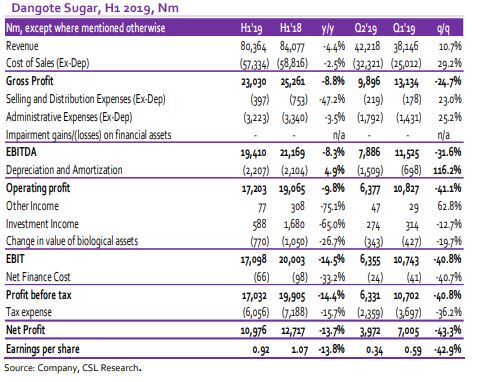

Dangote Sugar Refinery (DSR) reported H1 2019 Revenue of N80.4 billion, a 4.4% y/y decline from H1 2018 Revenue of N84.1 billion. Intense competition within the Industrial client business segment continued the influx of smuggled sugar and possible price cuts pressured Revenue. Similarly, Net Income fell 13.7% y/y to N10.9 billion in H1 2019 from N12.7bn in H1 2018.

The company in the face of declining Revenue also faced cost spikes in Q2 particularly on Raw materials (despite relatively stable raw sugar prices in Q2). Consequently, margins were significantly pressured. Going forward, we see very limited growth prospects for Dangote Sugar as we anticipate cost pressures will remain given the expected increase in raw sugar prices. Consequently, we cut our Net Income forecast for FY 2019e to N19.2 billion.

Dangote Sugar has faced severe competition in the Industrial customer base this year and was forced to take price cuts in Q2 2019 in a bid to defend market share. Furthermore, the recurring menace of smuggled sugar remains a severe concern for the growth prospects of the company. In addition, the Apapa gridlock continues to impact the distribution network thus increasing the lead time for product deliveries.

We revise down our target price for Dangote Sugar to N13.26/s from N14.53/s but maintain our Hold recommendation despite an attractive upside potential of 34.0% from today’s closing price of N9.90/s. Our HOLD recommendation evidences the weakness we see in the Sugar business. We arrive at our target price using a combination of the DCF and relative valuations in a ratio of 60:40. In its recently released H1 2019 financials, Dangote Sugar reported a 4.4% y/y decline in Revenue to N80.4bn in H1 2019 from N84.1 billion in H1 2018.

[READ MORE: Rams sell for as low as N21,000 in major markets as sellers witness mixed turnouts]

However, on a q/q basis, Revenue climbed 10.7% q/q to N42.2bn in Q2 2019 from N38.1bn in Q1 2019. The decline in Revenue on a y/y basis was driven by a decline in sales of the 50kg bag category (down 4.8% y/y to N75.6 billion) and revenue from molasses (down 27.9% y/y to N384.7 million). We believe the decline in the 50kg category stems from the loss of market share in the industrial segment given that key competitors are reporting stronger market share amidst tight industry growth. On the positive, there were upticks in Revenue from retail pack sales (up 0.7% y/y to N2.3 billion) and freight services (up 12.0% y/y to N1.8 billion) but these were unable to offset the decline in other

business segments due to their low percentage contribution.

Cost of Sales (adjusted for depreciation) declined at a slower pace to the fall in Revenue, down 2.5% y/y to N57.3 billion for H1 2019 from N58.8bn in H1 2018. On a q/q basis, Cost of Sales grew sharply by 29.2% faster than the 10.7% q/q growth in Revenue on the back of higher raw material cost (up 41.9% q/q to N26.3 billion) and direct labour cost (up 9.8% y/y to N905.7 millio) within the quarter. The increase in Cost of Sales comes as a surprise given stable raw sugar price during the period. The International Sugar Organisation raw sugar price tracker was lower by 1.0% in Q2 compared to Q1.

As a result, Gross Profit was pressured lower by 8.8% y/y to N23.0 billion in H1 2019 from N25.3 billion in H1 2018. On a q/q basis, Gross Profit declined significantly, down 24.7% to N9.9 billion in Q2 2019 from N13.1bn in Q1 2019. Gross margin shrank by 1.4ppts to 28.7% in H1 2019 while the spike in Cost of Sales in Q2 2019 pressured margin lower by 11.0ppts to 23.4% in Q2 2019.

Operating Expenses (adjusted for depreciation) declined 11.6% y/y to N3.6 billion in H1

2019 from N4.1 billion in H1 2018, on the back of a 3.5% y/y decline in Administrative

Expenses (excluding depreciation) to N3.2 billion and a 47.2% y/y decline in Selling &

Distribution Expenses to N397.3 million. The decline in Administrative Expenses was

driven by a 10.1% y/y drop in Employee cost and a 28.1% y/y decline in Management

Fees. Although Selling & Distribution Expenses declined y/y, we observed a steep

23.0% q/q rise as Dangote Sugar tried to protect the market share in the industrial

business segment.

[READ ALSO: Nigeria’s external reserves slip below $45 billion in just two months]

Despite the decline in Operating Expenses, lower Gross Profit for H1 2019 pushed

EBITDA lower by 8.3% y/y to N19.4 billion from N21.2 billion in H1 2018. EBITDA’s margin for H1 2019 was lower by 1.0ppts y/y to 24.2%. Aided by higher Depreciation Expense

booked by the company, Operating Profit fell 9.8% y/y to N17.2bn in H1 2019. EBIT

was down 14.5% y/y to N17.1 billion in H1 2019 from N20.0 billion in H1 2018 on the back of lower Other Income (down 75.1% y/y to N76.7 million) and lower Investment Income

(down 65.0% y/y to N588.2 million) booked by the company for the period. The company’s

lower Investment Income was due to a 68.3% y/y decline in the company’s Cash &

Cash Equivalents balance.

Lower Tax Expense (down 15.7% y/y to N6.1 billion) and Net Finance Cost (down 33.2%

y/y to N65.8 million) cushioned the decline in Net Income. Nonetheless, Net Income fell

13.7% y/y to N10.9bn in H1 2019 from N12.7bn in H1 2018. Notably, Net Income

plunged 43.3% q/q to N4.0 billion in Q2 2019 from N7.0bn in Q1 2019. Earnings per Share

(EPS) stood at N0.92/s for H1 2019 compared to N1.07/s in H1 2018.

Dangote Sugar has faced severe competition in the Industrial customer base this year and was forced to take price cuts in Q2 2019 in a bid to defend market share. Furthermore, the recurring menace of smuggled sugar remains a severe concern for the growth prospects of the company. In addition, the Apapa gridlock continues to impact the distribution network thus increasing the lead time for product deliveries.

Notably, Dangote Sugar enjoys its best period during the first half of the year. Thus,

while the company’s Revenue for H1 2019 was N80.4 billion, we expect Revenue for the

rest of the year to be lower than H1. Although Revenue pressures faced by Dangote

Sugar in 2019 has not been as intense as we expected, Revenue growth concerns

continue to linger. Thus, we raise our FY 2019e Revenue estimate from N136.4 billion to

N142.1 billion which implies a 5.5% y/y decline from FY 2018’s N150.4 billion.

Raw material cost has also been on the rise, thus impacting Cost of Sales. Raw material cost as a % of Revenue in H1 2019 was 55.7% as against 53.9% in H1 2018. The cost pressure was more pronounced in Q2 2019 with raw material cost gulping 62.2% of sales despite stable sugar prices in H1 2019.

We expect Sugar prices to climb higher for the rest of the year due to cuts in supply from major producing countries like Brazil as producers now divert capacity into production of Ethanol due to better margins. Consequently, we raise our Cost margin forecast for FY 2019e from 68.0% to 72.0% (H1 2019 – 71.3%). Our Cost of Sales forecast for FY 2019e now stands at N102.3 billion. Consequently, we have revised our Gross Profit and Gross margin forecasts for FY 2019e to N39.8 billion and 28.0% respectively from N43.6bn and 32.0%.

On a positive note, the company has successfully kept Operating Costs under control in 2019. We forecast a 15.3% y/y decline in Operating Expenses to N6.7bn. We expect this to be supported by a 12.6% y/y dip in Administrative expenses. Against this backdrop, we expect EBITDA to decline 10.9% y/y to N33.1bn while EBITDA margin declined 1.4ppts y/y to 23.3% for FY 2019e. Furthermore, we forecast a higher depreciation charge (+2.6%) as well as lower Other Income (-50.1%), thus our EBIT forecast is revised down to N28.0 billion Prior forecast – N31.6 billion), a decline of 14.3% y/y from N32.7bn in FY 2018.

As at H1 2019 result, DangSugar reported significantly lower cash balance (-65.3% y/y to N9.7 billion). Consequently, we expect the lower cash balance coupled with a moderating yield environment to impact the Investment Income. Consequently, we forecast a 33.1% y/y decline in Investment Income to N1.7bn for FY 2019e. Meanwhile, the company continues to pay down on its Loans and Borrowings (down 7.9% y/y), thus, we forecast a decline of 24.2% y/y in Interest Expense to N222.2m. We forecast a 14.8% y/y decline in Profit before Tax to N29.5 billion for FY 2019e. We also adjust our Effective Tax Rate to 35.0% (H1 2019 – 35.6%) from 30.0%. Consequently, Profit after Tax is forecasted to decline by 12.8% y/y to N19.2bn (Prior Forecast – N23.3 billion). Our EPS forecast prints at N1.61/s, a 12.9% y/y decline from FY 2018’s N1.85/s.

[READ FURTHER: N5 trillion debt: Buhari approves law empowering AMCON to access debtors’ account]

Valuation

We lower our target price for Dangote sugar to N13.27/s from our earlier communicated N14.53/s which implies an upside of 34.0% from today’s (09-Aug2019) closing price of N9.90/s but we maintain our HOLD recommendation on the stock. Our lower target price reflects the downward adjustments on major profit lines caused by cost pressures. Examining Dangote Sugar’s trading multiples shows the stock has been severely punished for the lacklustre performance over the past 6 quarters. The stock trades at a TTM EV/EBITDA of 3.5x which is a discount to its 5- Year EV/EBITDA average of 3.9x and our TTM EV/EBITDA Peer average of 9.3x. Despite low valuations, however, we retain a Hold recommendation given a dim outlook for Dangote sugar.

Our valuation combines a mix of DCF analysis and relative valuation. Our DCF analysis makes use of FCFF in the valuation methodology while our relative valuation relies on a blend of CSL EM Sugar peers and the company’s 5-year historical average. The DCF valuation has a greater weighting over relative valuation in a 60:4.