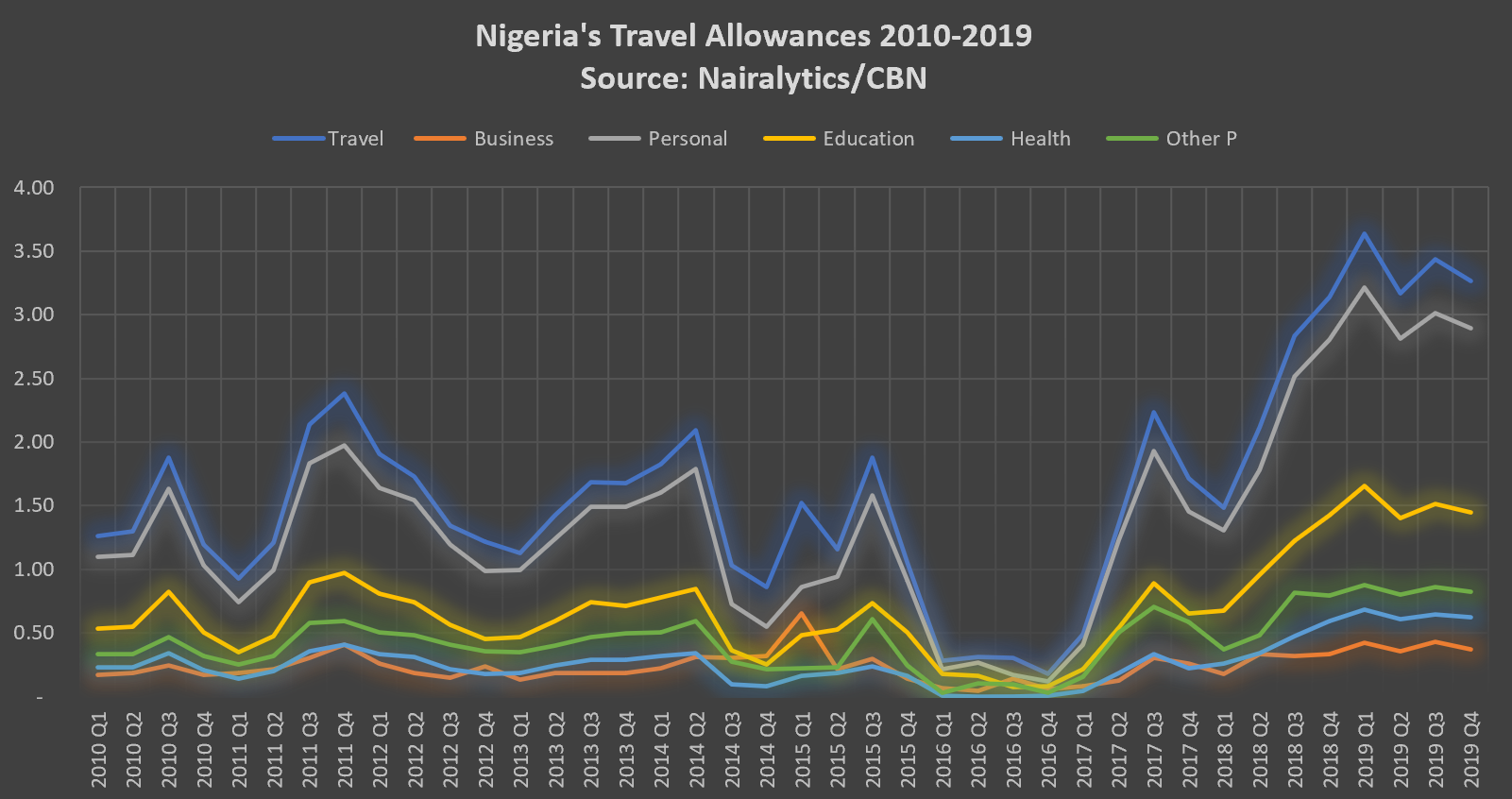

- Nigeria averaged about $3.3 billion per quarter in travel allowances in 2019.

- The devastating effect of Covid-19 on dollar shortages was recorded in the second quarter of 2020 with demand dropping to $115 million in the second quarter of 2020, down from $3.5 billion in the first quarter.

READ: $32 billion invested in Telecoms in the past 5 years – NCC

The second quarter of 2020 was when the Nigerian Government implemented its stiffest lockdown in major cities across the country.

2010 – 2019 Nairalytics Research

Why the addiction?

Nigeria’s insatiable need for dollar travel allowances is a symptom of the deterioration of public services, such as quality academic institutions, health care facilities, and notable tourist destinations. This is reflected in the breakdown of dollar demand emanating from travel allowances.

READ: Aviation reform will position Nigeria as a hub within sub-region – Minister

- Tens of thousands of Nigerians travel overseas annually to get quality education or for medical tourism, piling pressure on dollar demand locally.

- In Nigeria, the CBN allows about $4,000 quarterly for personal travel allowances, $15,000 per term/semester as allowances for payment of school fees.

- Despite the high rate of poverty in the country, thousands of middle-and upper-class Nigerians still travel abroad.

- In the first half of 2019 alone, data from the National Bureau of Statistics reveals over 1 million passengers travelled out of Nigeria (2.25 million passengers in the whole of 2018).

READ: Bureaux de Change operators kick against CBN’s new forex policy

Most of the passengers seek travel allowances, thereby piling pressure on Nigeria’s dollar reserves. While demand for dollars continues to rise, supply remains stagnant or lower when compared to other periods.

How it affects the exchange rate

The latest depreciation of the exchange rate in the parallel market is reflective of the rising increase in travel out of Nigeria.

- As many Nigerians resume international travel to Europe, Asia, and the Americas, demand for the greenback has also risen.

- Nairametrics research projects about $5 billion might be required in the 3rd and 4th quarter of the year to meet the demand for business travel.

- Unfortunately, travel into Nigeria is yet to pick up quickly enough, meaning there will be less inflow of dollars from arrivals into Nigeria compared to departures.

- We even believe demand for forex may be higher towards the end of the year or early January, as Nigerians prepare to transfer dollars to their wards schooling abroad.

READ: These are the fastest growing sectors of the Nigerian Economy

One critical source of dollar earnings for Nigeria is foreign remittances which average about $5.8 billion quarterly. However, we recorded a significant drop in the second quarter of the year to just about $3 billion, largely due to the Covid-19 lockdowns in Western countries.

A pick up in foreign remittances will cushion the demand pressure, a possible reason why the central bank relaxed controls of withdrawals of inflow of foreign remittances.

Explore Finance Related Data on the Nairametrics Research Website

Bottom Line

So long as our academic institutions remain underfunded, and health care facilities in poor condition, Nigerians demand for travel allowances will remain high.

- Interesting to note that some have mooted that a strategic move might be to allow or create a well-funded vehicle for the private sector to invest in a locally owned airline. This could retain some of the forex outflows which are often to the benefit of international airlines.

- Critics however point to the fact that the airline business is not profitable especially on international routes where Nigeria lacks a competitive edge.

READ: Naira rebounds at black market as CBN moves against illegal activities of currency traders