Agro-based companies listed on the Nigerian Exchange have reported yet another period of profitability growth in the first half of 2024.

This continues their impressive performance in 2023, where they achieved some of the highest profitability growth and return on equity in Nigeria.

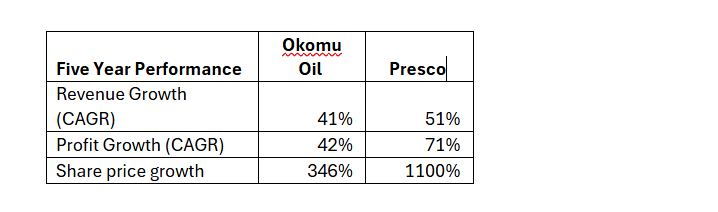

Two of the largest agro-based companies on the NGX, Okomu Oil Plc and Presco Plc, have shown particularly strong results.

Their 2024 financial statements reveal significant revenue growth and substantial pre-tax profits. Both companies also maintained robust balance sheets, expanded their net assets, and effectively managed their loans.

The performance of these companies is even more remarkable when considering the challenges posed by inflation and currency depreciation.

While many consumer goods companies struggled with losses, these two agro-based giants reported significant growth in their bottom lines.

First-half performance

Presco recorded the highest revenue at N88 billion in the first half of 2024, representing an 83% year-over-year increase from N48 billion in the previous year.

Okomu Oil also saw a substantial revenue increase, with an 84% year-over-year growth, rising from N40 billion in 2023 to N75 billion in 2024.

Both companies achieved gross profit values that surpassed their first-half 2023 figures. Presco announced a gross profit of N65 billion, a 105% increase compared to the same period in 2023.

Similarly, Okomu Oil’s gross profits climbed by 50% to N44 billion in 2024.

Presco’s pre-tax profit surged by 157%, from N15 billion in the first half of 2023 to N38 billion in the first half of 2024.

Okomu Oil’s pre-tax profit also increased, rising by 27% to N29 billion during the same period.

Earnings per share (EPS) for Presco and Okomu Oil increased by 157% and 24%, respectively.

Reason by the robust performance

In the 2023 annual report, Okomu Oil’s Chairman, Mr. Gbenga Oyebode, attributed the company’s revenue and pre-tax profit growth to “an inflation-driven increase in the price of products that the company sells.”

He noted that the prices of crude palm oil (CPO) rose by 22% year-over-year, while rubber prices saw a 28% increase.

Similarly, Presco’s Chairman, Mr. Olakanmi Rasheed Sarumi, attributed their revenue growth to the expansion of the company’s operational capacity.

He stated, “In 2023, we sold 105,000 tons of crude and refined products, compared to 91,400 tons in 2022.”

Both leaders highlighted their companies’ resilience despite the challenging business environment, characterized by rising energy costs and inflation.

Experts weigh in

According to Paul Uzum, a commodity analyst familiar with the palm oil sector, “The rise in commodity prices led to a scarcity of palm oil, which, combined with increased market demand, drove up prices.”

He further explained that palm oil companies are not immune to the high expenses and costs of doing business, especially in a climate where energy and labour costs are high. However, unlike the telecom sector, agribusinesses can efficiently pass production costs on to consumers.

“There are essential goods and services that consumers cannot do without, and food products are among them. The inflation of food prices in the market led to a high demand for palm oil,” Uzum noted.

He also pointed out that small-scale palm oil producers have had to raise prices to cope with the increased costs of production and processing, which are passed on to customers.

“Large-cap palm oil manufacturing companies are simply riding the waves of inflation and market demand without bearing the same cost pressures as subsistence farmers,” Uzum added.

Another commodity trader and analyst, Mr. Olayinka, attributed the increase in revenue and pre-tax profits to “large palm oil manufacturing companies capitalizing on market demand.”

Mr. Habib, a research analyst familiar with the Nigerian commodities market, linked the revenue boom of palm oil companies to the devaluation of the naira and the international price of CPO.

CPO and naira devaluation

Palm oil is traded as Crude Palm Oil (CPO) in the financial markets, and its price is influenced by demand, supply, and other economic factors. For instance, the Malaysian crude oil palm, traded as CPOc1, is currently priced at 843.75 USD per ton.

Mr. Habib explained that “Palm oil companies export and trade oils at an internationally pegged CPO price. With the naira’s depreciation, this translates into higher cash inflows when payments are converted to the local currency.”

He also noted that these companies can lower their prices to increase sales in the international market. Regardless of the strategy, when their payments are converted into naira, it often results in significant profits.

The combination of passing production costs to consumers, leveraging market demand, selling at international prices, expanding operational capacity, and benefiting from exchange rate fluctuations has contributed to the profitability of these companies in the first half of 2024.

Okomu Oil and Presco are currently trading at 14.7x and 8.3x their trailing twelve months earnings per share, with share prices at N345 and N485, respectively. Both companies have seen their share prices increase by 38% and 120% over the past year.