Nigeria received a sum of $1.46 billion from capital inflows in the third quarter of 2020 (Q3 2020), as against $1.29 billion received in the previous quarter (Q2 2020). This is according to the latest capital importation report released by the National Bureau of Statistics (NBS).

According to the report, the inflows of $1.46 billion represent a 12.86% increase compared to N1.29 billion received in Q2 2020. It however dipped by 74.03% as against $5.63 billion recorded in the corresponding period of 2019.

Also, checks by Nairametics showed that Nigeria received a total of $8.61 billion in capital inflows between January and September 2020.

READ: Capital flows to Nigeria down for the second consecutive quarter by 7.8% q/q

Key highlights

- The largest amount of capital inflows by type was received through other investments, which accounted for 43.75% of the total capital imported in Q3 2020.

- The production sector received the highest share of $400.1 million in Q3 2020, representing 27.38% of the total inflows.

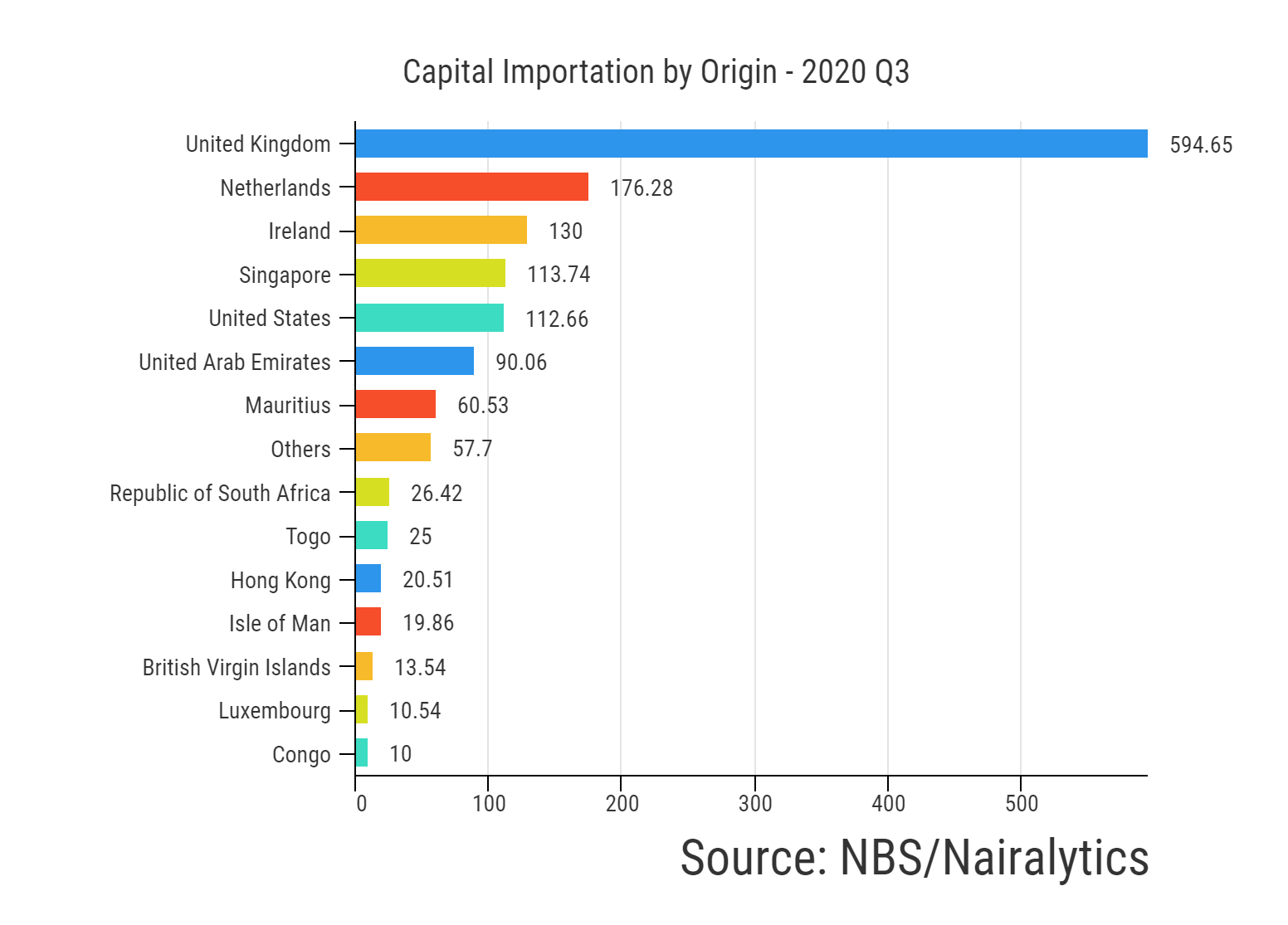

- The United Kingdom emerged as the top source of capital investment in the review period, accounting for 40.69% of the total inflows.

- By Destination of Investment, Lagos state emerged as the top destination of capital investment in Nigeria in Q3 2020 with $1,21 billion.

- By Bank, Standard Chartered Bank Nigeria Limited emerged at the top of capital investment in Nigeria in Q3 2020 with $438.98 million.

READ: Nigeria attracts foreign investment worth $5.85 billion in Q1

Capital inflow by type

Nigeria’s capital importation is categorized into three investment types: Portfolio Investment, Foreign Direct Investment (FDI), and Other Investment.

READ: CBN clears air on Diaspora Remittances, official inflows $2.6bn not $26bn

In the third quarter of 2020, Other investments formed the highest type of capital investment into Nigeria with a total inflow of $639.44 million, representing 43.75% of the total inflows.

The breakdown shows that $624.45 was received in form of loans while other claims recorded was $14.99 million.

READ: Nigeria’s mobile phone market bounces back to post healthy growth in 2020 Q3 – IDC

Foreign Direct Investment (FDI): FDI is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. In the latest report, FDI constituted 28.38% of the total inflows, all of which were received through equity.

Also, foreign direct investment ($414.79 million) grew by 179.2% in Q3 2020, compared to $148.59 million recorded in the previous quarter.

READ: Nigeria’s global gas flaring profile drops by 40% over 20 years

Portfolio Investment (FPI): During the period, a total of $407.25 million was received through portfolio investments, accounting for 27.87% of the total inflows.

Under the portfolio category, investment in money market instruments remains the largest recipient of capital inflows with a total of $363.15 million, followed by $44.1 million in equity, while none was recorded from bond investments.

READ: Dangote Cement market capitalization increased by 28% to cross N3 trillion mark in November

Capital inflows by sector

Further analysis of capital importation shows that eight sectors recorded a decline in capital importation, nine sectors recorded positive growth while four sectors received no investment in the period under review.

Meanwhile, the production sector received the largest share of investments with $400.1 million inflows, representing 27.38% of the total inflows in the quarter. The Banking sector followed closely with $384.4 million inflows, accounting for 26.3% of the total inflows.

READ: 58,800 contributors registered under micro pension plan – PENCOM Report

Others on the list of top five sectors include Shares ($283.2 million), Financing ($134.27 million), and Telecomms with $101.18 million inflows.

Capital inflows by origin

The United Kingdom maintained the biggest source of capital inflows for Nigeria, with a total investment of $594.65 million, followed by the Netherlands with $176.28 million.

READ: Udoma predicts positive economic outlook, puts Q1 2018 capital inflows at $6 billion

Others include Ireland ($130 million), Singapore ($113.74 million), and the United States ($112.66 million).

READ: Rewane outlines sectors to drive economy in 2020

Upshot

Despite the growth recorded in the third quarter, it is evident that capital inflow is still below expectation owing to the downturn caused by the worldwide spread of the covid-19 pandemic, which was characterised by travel restrictions, halt in business activities and loss of jobs.

READ: PEBEC reforms to boost foreign direct investments – Osinbajo

- Continuous records of low capital inflow could affect the country’s efforts to speedily recover from its economic recession as the economy requires substantial investments to scale through the covid and oil crash induced recession.

- Meanwhile, growth in foreign direct investment is a welcome improvement, growing by 179.15% (Q-o-Q).

- Analysts have stated that the low inflow of FDI is not good for the economy as other forms of capital importation have very low potential to drive the economy as compared to FDI.

READ: Edo, Rivers, Ondo, Katsina, 17 others attract zero investment in 4 months

Good read. If I may ask, is the breakdown of how much each area under the production sector received available?

Personally, I think the problems we face is helping to turn our attention to the things that matter. Our focus has been on oil for too long and little attention has been given to our diversity, most especially the human capital.