After a turbulent two years of currency swings with high foreign exchange losses and ballooning finance costs, many Nigerian companies are back in the black.

The naira’s relative stability in 2025 has slashed foreign exchange losses even delivering FX gains for some pushing headline profits higher in the first half of the year.

But profits alone do not tell the whole story. The real test of financial strength lies in the cash a business generates from its day-to-day operations.

This year, most of the listed companies are not just reporting improved profit they are producing exceptional net cash flow from operating activities, the lifeblood that funds expansion, pays down debt, and supports shareholder payouts.

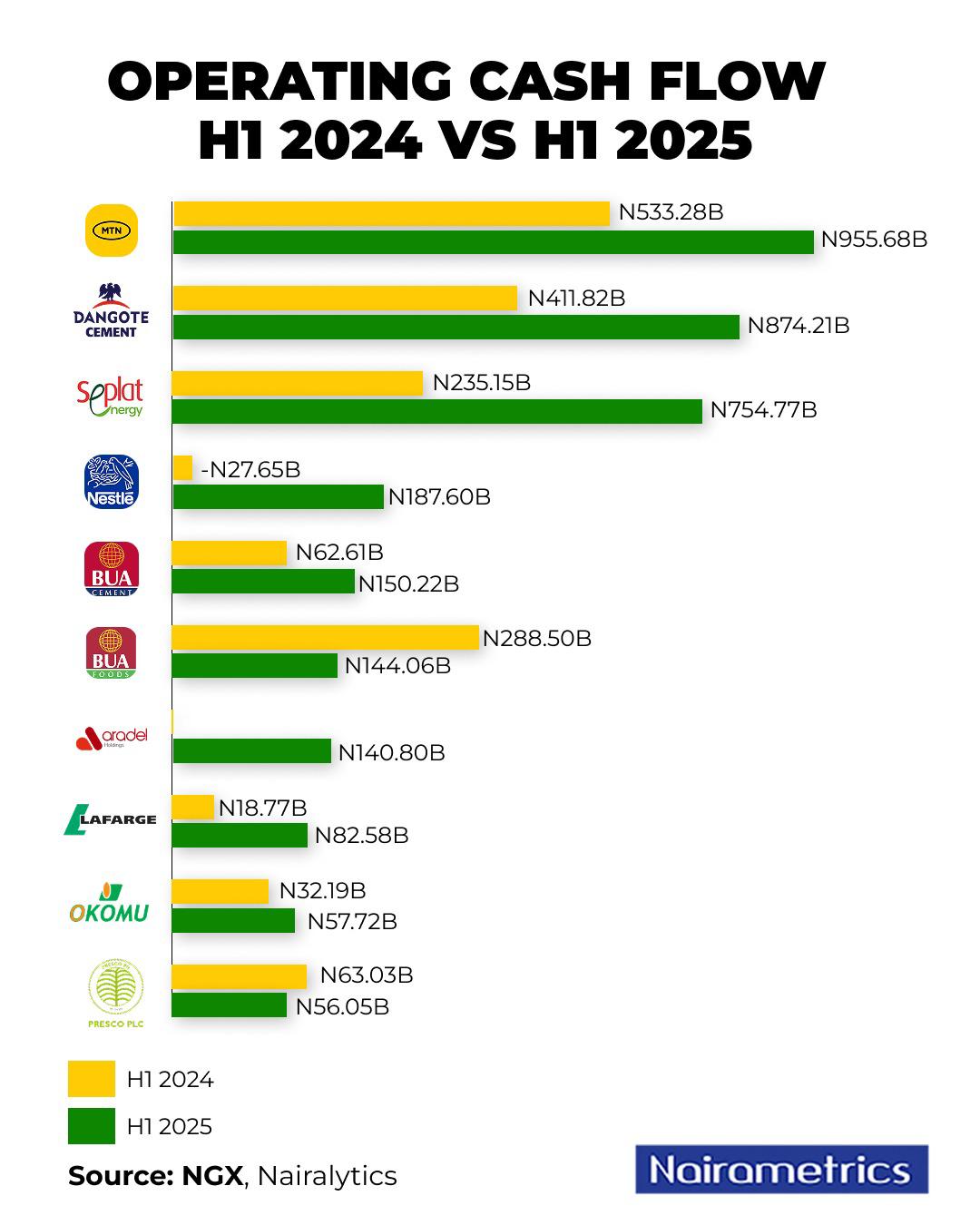

Nairametrics’ analysis of the financial statements of five heavyweights MTN Nigeria, Dangote Cement, Seplat Energy, Nestlé Nigeria, and BUA Cement confirms this trend.

These companies pulled in a combined N2.922 trillion in net cash flow from operating activities in just the first half of the year up 140% from the same period in 2024 and even 14% higher than their full-year 2024 figure.

Over the same period, their bottom line swung sharply into the black, with combined profit after tax hitting N1.21 trillion a dramatic turnaround from the N403 billion loss recorded a year earlier.

With the increased cash flow, analysts believe these companies are better positioned to fund expansion projects, reduce debt burdens, or reward shareholders through dividends.

More importantly, they note that stronger cash generation tends to boost a company’s intrinsic value and market appeal, potentially attracting fresh investor interest and driving share price appreciation.

From the ICT sector, MTN Nigeria generated N956 billion in net cash flow from operating activities in the first half of 2025, well above its N415 billion profit for the period.

This strong cash performance was driven by a surge in revenue, helping MTN sustain profits of N622 billion in the first half of 2025.

It marks a sharp rebound from the heavy FX translation losses and macroeconomic pressures experienced in 2024, with the turnaround gaining momentum from Q4 last year.

Analysts attribute the recovery to the naira’s rally, easing inflationary pressures, tariff hikes, and effective pricing strategies.

MTN’s Q2 2025 results have also strengthened its balance sheet, reducing negative equity from N458 billion at the end of 2024 to just N42.51 billion by mid-year.

Analysts at CardinalStone say the telco is well positioned to resume dividend payments in 2025, and with an operating cash flow per share yield of 9.8%, this could further enhance investor returns and boost its market appeal.”

From the industrials space, Dangote Cement delivered N874 billion in net cash flow from operating activities in H1 2025, more than double the N412 billion generated in the same period last year.

Unlike MTN Nigeria, which swung from losses in 2024, the cement giant has maintained steady profitability, with net income rising to N521 billion in the first half of 2025.

The strong performance was boosted by strong profit, high interest expenses, lower inventory levels, and a reduction in prepayments and other current assets, which freed up liquidity.

Market watchers believe that with this level of cash generation, Dangote Cement has additional flexibility to fund expansion projects, pay down debt, and sustain dividend payments.

On Seplat Energy, looking at the accounting profit of N42 billion in H1 2025, weighed down by hefty tax liabilities one might think the performance was modest.

But the cash flow story tells a very different tale: the company generated a remarkable N755 billion in net cash flow from operating activities, driven by strong profit before tax and an depletion, depreciation, and amortisation (DD&A) charge of over N518.9 billion, compared to N109.99 billion in H1 2024.

Roger Brown, Chief Executive Officer of Seplat Energy Plc, said the company is well placed to weather the recent macro volatility.

“Strong revenues and a focus on costs delivered significant positive cash flows, will enable us to further reduce net leverage, continue our strong quarterly dividend track record, and pay down an additional $100 million of debt,” he stated.

Seplat remains a dividend-paying company, offering a yield of 4.55% notably lower than its impressive operating cash flow per share yield of 24%.

This wide gap highlights the company’s capacity to not only sustain payouts but also retain ample liquidity for debt reduction and reinvestment, strengthening its long-term appeal to investors.

From the FMCG group, Nestlé Nigeria posted a modest profit of N50.57 billion in H1 2025, a significant recovery from the deep N177 billion loss recorded a year earlier.

But the real standout was cash flow from operating activities, which swung sharply into positive territory at N187.6 billion, compared to a negative N27.65 billion in H1 2024.

Analysts note that this cash turnaround reflects improved profits. An operating cash flow yield of 13% suggests strong cash-generating capacity relative to its market value.

For investors, this is significant it means that even though there’s no direct income through dividend payouts, the company retains substantial liquidity to fund expansion, reduce debt, or potentially pay future dividends.

BUA Cement, another major player in the sector, posted N150 billion in net cash flow from operating activities in H1 2025, up sharply from N62.6 billion in the same period last year.

The performance was underpinned by a more than twofold increase in pre-tax profit N215 billion, 435% higher than H1 2024 profit

However, unlike some of its peers, BUA Cement’s cash flow from operating activities was lower than its profit after tax (PAT) of N181 billion.

This divergence suggests that while the company reported strong accounting profits, less cash was generated from its core operations during the period.

Such a gap may point to higher working capital requirements, slower receivables collection, or other operational cash flow pressures.

Overall, while each company’s circumstances differ from MTN’s balance sheet revival to Seplat’s cash-rich energy play and Nestlé’s quiet turnaround the common thread is clear: in 2025, operational cash flow has become the truest indicator of corporate resilience in Nigeria’s recovering economy.

For investors, this wave of cash generation could signal a golden window for strategic positioning whether through dividend rebounds, capital gains, or exposure to companies poised to reinvest aggressively for growth.

The second half of the year will reveal whether these cash windfalls are sustainable, but for now, Nigerian corporates are proving that profits are only part of the story, and the real action is in the cash register.

Which platform can I use to invest in Nigeria stock market? Trusted one

The caption should have read “Top Nigerian firms swimming in…….”, because this is not the reality for most Nigerian firms especially medium and small companies. That caption is very misleading in my opinion.