Goldman Sachs, the world’s leading investment bank, recently revealed that Ethereum (ETH) will likely beat Bitcoin (BTC) as a store of value.

In its most recent research report, the elite bank highlighted Ethereum’s growing importance as a store of value, giving it a significant chance of overtaking the world’s most popular crypto asset as the dominant digital store of value.

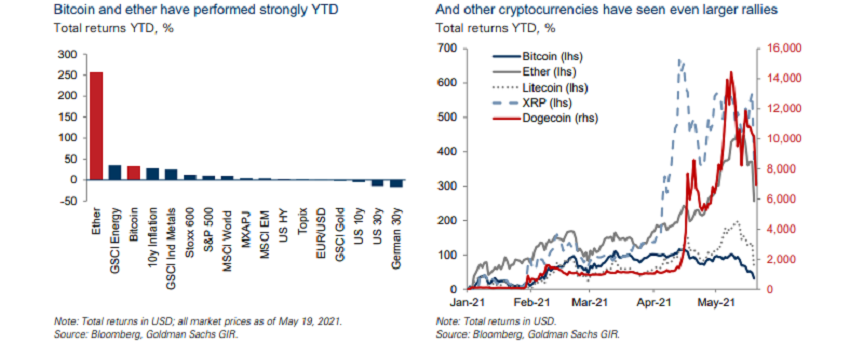

Recent price actions reveal that as of May 19th the altcoin had outperformed any major asset including Bitcoin with year-to-date performance of over 250%.

READ: Ether on record high as European Investment Bank launches digital bond on Ethereum

Already Bitcoin’s market dominance has dropped to a record low of 42.3% at the time this report was drafted, while Ethereum gains ground as it posts a market dominance of 18.7%, with its market capitalization almost halving Bitcoin.

READ: $119 billion valued investment bank, Goldman Sachs starts Bitcoin trading

Goldman Sachs based its bias on Ethereum’s multi-functional ecosystem that facilitates smart contracts and supports developers with the capability to create new applications on Ethereum.

In addition, the bank placed emphasis on the fact that many decentralized finance (DeFi) applications (such as YAM, Compound, Cream finance, UniSwap, Chainlink, and Melon) seeing record cash inflow, are being supported on Ethereum; and most non-fungible tokens are bought using Ether. This large number of transactions on the Ethereum network reflects its growing dominance.

READ: Elon Musk and MicroStrategy CEO announce Bitcoin Mining Council

Ethereum is a cryptocurrency designed for decentralized applications and the deployment of smart contracts, which are created and operated without any fraud, interruption, control, or interference from a third party.

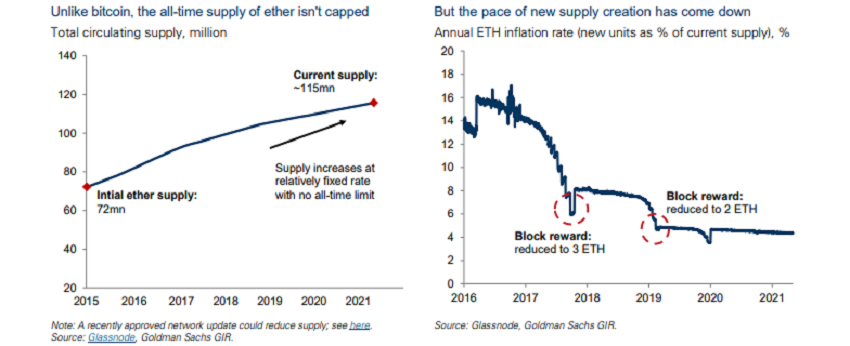

Goldman Sachs further disclosed that Bitcoin’s finite supply capability does not guarantee its dominance as a store-of-value asset.

“A major argument in favour of Bitcoin as a store of value is its limited supply. But demand, not scarcity, drives the success of stores of value… In fact, a fixed and limited supply risks driving up price volatility by incentivizing hoarding, potentially creating financial bubbles.”

READ: Why Ethereum transaction fees are often expensive

Recent reports that WisdomTree, a financial services firm, has filed for an Ethereum ETF with the Securities and Exchange Commission, has kept that flagship altcoin attractive to a growing number of investors.

Also, investors are increasingly flocking to Ether, on the bias that Ethereum founder, Vitalik Buterin recently affirmed that the crypto will undergo a major overhaul which will reduce the energy consumption by about 99% and thus, make the altcoin upgrade more environment-friendly than Bitcoin.

Vitalik hopes to achieve this by switching the crypto asset’s operational model from the existing Proof of Work System to Proof of Stake, a switch that will further reduce the running of powerful computing systems on the Ethereum network.

I definitely believe it

Etherum will get to 25k soon