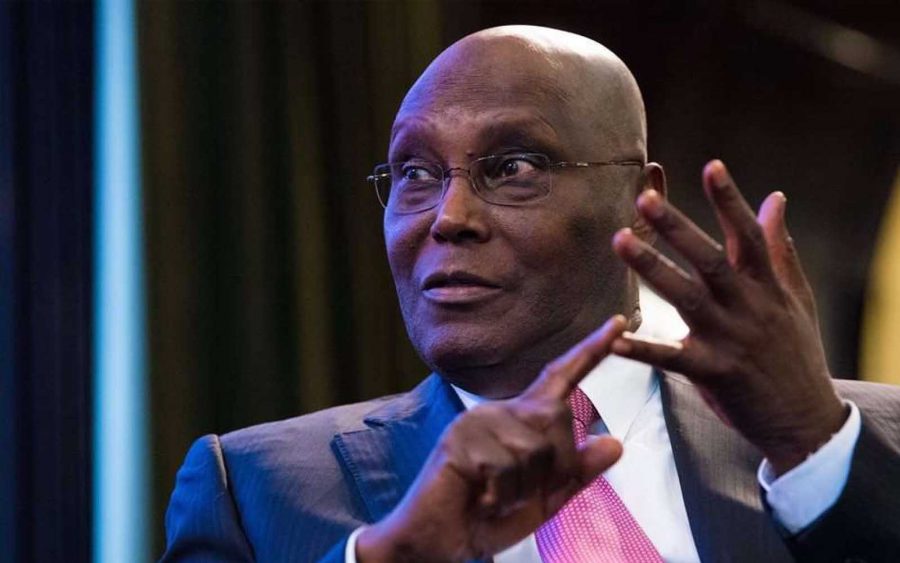

Former Vice President of Nigeria, Atiku Abubakar has warned that Nigeria Nigeria must stop borrowing for anything other than essential needs, he also added that very non-essential line items in the proposed 2021 budget must be expunged and others in a bid to kick start the economy from a recession.

Atiku disclosed this in a social media statement on Sunday, titled: “We Must Exit This Recession With Precision”.

Atiku said he received confirmation of Nigeria’s slide into recession for the second time in five years with a heavy heart. He urged that the poor economic environment could have been avoided if his ideas of cutting costs of governance were incorporated.

“This could have been avoided had this administration taken heed to patriotic counsel given by myself and other well-meaning Nigerians on cutting the cost of governance, saving for a rainy day, and avoiding profligate borrowing.

“Yes, the COVID-19 pandemic has exacerbated an already bad situation, however, we could have avoided this fate by a disciplined and prudent management of our economy.

” It serves no one’s purposes to quarrel after the fact. We must focus on solutions. Nigeria needs critical leadership to guide her back to the path of economic sustainability,” he said.

Atiku warned that Nigeria’s proposed 2021 budget is no longer feasible as the Federal Government does not have the budget to afford heavy luxuries. He, therefore, urged the government to expunge every non-essential line items from the budget.

“We must act now, by taking necessary, and perhaps painful actions. For a start, the proposed 2021 budget presented to the National Assembly on Tuesday, October 8, 2020, is no longer tenable.

“Nigeria neither has the resources, or the need to implement such a luxury heavy budget. The nation is broke, but not broken. However, if we continue to spend lavishly, even when we do not earn commensurately, we would go from being a broke nation, to being a broken nation.

“As a matter of importance and urgency, every non-essential line item in the proposed 2021 budget must be expunged.

“For the avoidance of doubt, this ought to include estacodes, non-emergency travel, feeding, welfare packages, overseas training, new vehicle purchases, office upgrades, non-salary allowances, etc,” Atiku said.

The former Peoples Democratic Party presidential candidate added that the budget must focus on essential items including human development investments and policies that increase the purchasing power of Nigerians.

” Nigeria ought to exclusively focus on making budgetary proposals for essential items, which include reasonable wages and salaries, infrastructural projects, and social services (citizenry’s health, and other human development investments)”

” Additionally, we have to stimulate the economy, by investing in human development, and increasing the purchasing power of the most vulnerable of our population. Only a well-developed populace can generate enough economic activity for the nation to exit this recession.”

Atiku called on a monthly stimulus package to poor Nigerians which he adds should be funded not by debt but by adding a 15% tax to luxury purchases.

He said, ” For example, a stimulus package, in the form of monthly cash transfers of ₦5000 to be made to every bank account holder, verified by a Bank Verification Number, whose combined total deposit in the year 2019 was lower than the annual minimum wage.

” How will this be funded? By more profligate borrowing? No. I propose a luxury tax on goods and services that are exclusively accessible only to the super-wealthy. A tax on the ultra wealthy to protect the extremely poor.

“A practical approach to this is to place a 15% tax on all Business and First Class tickets sold to and from Nigeria, on all luxury car imports and sales, on all private jets imports and service charges, on all jewellery imports and sales.”

“And above all, Nigeria must stop borrowing for anything other than essential needs. Again, for the avoidance of doubt, borrowing to pay salaries, or to engage in White Elephant projects, is not an essential need.

“If we keep borrowing, we stand the risk of defaulting, and that will make recession a child’s play because we will lose some of our sovereignty.

What you should know

Nairametrics reported that Nigeria’s Gross Domestic Product (GDP) in real terms declined by -3.62% (year-on-year) in Q3 2020, thereby marking a full-blown recession and second consecutive contraction from -6.10% recorded in the previous quarter (Q2 2020).