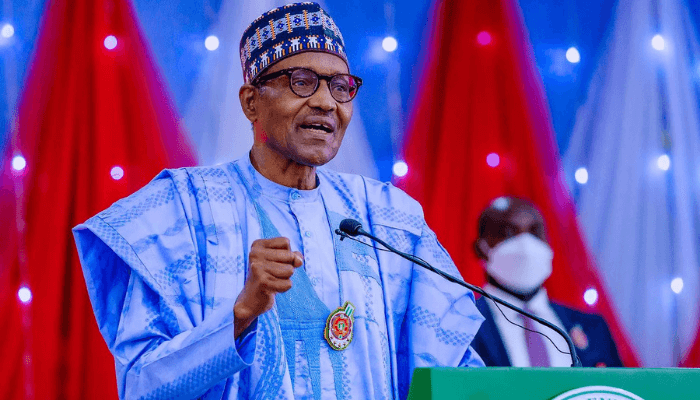

I remember reading the latest Nigeria Development Update report which stated that we had exited from our deepest recession in four decades. At that moment, I thought to myself; what’s that got to do with the price of fish? Well, it turns out the answer is… everything! The fangs of inflation still sink deep into the financial well-being of every Nigerian. Food prices continue to soar; going to the gym and maintaining a Netflix subscription seem to be luxury activities for those whom the blight of “Sapa” is yet to visit. There are now predictions of an Omicron-flavored 4th wave washing us onto the shores of the New Year. Sigh!

I had high hopes for 2021. No matter how much the “prophets” aka financial experts warned me about the year, I hung on tight to my hopes. As it happened, 2021 threw up more unfortunate twists than a Mexican melodrama. This was a year that gave us a doctor’s strike, continuous Boko Haram insurgency, rising cases of COVID-19 pandemic, herder-farmer conflicts, unrest in Southeastern Nigeria and the Nigerian bandit conflict. To be fair, 2021 also gave us Tem’s outstanding If Orange Was a Place album, but that was scant consolation.

These twists have had the effect of shrinking all of our purses in 2021. In April of this year, my team at Vested carried out a financial well-being study where we asked over 400 Nigerian families how they were doing money wise, and the results weren’t so surprising; 2 out of 3 Nigerians do not have up to ₦250K to tackle emergencies; 31% of Nigerians are anxious that the value of their wealth continues to decline due to inflation and devaluation of the Naira; and over 35% are concerned that their overall earnings are not sufficient to cover rent, quality education for children, safe housing in a preferred neighborhood, and all they would require to live sustainably.

Experts postulate that 2022 – a pre-election year, may show up with more challenges in addition to the ones mentioned earlier: the removal of subsidies; possible introduction of additional taxes, the floatation of the Naira; continuous undulating oil prices, are some of the few. They even predict that the aviation, tourism, hospitality, restaurants, manufacturing, and trade industries will continue to struggle.

This time around, I will pay attention to the prophets. I am ready for 2022. I started preparing sometime in October this year. Too early? I think not. Now, I am more confident to face the New Year. I am acquiring the right knowledge to build a wealth base and I am building Sleep-Well Money by being intentional with my savings and investments, I am bridging the money gap – doing what it takes to increase my income by starting a side hustle alongside my 9-to-5.

My question to you dear friend is: Are you prepared for 2022? If you don’t feel ready, allow me to share this approach: You can start by building your financial knowledge. I have worked with my team at Vested, a financial well-being platform, to create a Guide to Building Wealth – A series of free playbooks to help you achieve your 2022 money goals.

These free playbooks provide insights on the following and more;

– How to build Sleep-Well Money

– How to manage your personal cash flow like a CFO

– How to manage your personal risks like a CRO

– 10 questions to ask your financial advisor

– How you can bridge the money gap, especially if you are a woman

– How you can set realistic money goals and take action.

When it comes down to it, there are really only two options I see. You can either sit on the sidelines again and allow 2022 happen to you or you can face it head on by downloading your free guide to building wealth. 2022 Sapa might hit differently, but this time we will be prepared. Stay ambitious, friend.

Chidera,

Growth Enthusiast.