This is contained in a statement issued on the Economic Commission for Africa’s (ECA) website as part of recommendations of the African Sovereign Credit Review Mid-Year Outlook Report and seen by Nairametrics.

- “African regulators need to develop regulatory mechanisms to supervise the work of international CRAs operating within their respective jurisdictions to ensure proper business conduct and enforcement.

- “Regulators must ensure accountability on inaccurate rating opinions issued in Africa,” the report said.

Poor ratings affect investment in Africa

The joint report by the Economic Commission for Africa (ECA) and the African Peer Review Mechanism (APRM) said despite positive economic projections, Sovereign Credit ratings in Africa are getting worse.

A sovereign credit rating is an independent assessment of a country’s creditworthiness.

Sovereign credit ratings give investors insights into the level of risk associated with investing in the debt of a particular country, including any political risk.

The review report further recommended that African countries should regulate the publication of ratings and a rating calendar to curb impromptu rating announcements that disrupt financial markets.

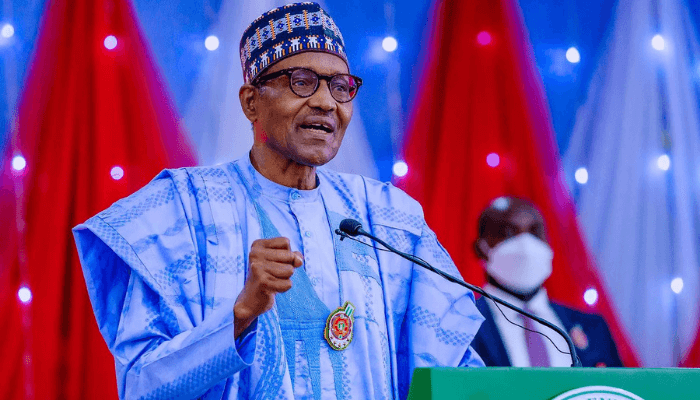

- “The recent downgrading of five African countries by the top three CRAs has reversed the optimism amongst investors on the international financial markets that African countries are recovering from the devastating Covid-19 economic shocks, ” the report said, citing that five African countries were downgraded by international credit rating agencies in 2023.“In 2023, Standard and Poor’s, Moody’s Investors Service, and the Fitch Group downgraded Ghana, Nigeria, Kenya, Egypt, and Morocco.

- It cited increasing government financing needs and pressures from the upcoming ‘wall of Eurobond maturities combined with poorly structured terms of international bonds.

- “Besides, the global credit rating agencies based their downgrades on ‘weakening external liquidity position,” it said.

- It said Nigeria and Kenya rejected Moody’s rating downgrades, citing a lack of understanding of the domestic environment by the rating agencies.

- The statement said both countries argued that their fiscal situation and debt were not as bad as estimated in Moody’s review.

- “Moody’s and Fitch also downgraded Egypt in a move that has pushed up its borrowing costs to issue a sovereign bond at over 10%.

- “Egypt currently has the highest sovereign bond value outstanding in Africa at 37.5 billion dollars, “it said.

The report said challenges were noted during the review period and these included errors in publishing ratings and commentaries and that analysts were located outside the African continent to avoid regulatory compliance, fees, and tax obligations.

Besides, the experts found that some impromptu ratings and announcements did not follow a rating calendar and there was herding behaviour amongst the rating agencies to follow other rating agencies’ actions, and there was increased rating analysts’ workload.

Improving Africa’s poor ratings

They noted that all these result in failures to adhere to applicable surveillance policies and procedures.

It called on CRAs to acknowledge weaknesses in their institutional structures and to have more African analysts address challenges stemming from foreign-based assessments.

- “Solution to these challenges lies in effective regulation and eliminating reliance on credit rating opinions,” said the report, adding that, “Effective regulation should ensure that rating agencies stay independent, keeping up the integrity and quality of the rating process.”

Get over it.

The United States was downgraded by Fitch just last week. It’s entirely inappropriate, and possibly a blatant conflict of interest, for any government, be it African, American, European, or any other, to try and regulate credit rating agencies. After all, these agencies are tasked with evaluating the creditworthiness of the very governments that are among the biggest issuers of credit securities worldwide.

It’s like asking a chef to review their own restaurant, or a student to mark their own exam.