By definition, mutual funds are pooled investment vehicles that collect money from various investors and invest the money so collected into various asset types and classes.

By nature, they are sort of pass-through entities that receive gain from their investments by way of dividends or interest or capital gains and then pay out those to the unit holders from whom the money invested were gathered.

More often than not, mutual fund investors know what mutual fund they invest in without knowing what such mutual funds are investing in.

However, mutual fund investors have the right to know what securities their mutual funds are investing in. This is more important with respect to ethically minded investors who try to avoid investing in “sin” stocks like the tobacco companies or pharmaceutical companies that manufacture abortion drugs or narcotics, among others.

Knowledge of what their mutual fund holds or invests in helps investors monitor incidence of investment strategy shifts.

Again, investors use the information on holdings to gauge their exposure to concentration risk, especially when they are invested in multiple mutual funds.

One of the reasons for mutual fund investment is diversification but if you invest in two mutual funds that hold virtually the same equity positions, then the aim of diversifying your portfolio by investing in those mutual funds is negated.

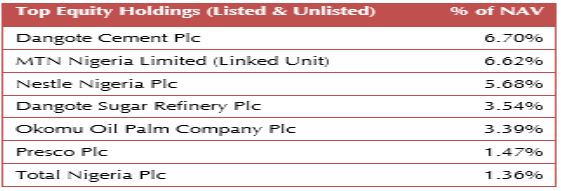

For example, a look at the top 10 holdings of Lotus Halal ETF reveals that it holds positions in Dangote Cement Plc, MTN Nigeria Ltd, Nestle Nig. Plc, Dangote Sugar, Okomu Oil Palm, as well as Presco Plc and Total Nigeria Plc.

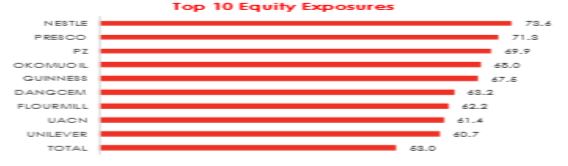

Now, compare that with the top 10 holdings in United Capital Equity Fund which comprises investments in Nestle Plc, Presco, PZ, Okomu Oil, Guinness, Dangote Cement, Flour Mills, UACN, Unilever and Total.

You can see that there is an overlap between the two funds in investments in Dangote Cement, Presco, Okomu Oil, Total Nigeria Plc, and Nestle Nig. Plc.

The implication of this, therefore, is that if you have invested in Lotus Halal ETF and United Capital Equity Fund, you will most likely be overexposed to, or overweight with those equities that are held in both funds.

The effect of this unwitting or involuntary overexposure is that a negative performance in a select few equities can magnify the loss on your portfolio.

Think of what happens if there is a negative performance in Dangote Cement, for example, it means that the performance of both Lotus Halal ETF and United Capital Equity fund will be impacted and an investor holding both funds will experience a “double whammy” of negative performance.

Of course, the exact opposite is also true with positive performance in Dangote, but in finance, investors pay more attention to downside risk than upside potential.

Where to Find Holdings Information

Unfortunately, many fund managers do not like to make known their holdings, arguing that doing so will reveal their secrets and undermine their perceived outperformance relative to their peers.

There is no gainsaying the fact that Nigerian mutual funds lack reporting transparency and as such, it is not easy to decipher through their records to know what they are holding or investing in. However, a few of them have been kind enough to publish that information.

For those who are research inclined, holdings information can be found in fund fact sheets where available; or as an investor, you can request the information from your fund manager on a right to know basis.

It will be prudent for the regulatory authorities to mandate fund managers to publish their holdings at least monthly, if not more frequently.

The extent to which mutual funds overlap can be insinuated or deduced from the simple statistics of correlation. Correlation is a measure of how two variables, in this case mutual fund prices, are related or change in relation to each other.

When two mutual funds are near perfectly positively correlated, chances are that they hold similar positions.

In more advanced markets, correlation coefficients among mutual funds, or even equities are readily available but not so much in the Nigerian market. However, analysts at Quantitative Financial Analytics have that information for those who would want to know.

According to Quantitative Financial Analytics, the correlation coefficient of Lotus Halal ETF and United Capital Equity Fund is .70, indicating that both funds’ prices move in the same direction 70% of the time. This implies that there is a 70% chance that they hold similar investment securities.

Another unfortunate thing about this issue is the dearth of financial instruments in the Nigerian market. There are so few “blue chips” in the Nigerian market that it is very difficult to see mutual funds that are not holding such supposedly blue-chip stocks in their portfolio.

This scarcity has therefore made it difficult to achieve diversification, in the strictest sense of the word, among mutual fund investors.

Be that as it may, it is still believed that one can achieve diversification by reviewing the holdings positions of mutual funds from time to time and making the required adjustments where possible, as well as investing in mutual funds that are not closely correlated with each other.

Good insight.