The Petroleum Products Pricing Regulatory Agency (PPPRA) has revealed that the non-availability of foreign exchange was the reason why many marketers were yet to start importation of petroleum products.

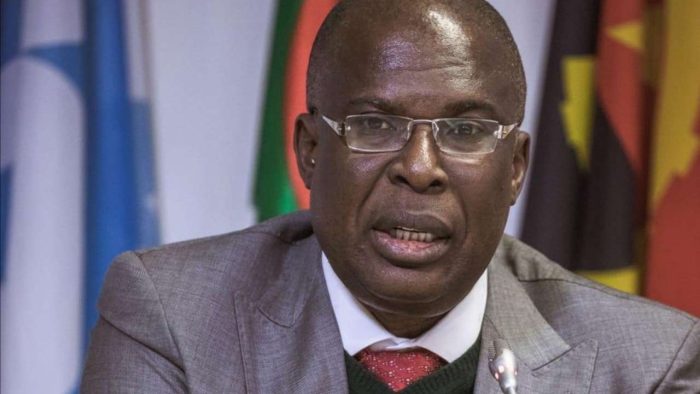

This disclosure was made by the Executive Secretary of the PPPRA, Saidu Abdulkadir, during a press briefing on the deregulation of the downstream oil and gas sector, on Tuesday in Abuja.

The PPPRA boss, who was represented by the General Manager, Administration and Human Resources of the agency, pointed out that although the Petroleum Products Marketing Company (PPMC), a subsidiary of the Nigerian National Petroleum Corporation (NNPC), is still the sole importer of petroleum products, PPPRA will continue to monitor development to check profiteering by marketers.

The PPPRA boss said, “The PPPRA as a regulator will continue the role of a watchdog in this deregulation regime. We will continue to maintain our role as a regulator and ensure that Nigerians are not short-changed in any way in this process.’’

“You know how things are globally with the impact of COVID-19 on the global oil market. Accessing forex remains a challenge for marketers.’’

“We are hopeful that in a few months to come, Nigerians will understand what the government is doing to stabilize the downstream sector.’’

Going further, the PPPRA Executive Secretary revealed that going forward, the price of premium motor spirit (PMS) popularly referred to as petrol, will be determined by the forces of demand and supply together with the international price of crude oil.

He reiterated that the government was no longer in the business of fixing the pump price of petrol, but would monitor marketers to avoid profiteering.

He also disclosed that the PPPRA may no longer provide the monthly price band for petrol as that would run contrary to the deregulation policy.