Introducing Bonds!!

In times of market volatility and uncertainty, where the Stock market is all over the place and alternative investments are being grounded due to the global pandemic that is Coronavirus, investors often opt for stable and reliable instruments like Bonds.

We are really excited to make Bonds available for our investor’s needs. The investment landscape has seen better days that’s why we dug really deep and are bringing users this very stable and reliable investment asset class.

Why Invest in Bonds on Wealth.ng

Among other things, investing in Bonds is secure, this makes this class of investment very attractive to cautious investors seeking better returns. Bonds also has the following benefits:

- Low Risk- compared to Equities

- Fixed and Regular Income

- Capital Appreciation

As an Investor, Bonds may be a suitable investment for you if:

- You want to invest in a product that guarantees the principal amount with interest upon maturity.

- You want to diversify and build a resilient portfolio

- You expect a guaranteed return

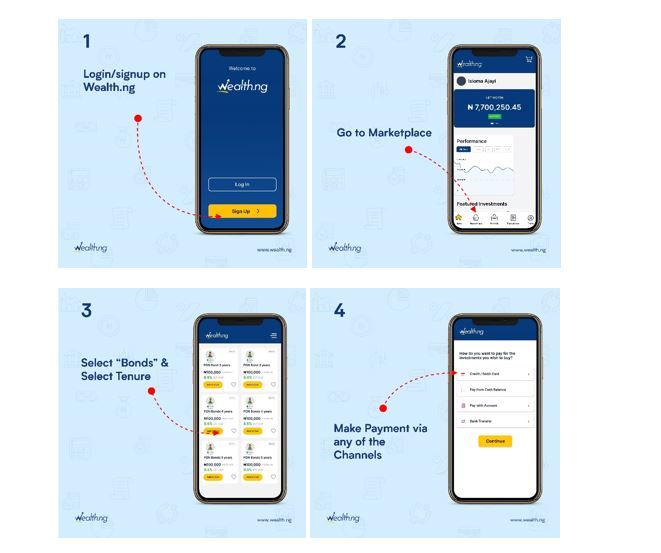

How to invest in Bonds on Wealth.ng

- Login/signup on Wealth.ng

- Go to Marketplace

- Select “Bonds” & Tenure

- Enter the amount - Minimum Investment of N100,000 is required.

- Make Payment via any of the Channels

FAQs

- Minimum Investment: You can start investing in bonds with a minimum subscription of N100,000.00.

- What Tenures and rates are Available? Generally, bonds are issued as 2 years bond, 5 years bond, 10 years bond and also 30 years bond. Access Bonds from 3 years on Wealth.ng and start enjoying the better life.

- 3 Year Bond – 7.80%

- 4 Year Bond – 7.80%

- 5 Year Bond – 7.35%

NB: Please note that rates are subject to change without notice, depending on the market demands. - Interest: For Bonds on Wealth.ng, investors will be paid interest for holding the bond at the end of the investment tenure. However, at the end of every year, the accrued interest for that year is paid directly into the user’s cash balance and the interest for the new year starts to accrue.

- Liquidation: You can sell your bond at any time before it matures. However, please note that you can break your investment with a little fee of 1%. The fee is removed from the accrued interest, and the remaining amount is sent to the user’s cash balance. Similar to other investments, we advise that you cultivate the savings culture and let your money grow before you take it out. Besides, the longer you leave it, the higher your returns.

Can we entrust fund fund with wealth.ng? Thank you