The Gross Domestic Product (GDP) of a nation serves as benchmark for gauging a nation’s economic health. It reflects the total market value of all final goods and services produced within a country’s borders during a specific period. A growing GDP indicates a thriving economy with expanding production.

The real estate and construction sectors are traditionally critical drivers of economic growth. They play a pivotal role in several key areas such as job creation, infrastructural development and investment and consumption.

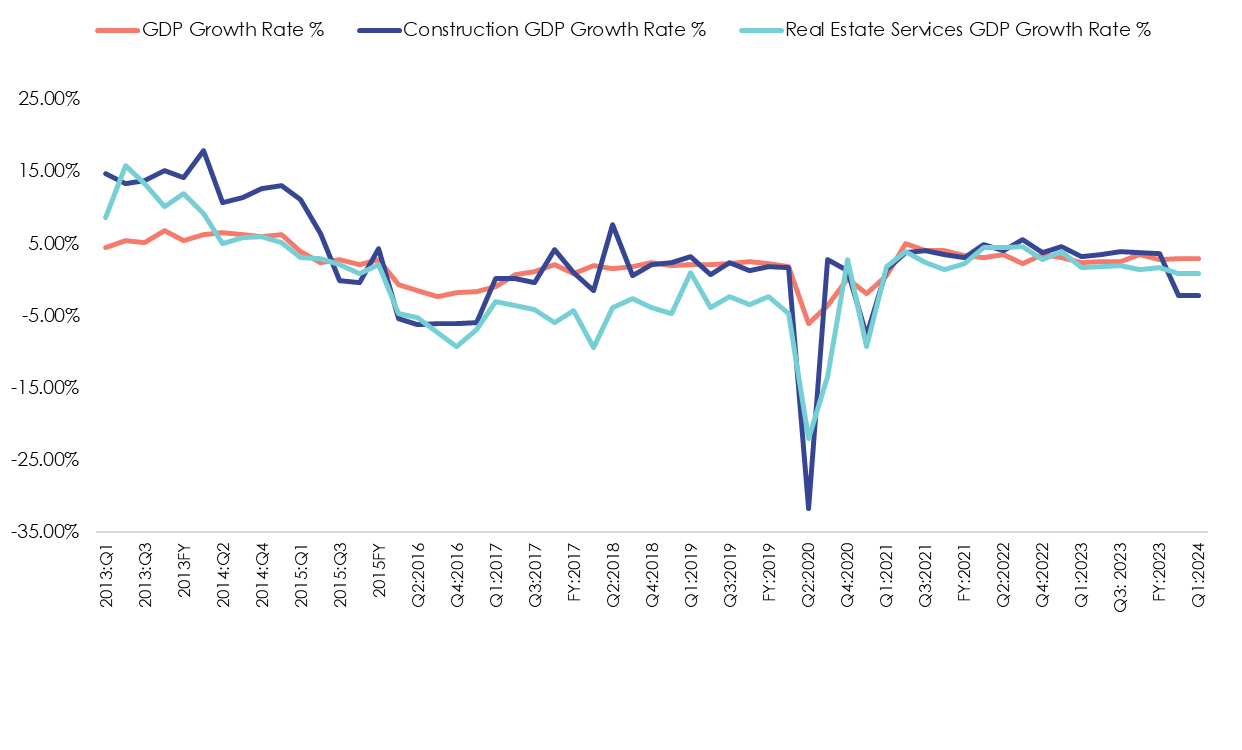

The first quarter GDP as released by the Nigerian Bureau of Statistics (NBS), revealed a decline in the real estate and construction sector’s growth in Q1 2024.

From the report, the real estate sector’s growth stood at 0.84%, a 0.50% (year-on-year) decline from the rate at 0.86% in the first quarter of 2023. On a (quarter-by-quarter) basis, the sector grew by –27.88% in Q1 2024. This contributed 5.20% to the real GDP in Q1 2024. This is lower than the 5.31% contribution recorded in the corresponding quarter of 2023.

The construction sector also recorded a decline in the Q1 2024 GDP. The sector’s GDP was recorded at 4.01% in Q1 2024, a 5.41% (year-on-year) decline from the rate recorded in the previous year.

The decline in the real estate and construction sectors’ contribution to GDP in Q1 2024 suggests a potential slowdown in these vital areas. This could lead to adverse consequences such as job losses, reduced infrastructure investment, and dampened economic activity.

To understand the root causes of this decline, we have outlined 10 potential factors that might have impacted these sectors.

10 Reasons for Nigeria’s Real Estate GDP Drop in Q1 2024

- High Inflation Rates

Nigeria’s real estate sector confronts a critical challenge due to surging inflation rates. According to the NBS (Nigeria Bureau of Statistics), inflation reached a staggering 33.69% in April 2024, resulting in a significant decline of consumer purchasing power. This downturn in consumer demand directly impacts the real estate market.

For example, inflation affects construction costs. Essential materials, like cement, have witnessed a price increase, with current prices ranging between ₦10,000-₦14,000 per bag, compared to significantly lower costs observed last year.

Compounding this issue is the government’s removal of petrol subsidies, which has worsened the fuel costs, leading to a substantial rise in transportation and logistics expenses within the construction industry.

This cost escalation, primarily fueled by soaring inflation rates and rising construction material prices, is demonstrably impacting property affordability. This decline in affordability directly translates to a decline in demand for properties across the real estate market

- Elevated Interest Rates

The High interest rates imposed by the Central Bank of Nigeria have increased the cost of borrowing. This has made financing construction projects and mortgages more expensive, deterring developers, buyers and investors from taking loans and investing in real estate.

Just last month, the CBN hiked the Monetary Policy Rate (MPR) by 150 basis points, bringing it to a new high of 26.25%. This marks the third increase in less than three months. Higher interest rates make borrowing less attractive, as the cost of servicing the debt becomes more expensive. This discourages potential borrowers and reduces the overall level of investment in the sector.

- Economic volatility

Economic instability, characterized by fluctuating exchange rates and uncertain fiscal policies, has created an unpredictable environment for investors. This uncertainty has led to a cautious approach, with both domestic and foreign investors applying a wait-and-see approach before investing in real estate.

The reduced pool of available capital for real estate and construction projects ultimately translates to a contraction in the sector’s contribution to Nigeria’s GDP.

- Decline in Investor Confidence

Negative news or a feeling that things aren’t clear can shake investor confidence in the real estate market. This can lead investors to defer on putting their money into real estate projects. Investors want to feel secure and informed before investing, and negative news or a lack of transparency can make them feel uncertain. This hesitation from investors can slow down the real estate sector and its contribution to the overall economy.

- Security Concerns

Security issues in certain regions may deter investors from undertaking construction projects in those areas.

This heightened risk environment can be fueled by factors like civil unrest, high crime rates, or even the threat of terrorism. Investors, with a keen eye for long-term stability, may be hesitant to commit capital to areas where the future is uncertain.

This discourages investment, potentially leading to a stagnation or even a decline in the real estate and construction sectors of these regions.

- Shifting Consumer Preferences

There is a growing demand for affordable housing and sustainable building practices. The existing market offerings may not align with these changing consumer preferences, leading to a mismatch between supply and demand. Developers who fail to adapt to these trends may find it difficult to attract buyers and tenants.

- Supply Chain Disruptions

Global disruptions in the supply chain for building materials could lead to project delays and cost increases, impacting both construction and real estate.

The cost of construction materials has been rising due to inflation, supply chain disruptions, and import dependency. High material costs make construction projects less financially viable, reducing the number of new developments.

- Inadequate Infrastructure

Poor infrastructure, such as inadequate roads, unreliable power supply, and insufficient water resources, hampers real estate and construction activities. Developers face higher operational costs and logistical challenges, which can deter new projects.

- Market Dynamics and Oversupply

In some regions, there has been an oversupply of certain types of properties, particularly high-end residential and commercial buildings. This oversupply has led to increased vacancy rates and downward pressure on some property prices, discouraging further investment in new developments.

- Decline in Foreign Direct Investment (FDI)

Political instability, security concerns, and unfavorable business conditions have led to a decline in foreign direct investment in Nigeria. FDI is crucial for funding large-scale real estate and construction projects, and its reduction limits the availability of capital for these sectors.

Conclusion

The decline in the contributions of the real estate and construction sectors to Nigeria’s Q1 GDP is a multifaceted issue influenced by economic, regulatory, and market factors. Addressing these challenges requires a comprehensive approach, including economic stabilization, regulatory reforms, improved access to finance, and targeted government policies. By understanding and tackling these ten potential reasons, Nigeria can work towards improving the real estate sector and grow the economy.

Read more articles like this on our insights page, www.buyletlive.com. You can also send us your comments, feedback, and contributions to research@buyletlive.com