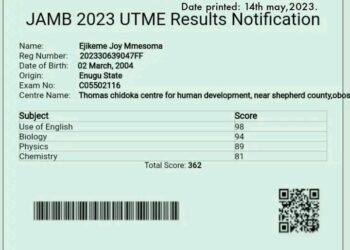

The Joint Admissions and Matriculation Board (JAMB) on Monday announced a timetable for its activities with the registration for the Unified Tertiary Matriculation Examination (UTME) and the Direct Entry (DE) examinations expected to commence on February 12, 2022, and end in March 2022.

This is coming barely 7 months after the examination body released the 2021 UTME results for candidates that sat for the examination between June 19 and June 22, 2021.

This was disclosed by JAMB in its weekly bulletin which was released by its Director of Public Relations, Dr Fabian Benjamin and can be seen on its website.

Also, JAMB in its timetable of events, pointed out that the mock examination for the UTME/DE will hold on April 20, 2022, while the UTME examination will hold on April 30, 20221.

What JAMB is saying

JAMB in its 2022 UTME/DE timeline of events attached to the bulletin announced that ‘’UTME/DE registration starts 12th February 2022 and ends 19th March 2022. Mock examination holds on 20th April 2022. UTME holds from 20th to 30th April 2022.”

What you should know

Recall that JAMB in an earlier published bulletin insisted that all prospective candidates for the 2022 Unified Tertiary Matriculation Examination (UTME) must get their National Identification Numbers (NIN) ahead of the exercise.

The examination body had stated that the introduction of the NIN to the UTME exams is a victory in the fight against exam malpractice by way of multiple applications, adding that the partnership with NIMC has made it harder for professional exam writers to register.

WHEN WILL JAMB START THEIR MOCK EXAM 2022 AND WHEN THE NOMAL EXAM START AND WHEN WILL ADMISSION BE OUT 2022