The Federation Account Allocation Committee (FAAC) disbursed the sum of N601.11 billion to the three tiers of government in December 2020 from the revenue generated in November 2020.

This is according to the FAAC report of December 2020, recently released by the National Bureau of Statistics (NBS).

The amount disbursed represents a 0.48% decrease when compared to N604 billion disbursed in November 2020. Checks by Nairametrics shows that December 2020 disbursement was the lowest allocation in the second half of 2020.

READ: FAAC: FG, States and Local Governments share N547 billion in June

Breakdown

- The amount disbursed comprised of N436.46 billion from the Statutory Account, N7.87 billion from FOREX Equalisation Account, and N156.79 billion from Value Added Tax.

- Federal Government received a total of N215.6 billion, representing 35.9% of the total allocation, States received a total of N171.17 billion (28.5%), while Local Governments received N126.79 billion (21.1%).

- Also, the sum of N31.39 billion was shared among the oil

producing states as 13% derivation fund. - Meanwhile, revenue-generating agencies such as Nigeria Customs Service (NCS), Federal Inland Revenue Service

(FIRS), and Department of Petroleum Resources (DPR) received N7.87 billion, N9.41 billion, and N3.98 billion respectively as cost of revenue collections.

A further breakdown showed that the sum of N143.82 billion was disbursed to the FGN consolidated revenue account; N3.68 billion shared as share of derivation and ecology; N1.84 billion as stabilization fund; N6.18 billion for the development of natural resources; and N5.08bn to the Federal Capital Territory (FCT) Abuja.

READ: FG receives N144 billion in dividends from NLNG in 2020

South-South region received the giant share

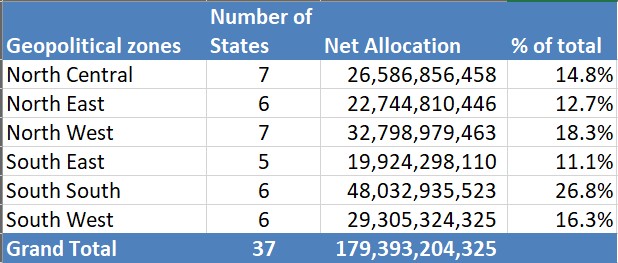

Out of the six geo-political zones in the country, the south-south region received the largest share of the total allocation.

- South-South states received a sum of N48.03 billion in December 2020, representing 26.8% of the total state disbursement.

- North West followed with an allocation of N32.8 billion, accounting for 18.3%, while South West received a sum of N29.31 billion (16.3%).

- Also, North Central received N26.59 billion (14.8%), North East N22.74 billion (12.7%), and South East received N19.92 billion (11.1%).

- It is worth noting that Delta State led the list of states with the highest allocation in December 2020, with a sum of N13.48 billion, closely followed by Lagos State with a sum of N12.46 billion).

- Others on the list include; Akwa Ibom state (N10.48 billion ), Rivers (N10.11 billion), and Bayelsa (N6.82 billion).

READ: Lagos re-channels, re-aligns Banana Island shoreline, says demolition continues

External debt deductions

A total of N6.45 billion was deducted from the allocations of the 36 states as part of external debt deductions in the month of December 2020.

- Lagos State parted with N2.44 billion, the highest deduction compared to other states, Kaduna followed with N537.7 million, Oyo State (N378.7 million).

- Others on the list of top five states include; Cross River (N311.3 million), and Rivers State with N227.1 million debt deduction.

READ: Nigeria’s capital inflows hit a new record low of US$9.7bn since 2016

Upshot

As states continue to struggle to meet their financial obligations due to the covid lockdown in 2020, a reduction in revenue allocation from the Federal Government could further compound their financial difficulties. However, it should serve as a challenge to the various state governments to seriously consider and put in place strategy to increase their internally generated fund to aid self-sustainability.

Good story, well written