Cloud scheduling startup, Calendly LLC announced it has raised $350 million in new funding to provide liquidity for early shareholders and employees and continue product development. This investment has now valued the company at more than $3 billion.

This funding round was led by OpenView Venture Partners, a Boston-based expansion-stage firm and existing investor, with participation from San Fransisco-based Iconiq Capital.

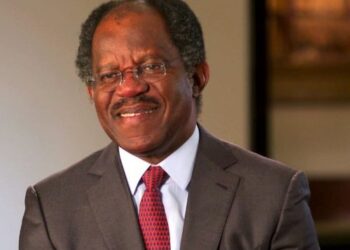

Founded in 2013 by Tope Awotona, Calendly simplifies the way meetings are scheduled by creating simple rules such as availability preferences, share links, or embed calendars and allows those seeking a meeting to pick a time using the service.

The platform can also be integrated with Google, Outlook, Office 365, and iCloud calendar to avoid double bookings along with automated task support linked into Salesforce, GoToMeeting, Zapier, and other services.

This new funding will be used to provide liquidity for early shareholders and employees as well as continue product innovation. It will also be used to build the platform with more tools and integrations and also expand its business with more talent.

According to Tope Awotona, “Our profitable, unique, product-led growth model has led to Calendly becoming the most used, most integrated, most loved scheduling platforms for individuals and large enterprises alike,”

This funding round is Calendly’s first since receiving $550,000 from local firm Atlanta Ventures and OpenView.

Tope also added that “While we considered outside investment an unnecessary distraction, we made the decision to partner with OpenView and Iconiq because of their insight and extended network within the tech industry. While some of the investment will add to our balance sheet, it will also be used to allow our early employees and early investors – who bet on this crazy idea years ago – to have some liquidity.”

What you should know

- In 2020, Calendly doubled its subscription revenue to $70 million and since then, the startup has grown massively despite the pandemic. It currently has more than 10 million users using it each month to streamline the way they schedule meetings, including teams at companies such as Zoom and Twilio.