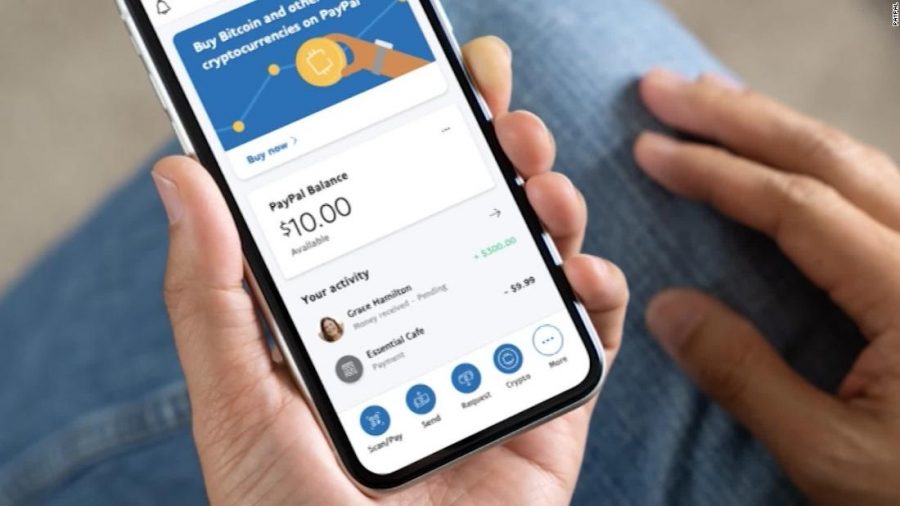

PayPal is set to outrightly purchase a crypto-security firm Curv as part of its campaign in building its crypto ecosystem, the company disclosed today.

According to a report credited to CNBC, the deal is estimated to be worth less than $200 million, it’s expected to close before June this year.

The company’s stock price however recorded some selling pressures at the time of writing amid rising U.S Treasury yields and greenback keeping global investors on their toes.

READ: CBN and cryptocurrency ban

The crypto startup about to be acquired by PayPal provides companies with Crypto security technology via the cloud. PayPal revealed that the purchase would help its expansion on supporting crypto.

“The acquisition of Curv is part of our effort to invest in the talent and technology to realize our vision for a more inclusive financial system,” PayPal’s Jose Fernandez da Ponte said in a statement.

In a press statement seen by Nairametrics, Dan Schulman, president, and CEO, PayPal, gave key insights on why the global payment company was going crypto; The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of; financial inclusion and access, efficiency, speed, the resilience of the payments system and the ability for governments to disburse funds to citizens quickly.

READ: U.S customers can now buy Cryptos with Paypal

“Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption, and inter-operability of these new instruments of exchange,” he said.

Furthermore, he said, “We are eager to work with central banks and regulators around the world to offer our support and to meaningfully contribute to shaping the role that digital currencies will play in the future of global finance and commerce.”

This offering was made possible through a partnership with Paxos Trust Company, a regulated provider of crypto services and products.