The Federal Government has commissioned the operations of Dukia Gold and Precious Metals Project (DGPMP) on Wednesday. The project is expected to enable Nigeria mine her gold reserves properly, trade responsibly and refine locally.

The Vice President, Prof. Yemi Osinbajo, while performing the virtual commissioning of the project, said Nigeria has potential reserves of 200 million ounces of gold reserves.

Osinbajo disclosed that the Dukia Gold and Precious Metals Project has been under construction for 7 years and it was his pleasure to see that the project is ready to start operations.

According to a press statement issued by the Director of Press, Federal Ministry of Mines and Steel Development, Mr. Edwin Okpara, the Vice President said, “I believed that the Dukia gold project would encourage the emergence of smaller-scale mining companies which, for the first time, would have a transparent and welcoming market for their mined gold and precious metals. This would create jobs and unleash the economic potential of mining communities.”

(READ MORE:Gold spot prices plunge as U.S releases impressive economic data)

Going further, he said, ‘’The project will create primary employment for local artisanal miners and mining cooperatives across the solid minerals value chain. Off-take agreements between DGPMP and local mining communities and owners of recyclable gold will be a useful provider of jobs in our post COVID-19 economy.”

Osinbajo also commissioned the Dukia-Heritage Bank Gold and Precious Metals Buying Centers, which is part of valuable private sector collaboration.

He opined that the buying center would provide a sustainable way for Nigerians to exchange their gold jewelry and other precious items for cash.

The vice president added, “This system of exchange not only helps to encourage a culture of recycling, but will also serve as a complementary source for the raw materials needed for the Dukia Gold & Precious Metals Refining Company.”

Osinbajo promised that the federal government would provide support and facilitate policies that would ensure successful deployment, implementation, and sustainable operations of the Dukia gold project as well as continuous support of the mining sector.

(READ MORE:Osinbajo sets up committee on reopening of Nigerian economy, suspends loan deductions for states)

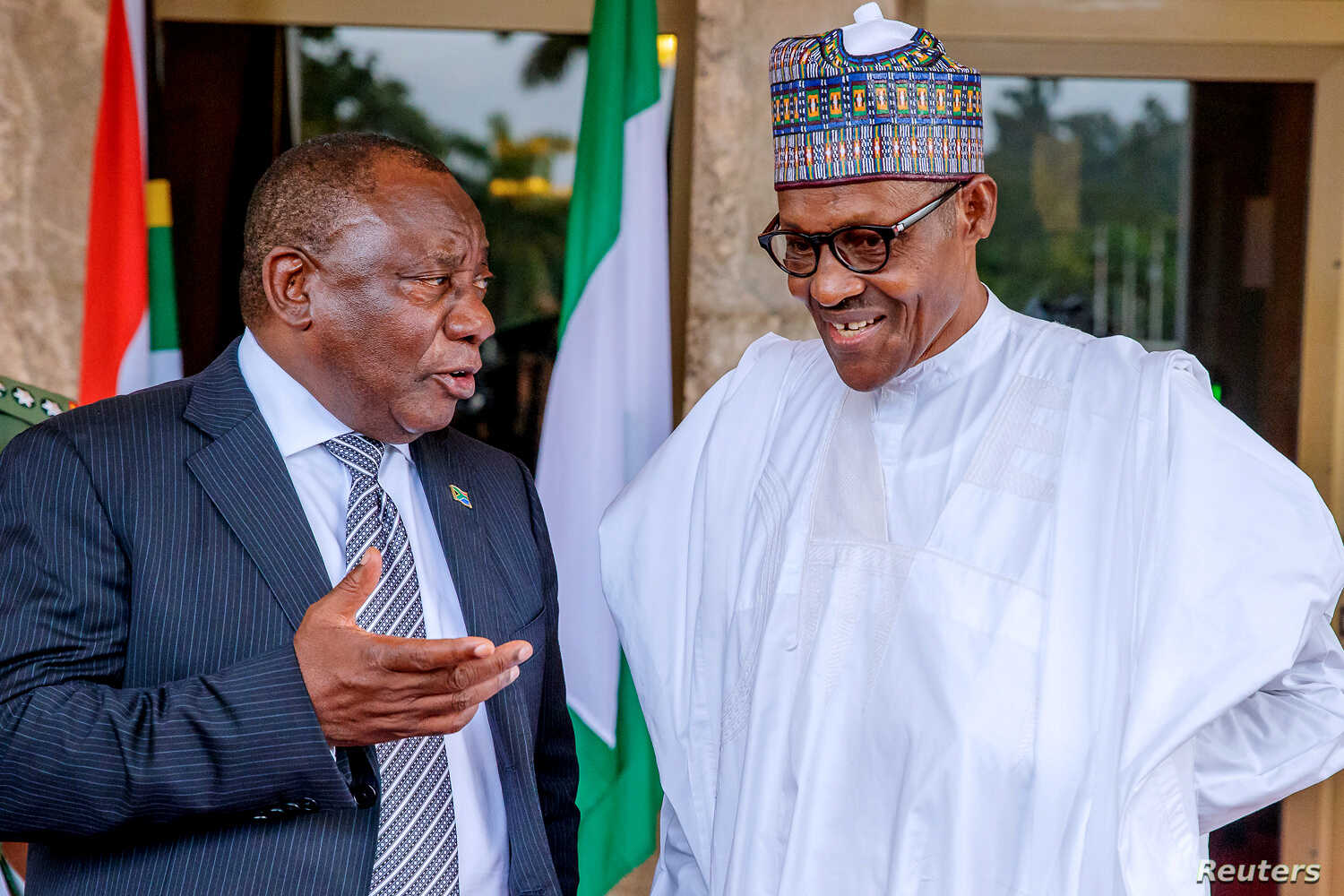

The Minister of Mines and Steel Development, Mr. Olamilekan Adegbite, in his own statement, said the launch of Dukia-Heritage is a testament of the unwavering effort of President Muhammadu Buhari’s administration to serve as a business-friendly regulator by providing the enabling environment for business to thrive.

Adegbite stated that the Buying Centre Initiative (BCI) would bring about efficiency and transparency to physical trading and transactions of mineral commodities in the country and also ensure that artisanal miners would receive the right pricing for their goods relative to illegal off takers.

The minister pointed out that his ministry has licensed two gold refineries and created a conducive fiscal and regulatory enabling environment for them to thrive of which Dukia is one of them.

There is no mention of the location of the refinery in the article making it appear as if it’s a virtual refinery.

So fill us in on it’s location, outlets and website.

Thanks