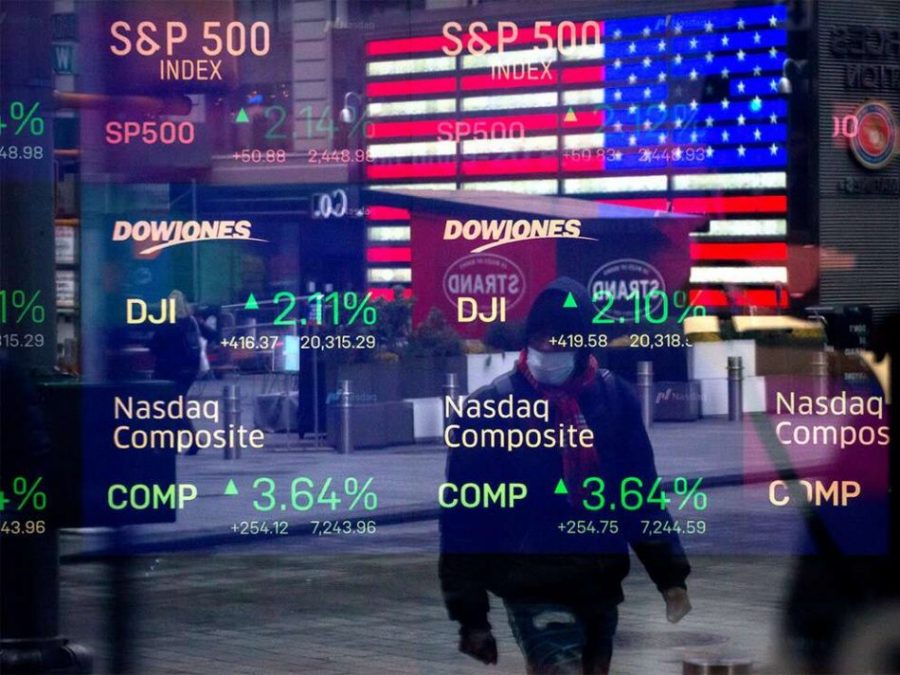

U.S. stocks continued their bullish trend at its most recent trading session, amid impressive gains recorded in Basic Materials, Consumer Goods, and Healthcare sectors thereby pushing U.S stocks to record high.

What we know

Shares in Accenture Plc gained an all-time high; up 6.87% to close at $264.44 and Shares in Nike Inc also rose to an all-time high; rising 1.55% to close at $140.48.

- At the close of the most liquid and biggest stock market in the world, the Dow Jones Industrial Average surged by 0.49% to print a new all-time high, while the S&P 500 index climbed up by 0.58%, and the NASDAQ Composite index ticked up by 0.84%.

- The best performers of the session on the Dow Jones Industrial Average were Johnson & Johnson, which rose 2.69% or 4.03 points to trade at 153.70 at the close.

- Rising stocks outnumbered falling ones at the New York Stock Exchange by 2012 to 1080 and 80 ended unchanged. On the Nasdaq Stock Exchange, 1989 stocks gained and 999 fell, while 89 ended unchanged.

What they are saying

Stephen Innes, Chief Global Market Strategist at Axi, in a note to Nairametrics, spoke on the prevailing macros pushing U.S stocks to record high amid an era of quantitative easing;

- “US equities were stronger overnight and were on track for fresh records. No stimulus breakthroughs, but no setbacks either, or as always, when it comes to Washington’s political morass, no news is being viewed as good news on that front. But in the case of bad news is good, the weak labour market data stoked optimism that Congressional leaders will finalize another round of stimulus before holiday wide lockdowns could shutter the ‘Last Chance Stimulus Saloon’ on Friday.”

What to expect

That said, U.S debt instruments are little changed despite the rally in U.S equities signalling the recent string of global central banks in the United States, United Kingdom, and European Union keeping a tight lid on key financial parameters to clear the way for more risky assets upsides, amid the 12-year-old bullish cycle presently in play.