Following the crash of the crude oil price, several infrastructural projects earlier scheduled for take-off in the first quarter of 2020 would be stalled, as the Federal Government is yet to come up with alternate sources to make up for the deficit.

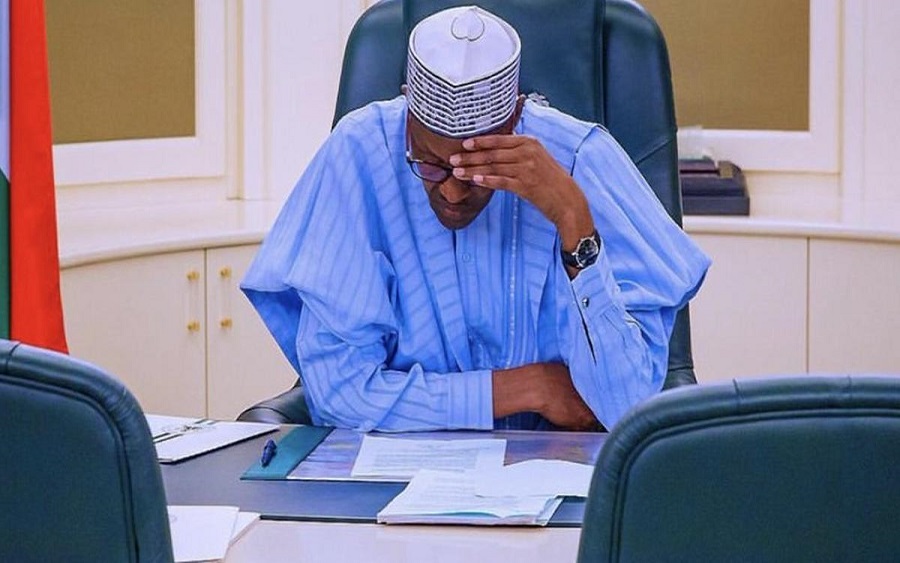

Many of the projects with strong economic impact on the Nigerian populace, were listed by President Muhammadu Buhari in his January new year letter to Nigerians as those to be executed starting from the first quarter of 2020.

However, these projects will now be stalled in view of almost 20% budget deficit, which the government has to grapple with.

[READ MORE: Buhari seeks amendment of new Finance Act)

The affected projects include the Ajaokuta-Kaduna-Kano project (AKK) gas pipeline project earlier scheduled for take-off in the first quarter of 2020;

- the OB3 gas pipeline and the expansion of the Escravos – Lagos pipeline;

- 47 road projects scheduled for completion in 2020/21, including roads leading to ports,

- major bridges including substantial work on the Second Niger Bridge.

- 13 housing estates under the National Housing Project Plan;

- the Lagos, Kano, Maiduguri and Enugu international airports to be commissioned in 2020;

- launching of an agricultural rural mechanisation scheme that will cover 700 local governments over a period of three years;

- the flag-off of the Livestock Development Project Grazing Model in Gombe State where 200,000 hectares of land has been identified;

- training of 50,000 workers to complement the country’s 7,000 extension workers;

- the Lagos – Ibadan and Itakpe – Warri rail lines listed for commissioning in the first quarter, and

- commencement of the Ibadan – Abuja and Kano – Kaduna rail lines also in the first quarter will also be stalled in this new development.

With this downturn in the global and Nigerian economy, the further liberalisation of the power sector to allow businesses to generate and sell power does not appear feasible in the first quarter, neither does the construction of the Mambilla Power Project listed to take off in the first half of 2020.

[READ ALSO: Buhari appoints new NIMASA Executive Director)

Minister of Transportation, Rotimi Amaechi, whose ministry supervises several infrastructure projects being undertaken by Chinese Consultation firms, has also revealed that ongoing construction works on the Lagos-Ibadan rail project had been stalled due to the inability of employees of the China Civil Engineering Construction Corporation (CCECC), who are handling the project, to return back to Nigeria due to the Coronavirus outbreak in their country.

Sequel to the crash in the global crude oil prices, President Muhammadu Buhari inaugurated a committee headed by Minister of Finance, Budget and National Planning, Zainab Ahmed and supported by Minister of State Petroleum Resources, Timipre Sylva, with Minister of State, Budget and National Planning, Clement Agba; CBN Governor, Godwin Emefiele and the Group Managing Director of the NNPC, Mele Kyari as members to finding a solution to the resulting budget deficit.