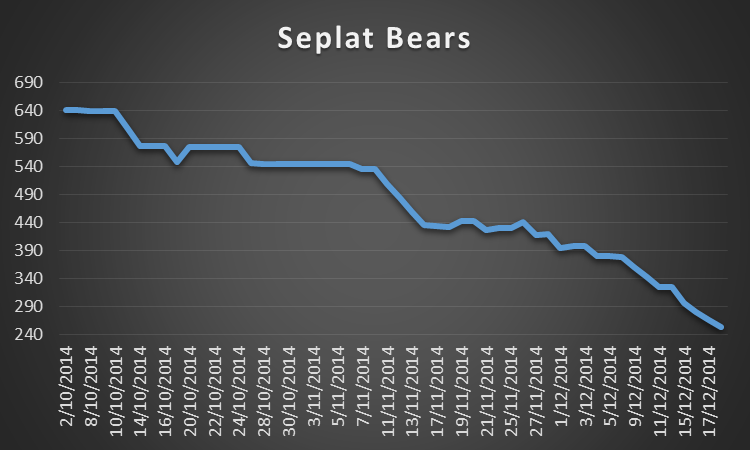

What a week it has been for Seplat!! In fact what a month!! If you bought Seplat at the tip of this chart and held on to it then you must be really brave. You are in fact the stuff fundamental investors are made of. This time two weeks ago Seplat was one of the worst performing stocks in the Index. In fact, it had fallen so deep, its P/E ratios was under 2x. At a point, I even felt the share price will bottom out at about N200 (at least at par with its Book Value Per Share). We bought Seplat at N420 and thought it was a bargain only for the stock value to nearly half that price afterwards. Even then, you sort of had the sinking feeling that this stock was there for the taking. Regardless of the effect of the price of oil, Seplat would somehow bottom out sooner. The problem was when? And then there was this rise.

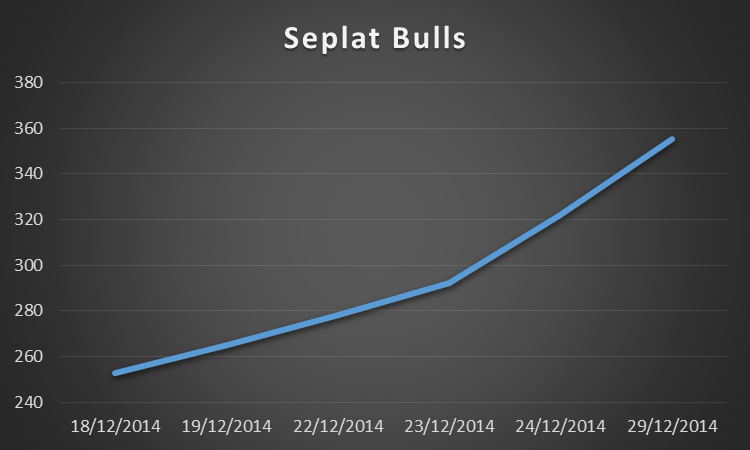

Seplat came out of the dungeon as the bulls appeared in full force. The stock has since December 18 gained about N100 or 42% in just over a week of intense rally. It gained 10% on Monday alone and looks set to finish the year on a high. But will this rally of life continue? It all depends on sentiments. Apart from the potential acquisition or merger of/with Afren nothing much appears to be happening to Seplat on the fundamental side of things. Oil prices are still down with no major signs of it bottoming out. Seplat is also likely to declare poor 2014 results when it releases early 2015. So this rally may just be influenced by profit seekers who are waiting to offload at the slightest opportunity. When that will happen, I really can’t say. All I know is this is a rally of life and cheers to this who rode it profitably.