The Federal Government has disclosed that it expects to save as much as N1 trillion ($2.6 billion) annually, and create massive jobs following the removal of fuel subsidy.

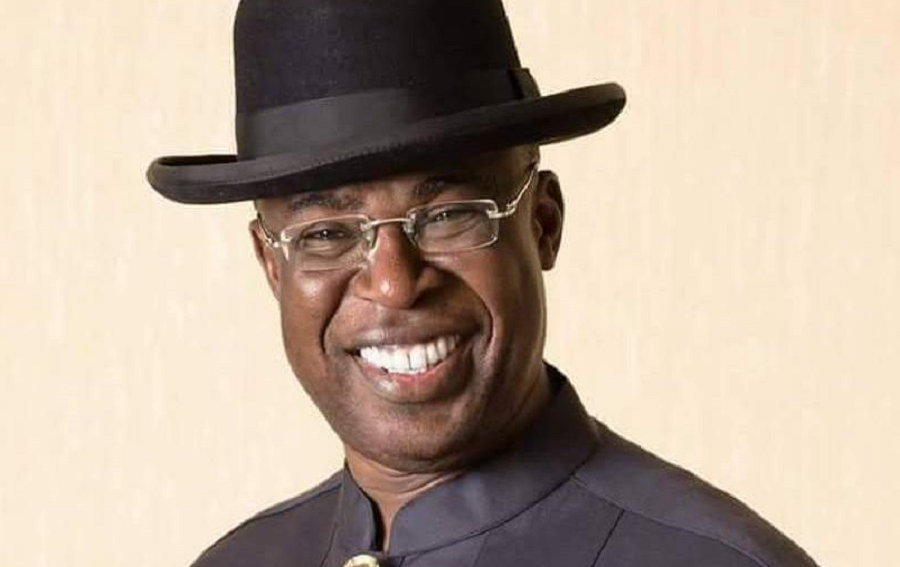

The disclosure was made by the Minister of State for Petroleum Resources, Timipre Sylva, during an interaction with newsmen in Abuja on Thursday, September 11, 2020.

READ: FG to give up majority stakes in its 4 refineries, to be privately managed

Sylva said, “It is time for Nigerians to face reality and do the right thing. What is deregulation going to do? It is going to free up a lot more money. At least from the very beginning, it will save us up to a trillion, and more every year. Already, we have taken off the budgetary provision for the subsidy which is about N500 billion in the budget.

“Also, we have taken off the excess forex price that special rate that was given to NNPC which also came at a cost. So, all the money that we used to defend the Naira at that time to subsidize the dollar will now be freed up for development. I believe that this discussion around subsidy has been a vexed issue that has captured the imagination of this country for a long time now,” the minister said.

READ: Government can unlock N4 trillion by removing these subsidies – PWC

He pointed out that past administrations had lacked the political will to deregulate the downstream sector, and remove subsidy despite attempts to do so. At some periods, the time was not good for it.

The Minister said, “And why did I say that time was not good for it? Does that imply the time is good for it now? The problem around deregulation is that people must understand first that the product we are talking about is a derivative of crude oil.

READ: Subsidy and PIB

“It is refined from crude oil. Therefore, it has a direct relationship with the price of crude oil. If the price of crude oil goes up, then you expect that it would reflect in the price of the derivative.

“So, the best time to achieve this we looked at was the time when crude oil prices are low so that Nigerians will get the benefit of those low prices.’’

READ: FG gives reason oil marketers are not yet importing petrol, stops monthly price fixing

The Minister, however, lamented that when the Federal Government announced the deregulation policy in March, and reduced the price of petrol which was beneficial to consumers, the price of services and goods in the market place did not reduce.

“Whenever there is a kobo increase in the pump price of petrol, people will use it as an opportunity to triple the selling price of their commodities,” he said.

It’s a shame the minister is bold enough to only link the price of the products to the price of crude oil simply because it is Refined Petroleum.

He’s definitely not oblivious of the fact that this also has to do with us importing RP rather than refining domestically.

The basic problem constituting over 60% of the high price is the non-functionality of our refineries (yet the NNPC benefits from statutory transfers in every budget as part of the GOEs).

LIKE COMMENT